Financial Strategy

What are the two key phases of personal finance according to Scott Galloway, and how should people approach them?

According to Scott Galloway, personal finance consists of two key phases: investing and harvesting. The investing phase occurs during younger years when individuals should save money to deploy capital that grows while they sleep, providing future security. During this phase, market downturns are actually beneficial as they create opportunities to purchase assets at lower prices. The harvesting phase comes later in life when one begins spending more than earning, living off accumulated investments. Galloway criticizes current economic policies that artificially support markets through government intervention, which prevents younger generations from experiencing the natural investment opportunities that market cycles would normally provide.

Watch clip answer (00:58m)How has Blackstone's performance been in India compared to other markets?

Blackstone's operations in India have generated their highest returns globally. Steve Schwarzman, Blackstone's CEO, states that both their private equity and real estate investments in India have been 'enormously successful' for the company. Private equity, which involves buying companies and improving them, along with real estate investments, have yielded exceptional performance in the Indian market. This remarkable success positions India as Blackstone's top-performing region worldwide, demonstrating the significant potential of the Indian market for strategic institutional investors.

Watch clip answer (00:22m)How are Qatar and India expanding their investment relationship?

Qatar, with its substantial disposable income, is seeking new segments to diversify and grow its financial investment portfolios beyond traditional sectors. This aligns with the strengthening private sector collaboration between Qatar and India, which aims to increase annual trade to $28 billion over the next five years. Both nations are exploring opportunities in emerging sectors like pharmaceuticals, agritech, fintech, and space exploration, creating a mutually beneficial investment landscape that leverages India's expanding economy and Qatar's financial resources.

Watch clip answer (00:15m)What is Goldman Sachs' revised forecast for gold prices in 2025 and what factors are driving this change?

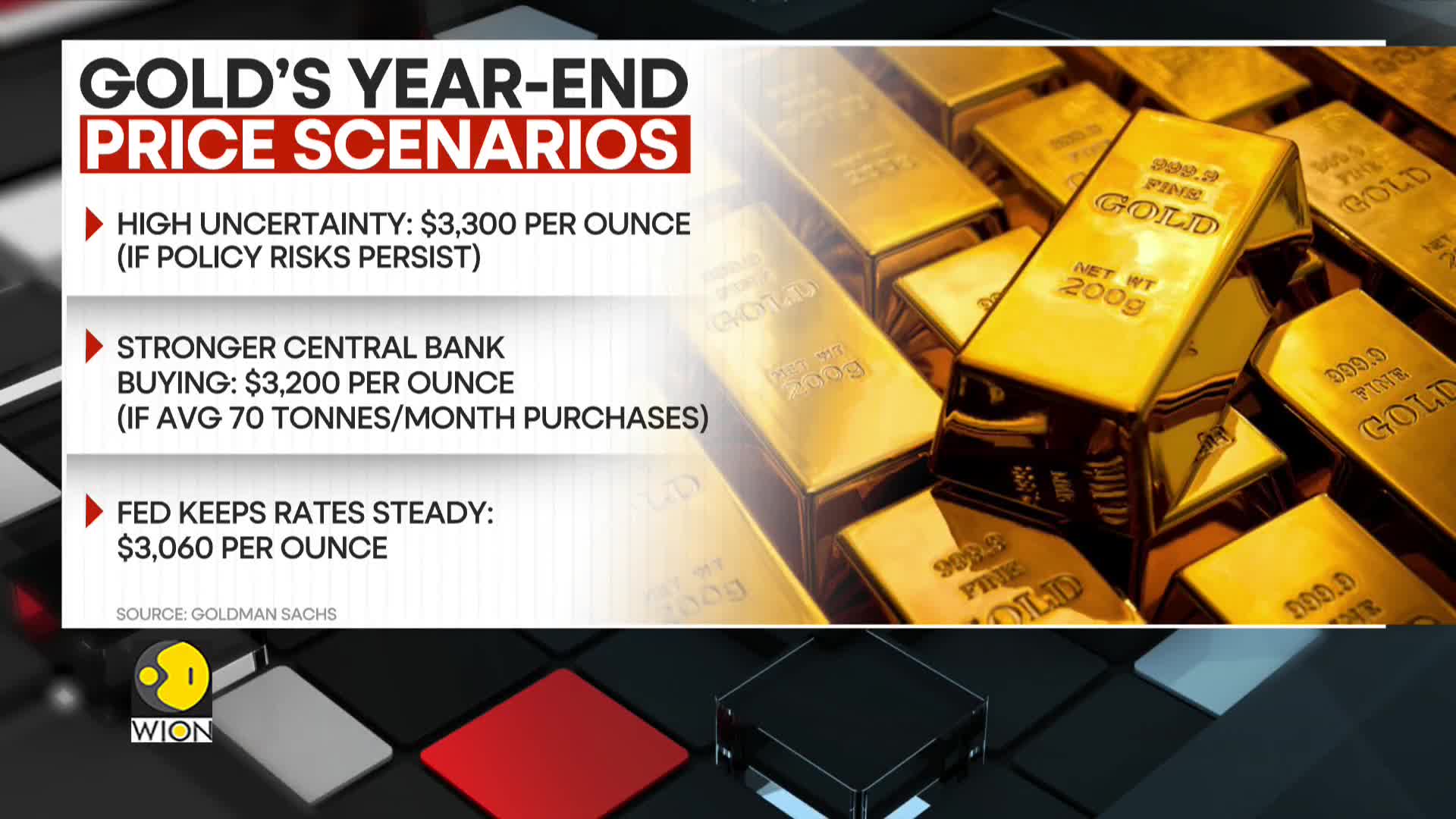

Goldman Sachs has increased its year-end 2025 gold price forecast to $3,100 per ounce, up from its previous estimate of $2,890. This upward revision is primarily attributed to sustained central bank demand for gold, which is expected to continue driving market prices higher. The investment bank projects that this central bank demand will add approximately 9% to gold prices by the end of the year, reflecting growing institutional confidence in gold as a strategic asset amid various economic uncertainties.

Watch clip answer (00:19m)What is Goldman Sachs' forecast for gold prices by the end of 2025?

According to Goldman Sachs, gold prices could potentially surge to $3,300 per ounce by the end of the year, primarily driven by ongoing high uncertainty in the financial markets. This bullish forecast is specifically influenced by concerns regarding tariffs and monetary policy risks that are expected to persist. The investment bank believes that prolonged economic and policy uncertainties will create favorable conditions for gold's appreciation as investors seek safe-haven assets. This projection represents a significant potential upside from current gold prices as the precious metal continues to be viewed as a hedge against financial instability.

Watch clip answer (00:14m)What is Goldman Sachs' forecast for gold prices and what factors are driving this prediction?

Goldman Sachs has revised its gold price forecast upward, primarily due to sustained central bank demand, which is expected to add 9% to gold prices by the end of the year. The bank has increased its assumption for monthly central bank gold purchases to 50 tonnes, up from its previous estimate of 41 tonnes. According to Goldman, this structural demand, combined with gradually increasing ETF holdings as interest rates decline, should outweigh any potential price drag from normalizing investor positioning, supporting their bullish outlook for gold.

Watch clip answer (00:30m)