Tax Compliance

Who is eligible for home office deductions after the 2018 tax reforms?

After the 2018 tax reforms, home office deductions are no longer available to regular remote workers who are W2 employees. These deductions are now limited to self-employed individuals who are not employed by a company, or those who have a second job outside their primary W2 position. To qualify, individuals must exclusively use a specific space in their home for work purposes. This means the area must be dedicated solely to business activities. These eligibility requirements significantly narrowed who can claim home office expenses, making it primarily a benefit for freelancers, independent contractors, and those with side businesses.

Watch clip answer (00:26m)What are ways people can reduce their tax bill?

Taxpayers can reduce their tax bill by maximizing contributions to their 401k or other retirement funds before the April 15 deadline, which provides pre-tax benefits for the 2024 tax season. This is a key opportunity that's still available. Additionally, given potential IRS staffing changes mentioned by Trump, including cutting staff or reassigning agents to border duties, it's advisable to file taxes as early as possible. Filing promptly ensures taxpayers receive assistance before any potential reduction in IRS services occurs.

Watch clip answer (00:48m)How does the simplified home office deduction method work?

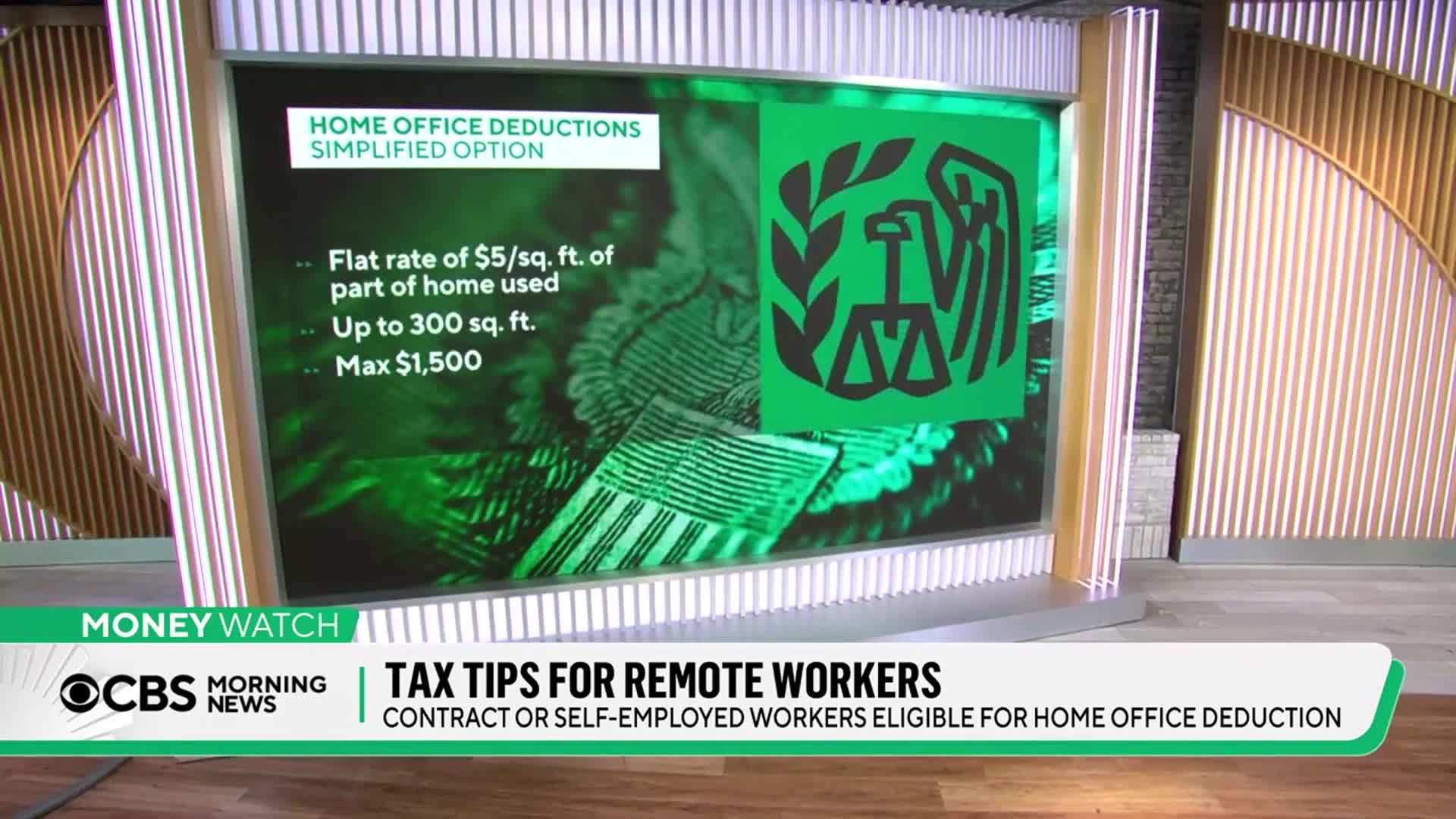

The simplified home office deduction method allows eligible taxpayers to claim $5 per square foot of their workspace, with a maximum allowable space of 300 square feet. This means the maximum deduction available through this simplified method is $1,500 ($5 × 300 square feet). This straightforward calculation method was introduced following the 2018 tax reforms to make it easier for self-employed individuals and those with secondary jobs to claim their legitimate home office expenses without complex recordkeeping requirements.

Watch clip answer (00:07m)What health insurance deductions are available for self-employed individuals?

Self-employed individuals who purchase their own health insurance can deduct all health insurance premiums not only for themselves, but also for their spouse and children. This is a significant tax benefit that helps offset the cost of obtaining private health coverage when you don't have employer-sponsored insurance. To properly claim this deduction, meticulous record-keeping is essential. Self-employed taxpayers must maintain organized documentation and save all receipts related to their health insurance premium payments. Unlike traditional employees who lost the ability to deduct unreimbursed expenses after the 2018 tax reforms, self-employed individuals retain this valuable tax advantage.

Watch clip answer (00:18m)Can remote workers claim home office tax deductions?

Since the 2018 tax reforms, most remote workers cannot claim deductions for unreimbursed expenses or home office costs. This change significantly impacts employees working from home who might have previously expected to receive tax benefits for their home workspace arrangements. While many remote workers may be considering office deductions as tax season approaches, the current tax code restricts these benefits, regardless of whether you're working from your couch, bed, or a dedicated home office space as an employee. Self-employed individuals, however, may still qualify for certain home office deductions under different rules.

Watch clip answer (00:17m)What expenses can self-employed remote workers deduct from their taxes for a home office?

Self-employed remote workers can deduct much more than just basic office equipment. Beyond cell phones, laptops, printers and supplies, they can deduct a portion of their rent or mortgage, real estate taxes, homeowners insurance, and utilities based on the percentage of home used exclusively for business. For example, if 20% of your home serves exclusively as an office, you can deduct 20% of these housing-related expenses from your taxes. Proper documentation is essential when claiming these deductions, as all expenses must be thoroughly recorded to support your tax claims.

Watch clip answer (00:32m)