Investment Trends

How are Indian stocks performing compared to other Asian markets?

Indian stocks are showing remarkable resilience by trading higher despite a broader downtrend in Asian markets. During a volatile trading session, Indian equities have maintained positive momentum while other Asian stocks trade lower, demonstrating the relative strength of the Indian market. The Nifty index is specifically attempting to reclaim the key psychological level of 23,000, which represents an important threshold for market sentiment and investor confidence in the Indian economy.

Watch clip answer (00:09m)What is happening to property income in Beijing?

In Beijing, per capita net property income fell by 0.6%, marking its third consecutive year of decline. The primary driver of this downturn is falling rental income, which has significantly impacted the property market. This persistent decline indicates a troubling trend in Beijing's real estate sector, affecting household earnings and potentially contributing to broader economic challenges in China.

Watch clip answer (00:13m)How is China's real estate decline affecting the middle class?

China's underperforming real estate market is significantly impacting its middle class population. Property income, which forms a crucial component of household earnings, is declining, indicating asset depreciation for numerous homeowners across the country. This financial setback is particularly concerning as property has traditionally been a key wealth-building mechanism for China's middle class. The diminishing returns from real estate are contributing to weakened consumer confidence and creating financial strain on middle-class households who have invested substantially in property.

Watch clip answer (00:14m)What is the projected outlook for China's property market in the coming years?

China's property market faces significant challenges ahead, with Barclays projecting property sales to decline another 10% in 2025, following a steep 13% drop in 2024. The Chinese stock market has already underperformed for an extended period, providing little relief to investors in this sector. In a worst-case scenario, analysts suggest the property crisis could potentially extend until 2030, indicating a prolonged period of market adjustment. This persistent downturn reflects deeper structural issues in China's real estate sector, with implications for both domestic and international investors.

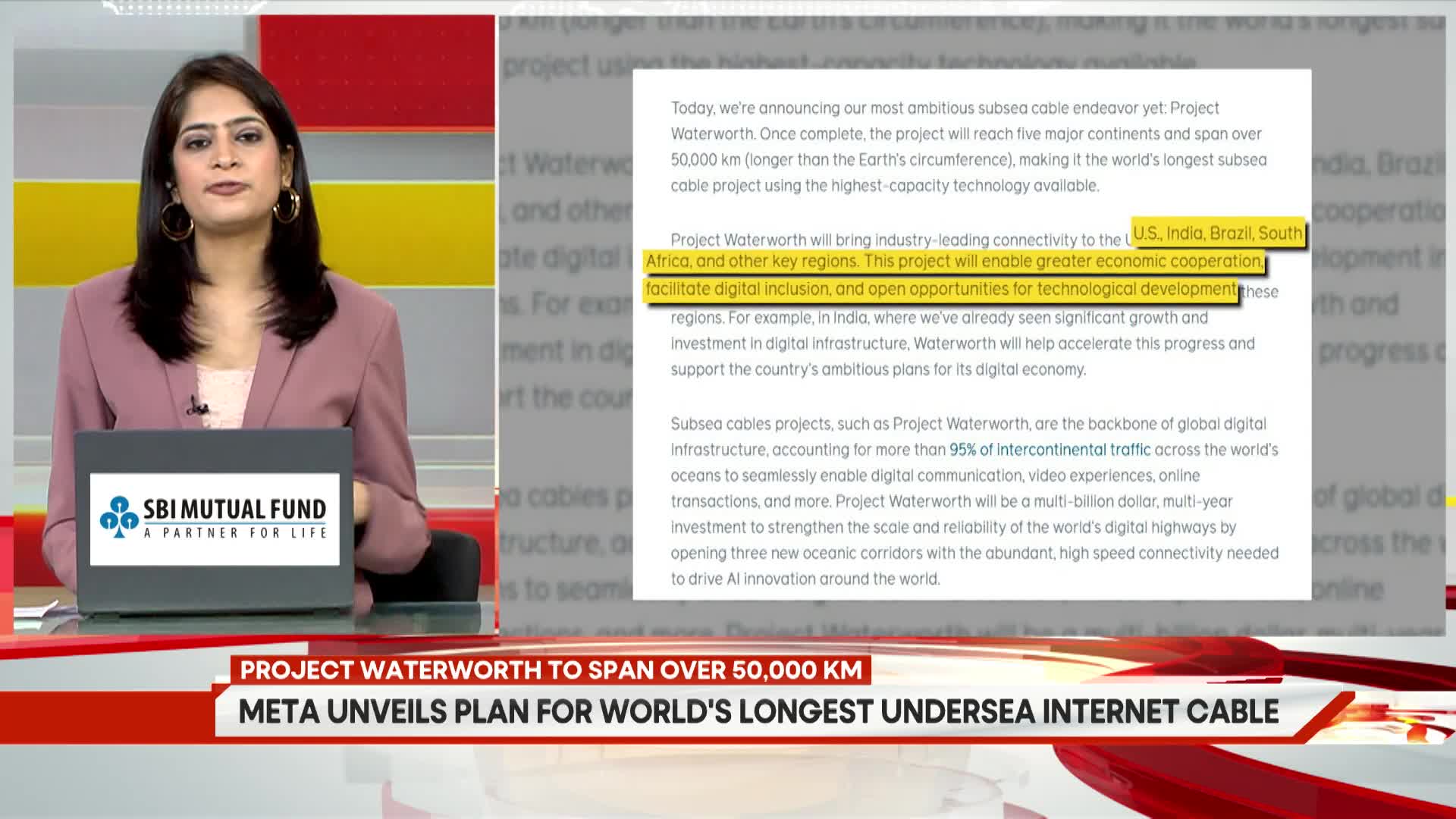

Watch clip answer (00:20m)What is Project Waterworth and what is its purpose?

Project Waterworth is Meta's ambitious 50,000-kilometer subsea cable project that will connect five continents, becoming the world's longest underwater cable network. The multi-billion dollar initiative will link the United States, India, Brazil, South Africa, and other key regions, reaching depths of up to 7,000 meters. Meta's stated aim is to enable greater economic cooperation, facilitate digital inclusion, and create opportunities for technological development in connected regions. The project employs advanced routing and innovative cable burial strategies to protect against damage in high-risk areas like shallow coastal waters, while expanding network infrastructure and alleviating data congestion for telecom operators worldwide.

Watch clip answer (01:25m)Why should investors be cautious when approaching meme coins?

Investors should exercise extreme caution with meme coins due to their volatile nature and lack of intrinsic value. The clip references a scandal involving Argentina's president promoting a cryptocurrency that subsequently crashed, highlighting the significant risks these speculative assets pose to investors. Meme coins, which began as jokes, have evolved into investment vehicles that are susceptible to fraud and market manipulation. As governments increase regulatory scrutiny of these cryptocurrencies, the potential for sudden value collapse remains high, making them particularly dangerous for retail investors seeking quick profits.

Watch clip answer (00:16m)