Market Reaction

Why should investors buy gold and gold mining stocks now instead of waiting for pullbacks?

Peter Schiff advises investors not to wait for pullbacks in gold prices, emphasizing that pullbacks will likely be quick and shallow. He notes that gold has reached new highs ($2,204 per ounce) and predicts gold mining stocks could explode higher by 10-20% in a single day as the market recognizes the Fed's inevitable rate cuts. Schiff argues that rate cuts are coming not because inflation is defeated, but because the country is broke and facing potential financial and banking crises. This environment creates a strong bullish case for precious metals as inflation will continue. His key message is clear: the sooner investors buy gold and silver, the cheaper it will be, as these assets have a long upward trajectory ahead.

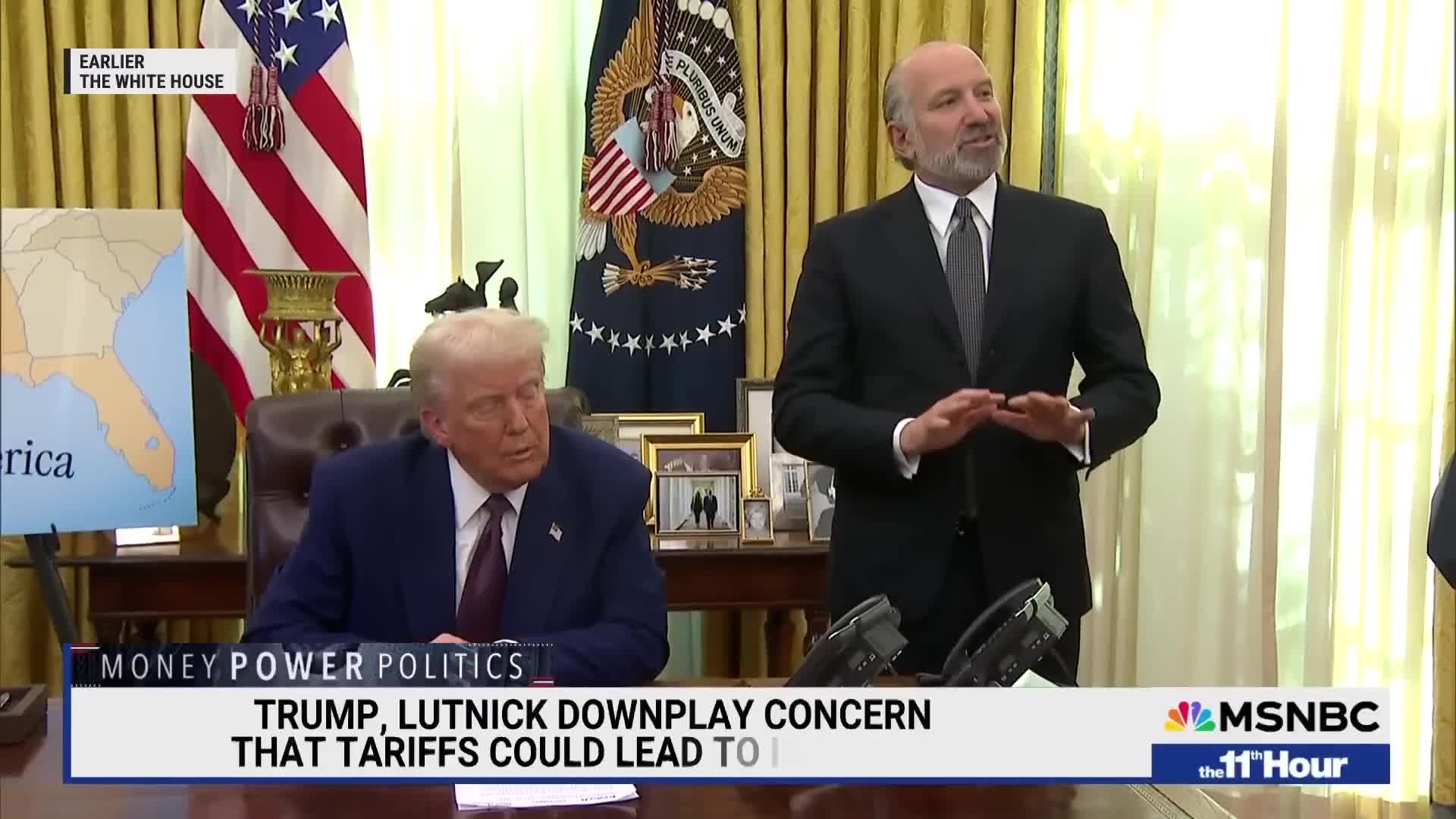

Watch clip answer (01:45m)Will prices rise because of Trump's tariffs?

The transcript reveals uncertainty about whether Trump's tariffs will increase consumer prices. When directly questioned, an economic advisor from Trump's team avoids giving a definitive answer, stating that 'prices fluctuate' and claiming to be 'confident' there won't be strong evidence of price effects from tariffs. However, experts in the discussion express concerns about these tariffs creating business uncertainty that could hurt US investment. The news analysts note that prices for gas and groceries have already risen and may increase further if the tariffs are implemented. The discussion also highlights how these policies might impact international trade relationships and alliances.

Watch clip answer (03:25m)How did the markets react to Trump's delay in tariff implementation?

The markets reacted very positively to the announcement that the tariff study wouldn't be completed until April 1, with tariffs potentially not being implemented until sometime after that date. This delay in the implementation of potential new tariffs was received as a relief by market participants. As Bill Cohan explains, this postponement gives businesses and investors more time to prepare and adjust strategies, reducing immediate economic uncertainty. The market's positive response indicates that concerns about tariffs' inflationary impact and potential disruption to global trade had been weighing on investor sentiment.

Watch clip answer (00:15m)What are the major legal and financial risks associated with meme coin investments?

Meme coins face multiple risks including market manipulation, where 'market makers' artificially inflate trading volumes and prices through fake transactions to lure unsuspecting investors. Additionally, 'pump and dump schemes' artificially inflate prices before major sell-offs, leaving late investors at a loss. In October 2024, US authorities charged 18 people and major crypto firms for various frauds targeting everyday investors. Beyond manipulation, meme coins experience unpredictable price volatility and lack real-world applications or long-term viability. Investors also face potential legal crackdowns that could impact market presence, and exposure to hackers and criminal operators. For these reasons, extreme caution is advised when considering meme coin investments.

Watch clip answer (01:11m)How did defense stocks perform compared to tech stocks in the recent market?

While heavyweight tech stocks experienced declines, defense stocks continued to gain ground in the broader market, showing notable resilience. This divergent performance occurred alongside positive movement in mid and small cap indexes, with the BSE Mid cap index adding 1.2% and the small cap index surging by a more substantial 2.4%. This pattern indicates a rotation of investor interest from technology into defense sectors, potentially reflecting changing market sentiments and sector-specific dynamics.

Watch clip answer (00:13m)How did Asian markets perform on Wednesday?

Asian markets closed with mixed results on Wednesday as investors responded to recent earnings releases and economic indicators. Japan's Nikkei 225 showed gains, buoyed by strong corporate earnings, while Chinese markets struggled amid continued economic uncertainty. In India, the benchmark indices ended slightly lower after a volatile trading session. The Nifty index declined as heavyweight tech stocks faced downward pressure, though defense stocks continued to show strength in the broader market. This mixed performance reflects varying regional economic conditions and sector-specific trends across Asian markets.

Watch clip answer (00:27m)