Personal Finance

What are the two parts of the CFP certification education requirement?

The CFP certification education requirement consists of two key components. First, candidates must complete coursework through a CFP Board registered program, covering essential topics like income planning, risk management, investments, retirement planning, and estate planning. This culminates in a capstone course where students create a comprehensive financial plan. Second, candidates must submit their bachelor's degree transcript for verification. The degree can be in any discipline and submitted at any time, even after taking the CFP exam. Notably, those with certain credentials may qualify for an accelerated path, allowing them to skip most coursework and proceed directly to the capstone course.

Watch clip answer (01:33m)What are the two key phases of personal finance according to Scott Galloway, and how should people approach them?

According to Scott Galloway, personal finance consists of two key phases: investing and harvesting. The investing phase occurs during younger years when individuals should save money to deploy capital that grows while they sleep, providing future security. During this phase, market downturns are actually beneficial as they create opportunities to purchase assets at lower prices. The harvesting phase comes later in life when one begins spending more than earning, living off accumulated investments. Galloway criticizes current economic policies that artificially support markets through government intervention, which prevents younger generations from experiencing the natural investment opportunities that market cycles would normally provide.

Watch clip answer (00:58m)What will George Camel's free webinar teach people about breaking the paycheck-to-paycheck cycle?

George Camel's webinar will teach participants practical strategies to break the paycheck-to-paycheck cycle in just 90 days. The session focuses on finding hidden money in your budget and creating financial margin, even for those who are already debt-free. Participants will learn unique ways to save more, spend less, and free up resources to pursue financial goals. The free, virtual webinar scheduled for September 16th at 1pm Eastern/12pm Central will use the EveryDollar platform to demonstrate these techniques. Registration is available at everydollar.com/webinar, and those who can't attend live can watch the replay later.

Watch clip answer (00:43m)What are the key details and potential impacts of the Capital One and Discover merger?

Shareholders have approved a $35 billion merger between Capital One and Discover, which would make Capital One the largest credit card issuer in the United States. This significant consolidation in the financial services industry represents a strategic move to enhance Capital One's market position. According to experts, the merger could deliver several consumer benefits, including expanded payment access locations where customers can use their cards. Additionally, the combined entity may potentially offer lower interest rates to consumers, making credit more affordable. The deal marks a major shift in the credit card landscape that could reshape competition in the industry.

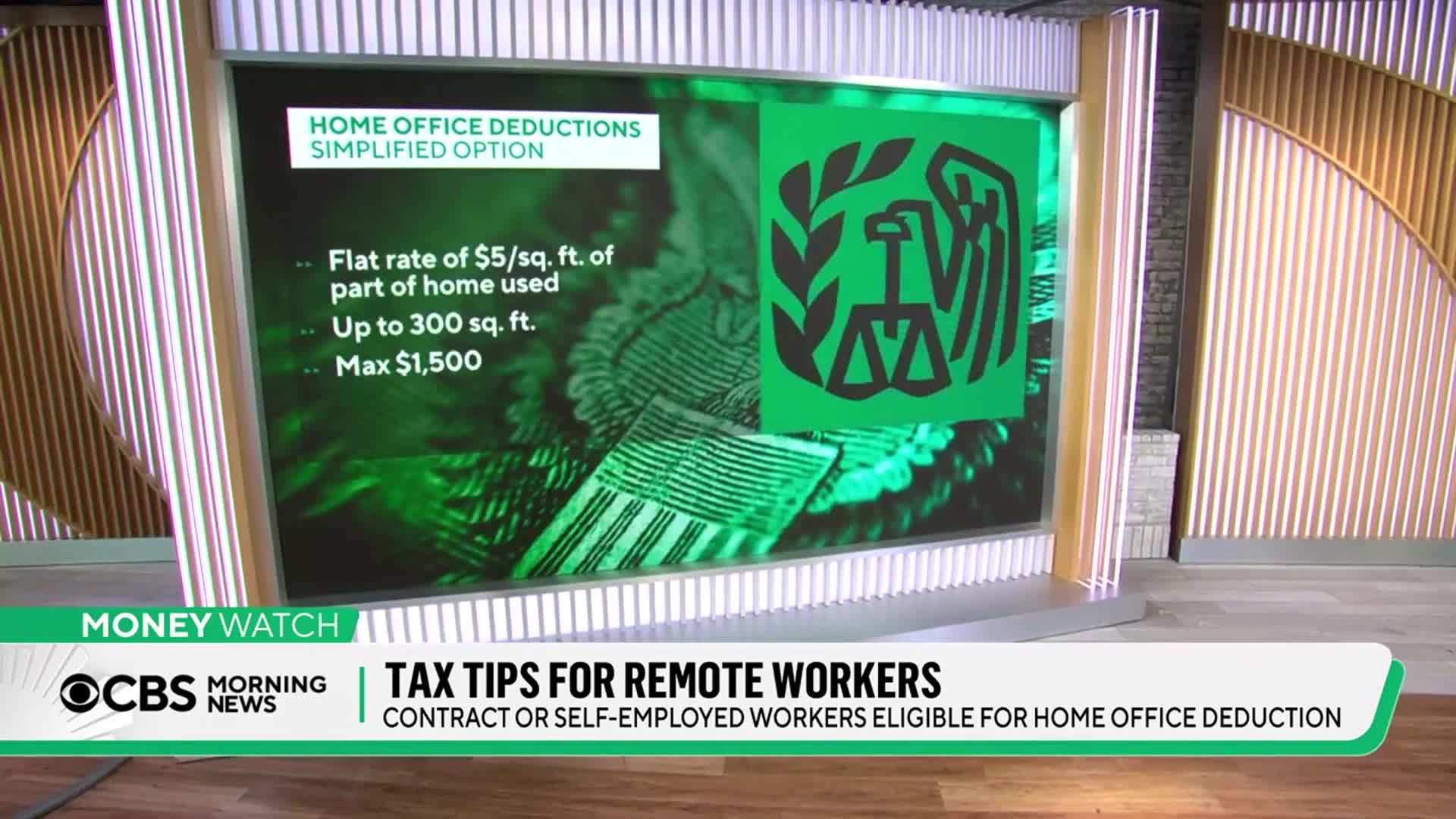

Watch clip answer (00:16m)What are ways people can reduce their tax bill?

Taxpayers can reduce their tax bill by maximizing contributions to their 401k or other retirement funds before the April 15 deadline, which provides pre-tax benefits for the 2024 tax season. This is a key opportunity that's still available. Additionally, given potential IRS staffing changes mentioned by Trump, including cutting staff or reassigning agents to border duties, it's advisable to file taxes as early as possible. Filing promptly ensures taxpayers receive assistance before any potential reduction in IRS services occurs.

Watch clip answer (00:48m)How does the cost of healthcare in the US compare to other countries, particularly for childbirth?

The US healthcare costs are dramatically higher than other countries. The average annual cost per person in the US is around $12,000 compared to just $1,000 in Turkey. For childbirth specifically, American mothers report paying $20,000-$40,000, while in countries with universal healthcare like England and France, the cost is zero or fully covered by insurance. This disparity particularly affects women, who face both reproductive health expenses and typically live longer than men—factors not adequately accounted for in the US healthcare system.

Watch clip answer (01:55m)