Real Estate

What is the scale and focus of Blackstone's investments in India?

Blackstone has established itself as the largest private market investor in India, having invested over $15 billion in the country over 15 years, with a remarkable $6 billion invested just in the last year alone, indicating an accelerating pace. Technology has emerged as Blackstone's single largest area of investment in India, spanning both private equity investments in companies like Telenet, Task, and IBS Software, and real estate holdings. In the real estate sector, Blackstone has become India's largest commercial landlord, owning 120 million square feet of property including a majority of IT parks, with major technology companies like IBM and Cognizant as tenants.

Watch clip answer (01:05m)How has Blackstone's performance been in India compared to other markets?

Blackstone's operations in India have generated their highest returns globally. Steve Schwarzman, Blackstone's CEO, states that both their private equity and real estate investments in India have been 'enormously successful' for the company. Private equity, which involves buying companies and improving them, along with real estate investments, have yielded exceptional performance in the Indian market. This remarkable success positions India as Blackstone's top-performing region worldwide, demonstrating the significant potential of the Indian market for strategic institutional investors.

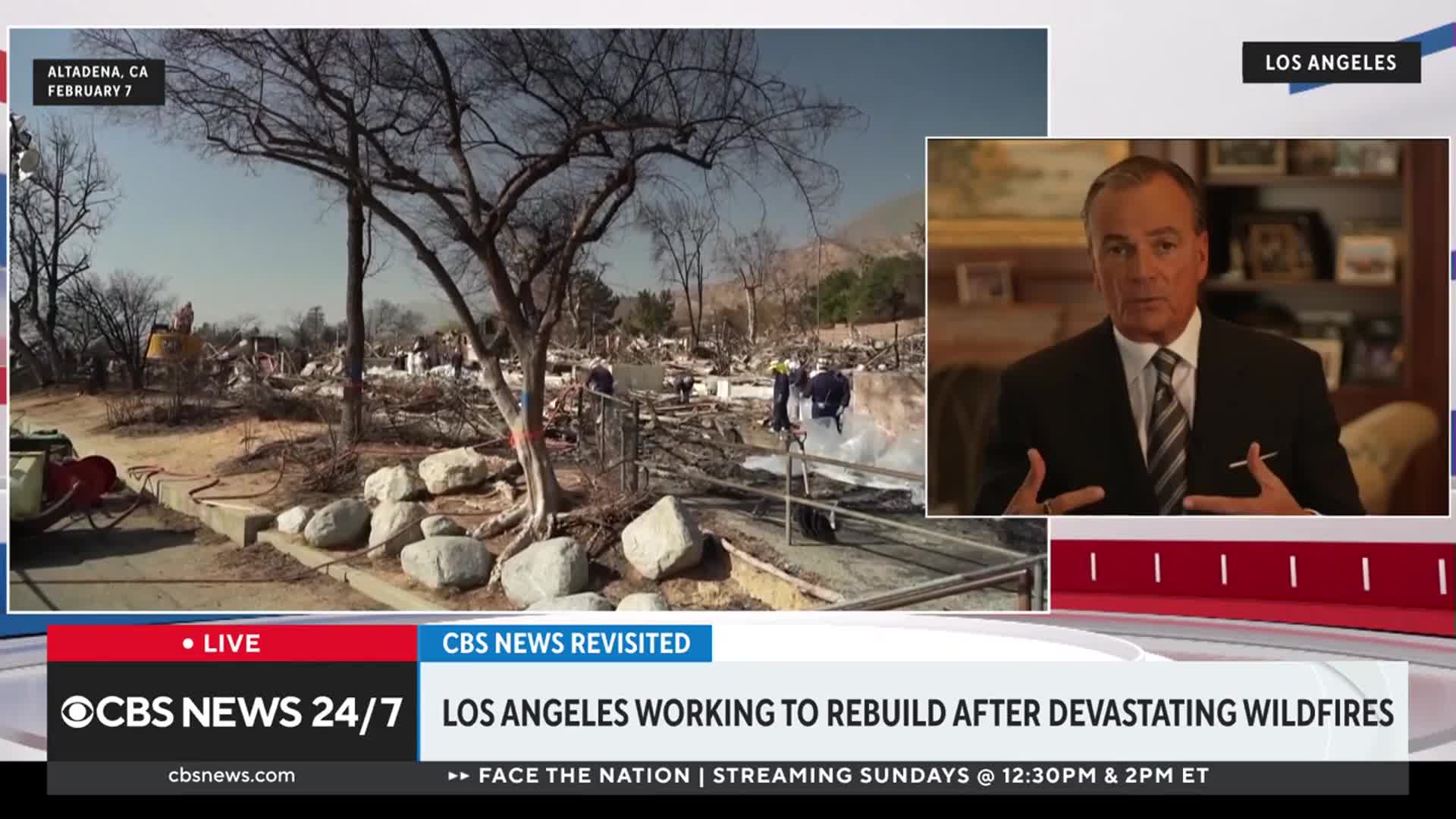

Watch clip answer (00:22m)Is the proposed 12-18 month timeline for rebuilding Los Angeles after the wildfires satisfactory?

According to Rick Caruso, the proposed timeline could be shortened. When asked about Steven Soboroff's (the appointed chief recovery officer for Los Angeles) estimation of 12-18 months before rebuilding can begin, Caruso expressed that the timeline should be tighter than that. He specifically stated that 12 months might be realistic, but implied that even this timeframe could potentially be improved upon. This suggests that Caruso believes more urgent action is needed to expedite the recovery process following the devastating wildfires in Los Angeles.

Watch clip answer (00:16m)What has happened to China's consumer confidence index and what does it indicate?

China's consumer confidence index has experienced a dramatic decline, dropping from 121.5 in January 2022 to 86.4 in December 2024. This sharp decrease of nearly 35 points over a three-year period signals significantly weakened consumer sentiment throughout the Chinese economy. This plummeting confidence level reflects broader economic concerns in China, particularly related to the struggling real estate sector. The decline indicates consumers are increasingly pessimistic about their financial prospects, which could lead to reduced spending and further economic challenges ahead.

Watch clip answer (00:12m)What is Barclays' forecast for China's property market in 2025?

Barclays projects that China's property sales will decline by another 10% in 2025, following a significant 13% drop in 2024. This continued downturn reflects the persistent challenges facing China's real estate sector. In the worst-case scenario, analysts at Barclays suggest that the property crisis could extend until 2030, indicating a potentially prolonged period of market distress. This forecast has serious implications for China's economy, particularly affecting middle-class wealth and consumer confidence.

Watch clip answer (00:13m)Are there any signs of recovery in China's real estate market despite the prolonged downturn?

Despite the prolonged real estate downturn in China, some analysts see early indications of a potential turnaround. New home prices experienced an uptick in January, while the stock market has shown short-lived rebounds, particularly in the tech sector following AI innovation launches. However, significant uncertainty persists in the market. Government policymakers continue implementing stimulus measures, but their effectiveness for long-term real estate stability remains unclear. As China navigates this economic challenge, attention is focused on the government's upcoming strategies to stabilize the property sector and restore investor confidence.

Watch clip answer (00:35m)