Mining Industry

Why should investors buy gold and gold mining stocks now instead of waiting for pullbacks?

Peter Schiff advises investors not to wait for pullbacks in gold prices, emphasizing that pullbacks will likely be quick and shallow. He notes that gold has reached new highs ($2,204 per ounce) and predicts gold mining stocks could explode higher by 10-20% in a single day as the market recognizes the Fed's inevitable rate cuts. Schiff argues that rate cuts are coming not because inflation is defeated, but because the country is broke and facing potential financial and banking crises. This environment creates a strong bullish case for precious metals as inflation will continue. His key message is clear: the sooner investors buy gold and silver, the cheaper it will be, as these assets have a long upward trajectory ahead.

Watch clip answer (01:45m)What action has a Chinese firm taken regarding lithium processing equipment?

A Chinese firm has implemented export controls on key filtration equipment used in lithium processing. This move represents the early impact of Beijing's proposed export control policies, suggesting a shift in China's approach to managing strategic resources and technologies. The restriction on this critical equipment could potentially disrupt global lithium supply chains, which are essential for industries like electric vehicles and renewable energy storage. This development signals China's increasing use of trade policy as a geopolitical tool amid rising international tensions.

Watch clip answer (00:08m)What strategic offer did Ukraine make to the United States during the Munich security conference?

During the Munich security conference, Ukraine presented a transactional offer to the United States, specifically linked to American access to Ukrainian minerals and other resources. This strategic proposal came as Ukrainian President Zelensky met with Vice President Vance, with Ukraine essentially adopting President Trump's transactional approach to diplomacy. The discussions centered around a fundamental trade-off: how America would benefit if it continues to provide support to Ukraine. By offering access to its rich mineral resources, Ukraine is attempting to frame continued American backing as mutually beneficial rather than purely humanitarian or geopolitical, creating a business-like proposition that might appeal to the transaction-oriented Trump administration.

Watch clip answer (00:29m)What is the significance of a Chinese firm halting exports of filtration equipment for lithium processing?

The Chinese firm's decision to halt exports of key filtration equipment used in lithium processing represents the early impact of Beijing's proposed export controls. This move has significant implications for the global lithium supply chain at a time when demand for lithium is surging worldwide for technology and energy applications. This development signals China's strategic control over critical components in the lithium processing industry, potentially affecting international markets and trade relationships. As lithium is essential for batteries and renewable energy storage, this export restriction could impact global transition to clean energy technologies and increase dependencies on Chinese manufacturing capabilities.

Watch clip answer (00:10m)What recent action has China taken regarding lithium processing equipment exports and why is it significant?

A Chinese firm has halted exports of key filtration equipment used in lithium processing, marking an early impact of Beijing's proposed export controls. This decision is significant as it signals China's willingness to restrict access to critical components in the lithium supply chain, which is essential for modern technology including batteries for electric vehicles and electronics. The move appears to be part of China's broader strategy to leverage its dominance in critical minerals and processing technologies, potentially affecting global supply chains. This development indicates escalating trade tensions and highlights the geopolitical importance of controlling resources essential to technological advancement and energy transition.

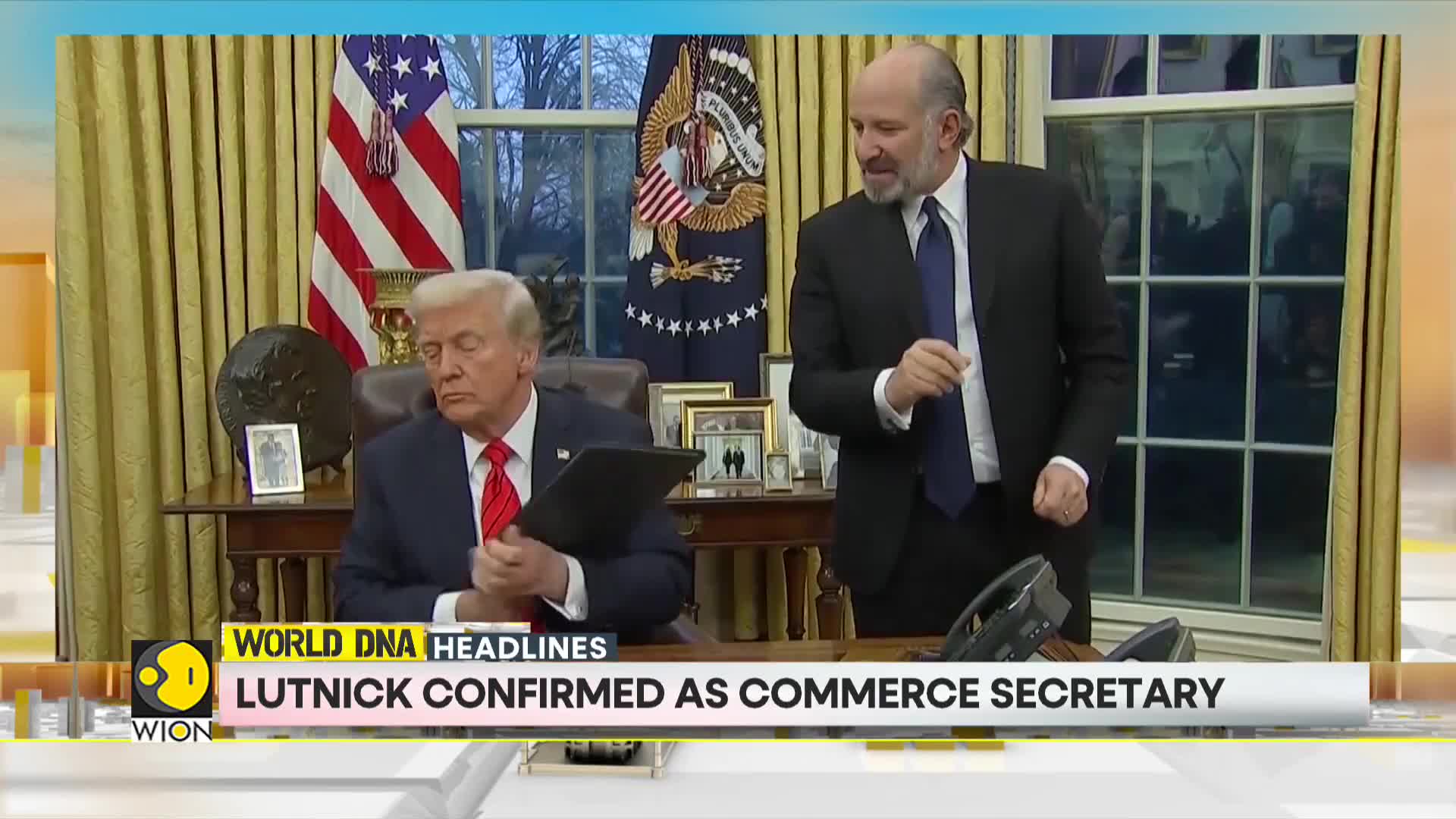

Watch clip answer (00:10m)What was the U.S. proposal regarding Ukraine's mineral resources and why was it rejected?

The U.S. proposed acquiring 50% of Ukraine's mineral wealth, including oil and gas resources, as a form of reimbursement for the billions invested in supporting Ukraine during the war. U.S. National Security Adviser Mike Waltz characterized it as American people deserving 'some kind of payback' for their investment in the conflict. President Zelensky ultimately rejected this proposal because it lacked security guarantees for Ukraine. While Ukrainian officials noted one potential benefit would be reinvesting profits into post-war reconstruction, these assurances were insufficient without explicit security commitments, leading to Ukraine's refusal of the deal.

Watch clip answer (00:50m)