Investment Trends

Is it better to invest in Bitcoin directly or in mining companies after the 2024 Bitcoin halving?

The 2024 Bitcoin halving presents a complex investment landscape. Despite cutting miner revenue by 50%, Bitcoin's expected rising demand makes it an attractive long-term investment option. However, mining companies face significant challenges with reduced revenue per unit of hash power. For investors, this creates a fundamental decision between investing directly in Bitcoin, which benefits from increasing scarcity and demand, or in mining companies that extract it. While Bitcoin itself may offer more straightforward exposure to price appreciation, mining investments require considering operational challenges alongside potential industry consolidation opportunities in the post-halving environment.

Watch clip answer (00:31m)Why does Goldman Sachs consider gold a valuable investment?

Goldman Sachs emphasizes that gold serves as a crucial hedge against multiple economic challenges in today's volatile market. Specifically, gold provides protection against financial and recessionary risks that could impact investment portfolios. Additionally, gold's value as a strategic asset is enhanced during periods of trade tensions and Federal Reserve policy uncertainty. This protective quality explains why Goldman has raised its forecast to $3,100 per ounce by the end of 2025, with increased central bank purchasing expected to reach 50 tonnes monthly.

Watch clip answer (00:10m)What is Goldman Sachs' revised forecast for gold prices in 2025 and what factors are driving this change?

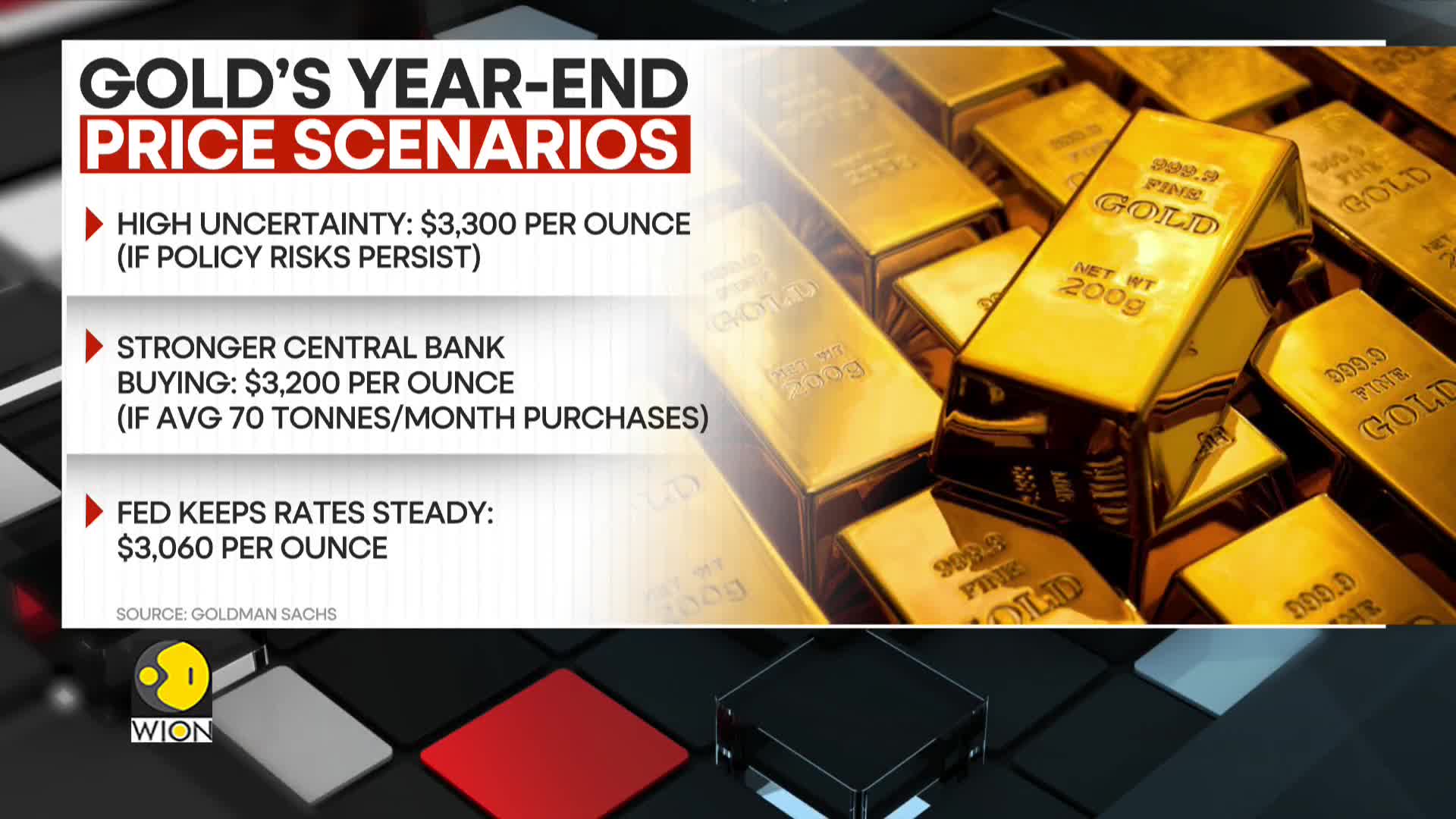

Goldman Sachs has increased its year-end 2025 gold price forecast to $3,100 per ounce, up from its previous estimate of $2,890. This upward revision is primarily attributed to sustained central bank demand for gold, which is expected to continue driving market prices higher. The investment bank projects that this central bank demand will add approximately 9% to gold prices by the end of the year, reflecting growing institutional confidence in gold as a strategic asset amid various economic uncertainties.

Watch clip answer (00:19m)What is Goldman Sachs' forecast for gold prices by the end of 2025?

According to Goldman Sachs, gold prices could potentially surge to $3,300 per ounce by the end of the year, primarily driven by ongoing high uncertainty in the financial markets. This bullish forecast is specifically influenced by concerns regarding tariffs and monetary policy risks that are expected to persist. The investment bank believes that prolonged economic and policy uncertainties will create favorable conditions for gold's appreciation as investors seek safe-haven assets. This projection represents a significant potential upside from current gold prices as the precious metal continues to be viewed as a hedge against financial instability.

Watch clip answer (00:14m)What is Goldman Sachs' forecast for gold prices and what factors are driving this prediction?

Goldman Sachs has revised its gold price forecast upward, primarily due to sustained central bank demand, which is expected to add 9% to gold prices by the end of the year. The bank has increased its assumption for monthly central bank gold purchases to 50 tonnes, up from its previous estimate of 41 tonnes. According to Goldman, this structural demand, combined with gradually increasing ETF holdings as interest rates decline, should outweigh any potential price drag from normalizing investor positioning, supporting their bullish outlook for gold.

Watch clip answer (00:30m)What is Goldman Sachs' gold price projection for 2025 if the Federal Reserve keeps interest rates steady?

According to Goldman Sachs, if the Federal Reserve maintains steady interest rates, gold prices are expected to reach $3,060 by 2025. This bullish outlook is supported by several factors including ongoing central bank demand and anticipated ETF inflows. Goldman Sachs views gold as an important hedge against fiscal instability, inflation concerns, and trade tensions in the current economic climate. The bank has outlined various price scenarios based on monetary policy uncertainty and central bank purchasing trends, ultimately reinforcing a positive perspective on gold as an investment during economic fluctuations.

Watch clip answer (00:07m)