Financial Strategy

Financial strategy is a comprehensive approach that helps individuals and organizations effectively manage their financial resources to achieve long-term goals and ensure sustainable growth. At its core, a financial strategy encompasses elements such as **investment planning**, **budgeting**, risk management, and securing retirement strategies. The ability to navigate these components allows businesses to align financial goals with operational objectives, ultimately enhancing shareholder value and contributing to overall fiscal stability. In today’s dynamic economic environment, the relevance of a well-structured financial strategy continues to grow, particularly with recent advances in technology and shifts in regulatory frameworks. Financial leaders are increasingly adopting modern strategies that leverage **advanced analytics** and **AI** to optimize decision-making processes, enhance operational efficiency, and deliver personalized customer experiences. Furthermore, effective strategies involve continuous monitoring and assessment, enabling organizations to adapt to market changes and remain competitive. This focus on adaptability ensures proper **capital allocation**, aligns with broader business strategies, and fosters resilience against economic fluctuations. By incorporating elements like **professional financial advisement**, thorough investment evaluations, and a proactive stance on retirement planning, individuals can build a robust financial foundation. Crafting a sound financial strategy is essential for anyone looking to navigate the complexities of modern finance, mitigate risks, and pursue profitable opportunities in a constantly evolving landscape.

What is Goldman Sachs' gold price forecast for 2025 and what factors could drive it higher?

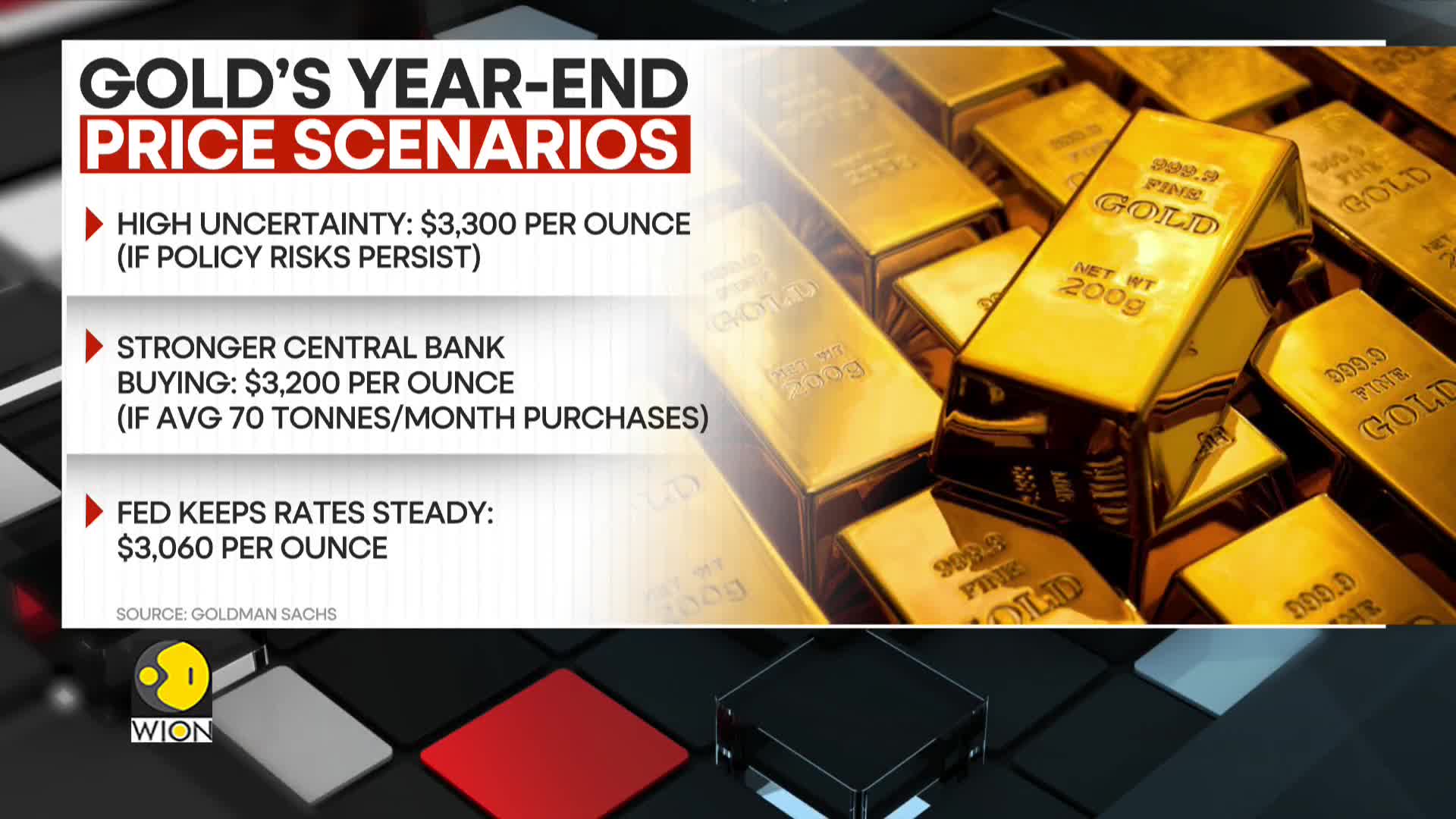

Goldman Sachs has raised its gold price forecast to $3,100 per ounce by the end of 2025, citing concerns over US fiscal sustainability as a key driver. According to their analysis, if these fiscal concerns escalate further, gold could rise an additional 5% to reach $3,250 per ounce by December 2025. The forecast is supported by growing fears of inflation and fiscal instability, which could trigger higher speculative positioning and stronger ETF inflows in the gold market. This outlook reflects gold's traditional role as a hedge against economic uncertainty, with the potential for significant price appreciation as investors seek safe-haven assets amid financial risks.

Watch clip answer (00:19m)What is Goldman Sachs' gold price projection for 2025 if the Federal Reserve keeps interest rates steady?

According to Goldman Sachs, if the Federal Reserve maintains steady interest rates, gold prices are expected to reach $3,060 by 2025. This bullish outlook is supported by several factors including ongoing central bank demand and anticipated ETF inflows. Goldman Sachs views gold as an important hedge against fiscal instability, inflation concerns, and trade tensions in the current economic climate. The bank has outlined various price scenarios based on monetary policy uncertainty and central bank purchasing trends, ultimately reinforcing a positive perspective on gold as an investment during economic fluctuations.

Watch clip answer (00:07m)How have US-Russia negotiation talks impacted European gas prices and what potential corporate shifts might follow?

European gas prices for March delivery fell by 10% following speculation around US-Russia talks, demonstrating immediate market sensitivity to potential diplomatic shifts. This price movement reflects broader economic implications of changing relations between these major powers. The situation presents significant challenges for EU unity if the US softens its stance on Russia. Major European corporations, including energy giants like BP and TotalEnergies, are positioning themselves for a possible return to Russian markets, especially if they perceive US competitors gaining an advantage. The coming months will be crucial in determining whether these negotiations lead to a strategic realignment in energy trade relationships.

Watch clip answer (00:33m)What is President Trump's recent order regarding tariffs and when might they be implemented?

President Trump has ordered his administration to investigate imposing reciprocal tariffs on all U.S. trading partners. According to Commerce Secretary nominee Howard Lutnick, a comprehensive country-by-country study will be completed by April 1st, after which the President would implement the final tariff decisions. This move comes at a challenging time as inflation is once again heating up in the economy, which increases the stakes for Trump's trade strategy. The administration appears to be positioning these tariffs as a way to 'even the score' with other countries, though the timing raises questions about potential economic impacts amid rising inflation.

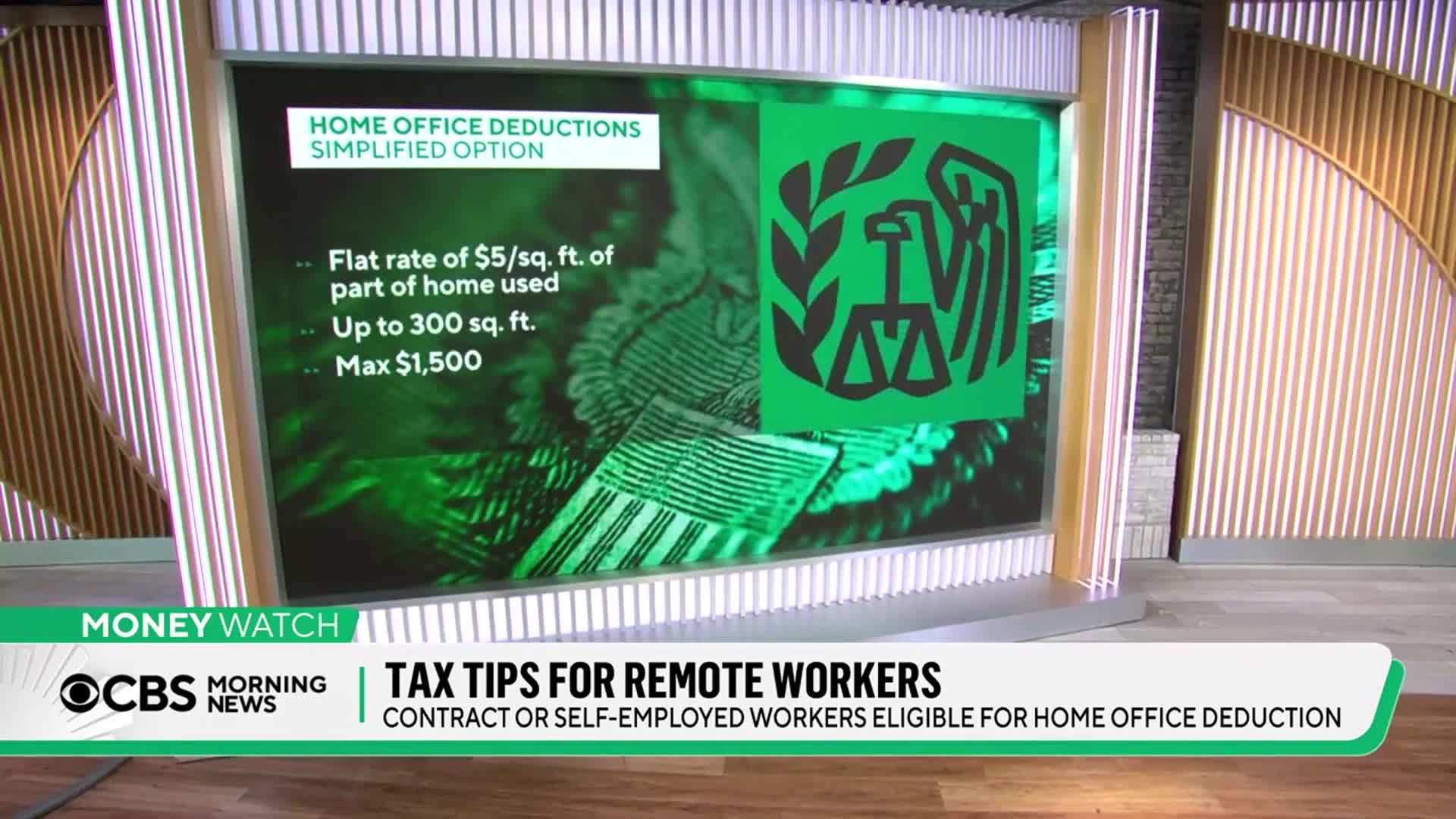

Watch clip answer (00:24m)What are ways people can reduce their tax bill?

Taxpayers can reduce their tax bill by maximizing contributions to their 401k or other retirement funds before the April 15 deadline, which provides pre-tax benefits for the 2024 tax season. This is a key opportunity that's still available. Additionally, given potential IRS staffing changes mentioned by Trump, including cutting staff or reassigning agents to border duties, it's advisable to file taxes as early as possible. Filing promptly ensures taxpayers receive assistance before any potential reduction in IRS services occurs.

Watch clip answer (00:48m)What is the predicted future price for gold according to analysts?

According to financial analysts featured on WION News, gold is predicted to reach an unprecedented milestone of $3,000 per ounce in the near future. This would mark the first time ever that the yellow metal has achieved such a high valuation. This bullish prediction comes amid a complex market landscape characterized by muted performance in Asian shares while European stock indices, particularly in the defense sector, have been surging. The anticipated gold price surge appears to be influenced by ongoing geopolitical tensions that are reshaping market dynamics and investor strategies.

Watch clip answer (00:05m)