Financial Services Industry

How has the career path for MBA graduates changed over the years?

The career landscape for MBA graduates has shifted dramatically. While 10-15 years ago Wall Street and investment banking were the dominant paths for MBAs, today's graduates are increasingly choosing consulting careers instead. According to Dimitri, consulting has become the biggest industry for MBA students, offering opportunities to analyze financials, manage risks, and work on special projects for various companies. This shift reflects changing priorities among business graduates, with many no longer interested in traditional Wall Street careers. Notably, MBA graduates are now earning more money in consulting and technology fields than in traditional finance roles.

Watch clip answer (01:14m)How did Sebastian Siemiatkowski develop the idea for Klarna while working at a factoring firm?

While working at a factoring firm in 2004, Sebastian noticed that small e-commerce companies needed better payment solutions. As a sales representative calling businesses, he found established companies weren't interested in switching services, but emerging online retailers were eager for solutions that could save them money. Through conversations with these entrepreneurs, Sebastian realized there was an opportunity in the payment space. Despite planning to return to his studies, he presented his idea at a university incubator that promoted student entrepreneurship. This concept eventually evolved into Klarna's buy now, pay later model, transforming from a simple payment service for small e-commerce companies into a global financial technology platform.

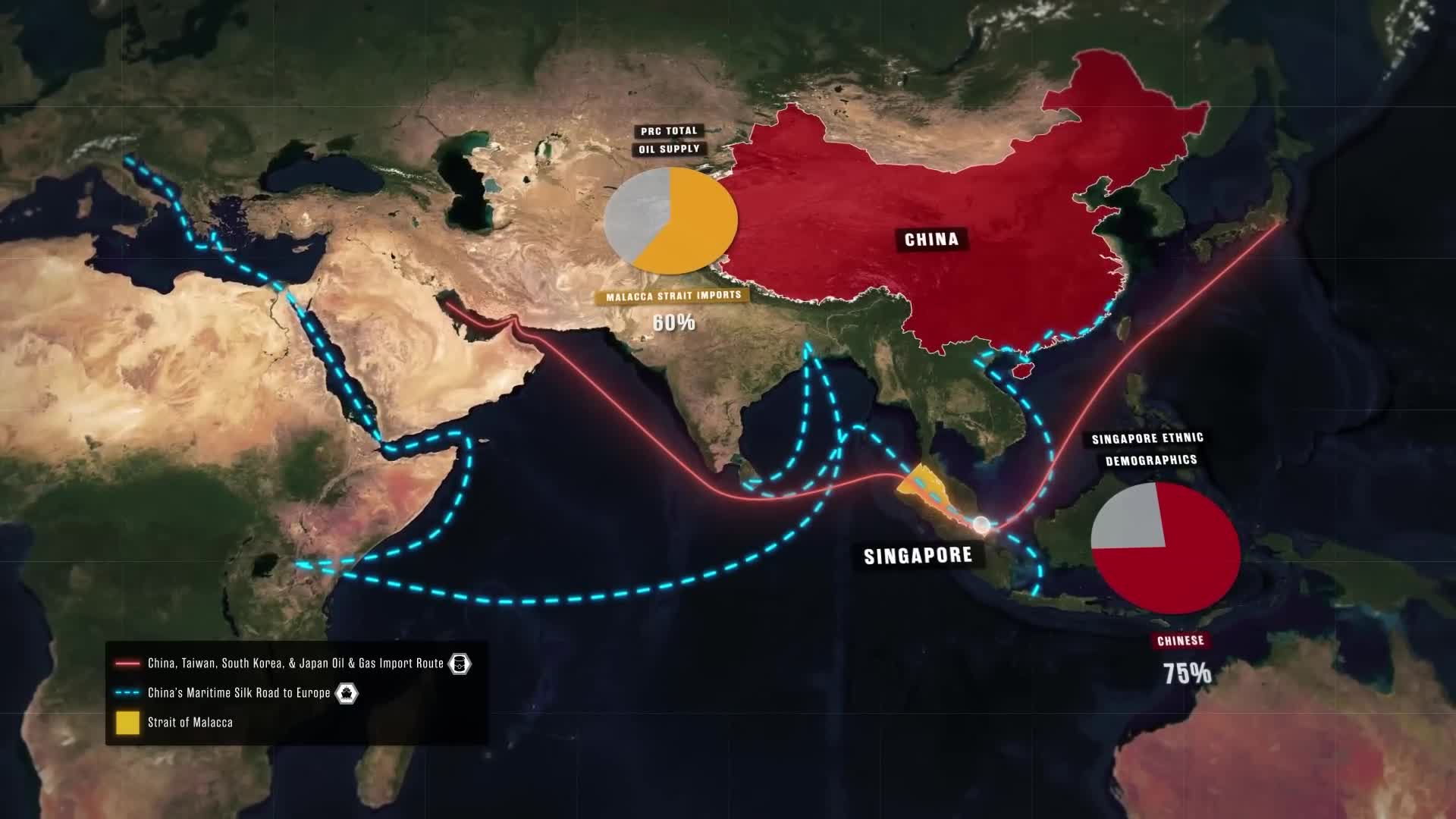

Watch clip answer (02:31m)What challenge does Singapore face in the changing global landscape?

Singapore faces the horrifying prospect of navigating a potentially less globalized world. After successfully riding the wave of globalization for 60 years since being ejected from Malaysia, the country's remarkable economic success is now threatened by changing global dynamics. Singapore's prosperity was built on an unprecedented era of openness, connectivity, and free access to seas. This environment enabled the small nation to grow wildly successful and powerful despite its limited size. Any reversal in global openness could severely impact Singapore's economic model and regional influence.

Watch clip answer (00:22m)What is the significance of the Capital One and Discover merger?

The merger represents a significant consolidation in the financial sector, with shareholders recently approving a $35 billion deal between Capital One and Discover. Upon completion, this strategic combination will transform Capital One into the largest credit card issuer in the United States, marking a pivotal shift in the credit card industry landscape. This development is noteworthy not just for the companies involved but potentially for consumers as well. As the merged entity gains increased market share and greater economies of scale, it may lead to expanded payment access options and possibly lower interest rates for credit card users.

Watch clip answer (00:12m)What is the current threat level of an asteroid hitting Earth?

NASA astronomers are tracking a large asteroid (130-300 feet long) expected to pass close to Earth in December 2032. The probability of impact has increased to just over 3%, up from 2.8% previously. This represents the highest risk level ever recorded for a large space rock. Despite this increase, the overall odds remain relatively low, and experts advise the public to remain calm about the potential threat.

Watch clip answer (01:08m)What are the key details and potential impacts of the Capital One and Discover merger?

Shareholders have approved a $35 billion merger between Capital One and Discover, which would make Capital One the largest credit card issuer in the United States. This significant consolidation in the financial services industry represents a strategic move to enhance Capital One's market position. According to experts, the merger could deliver several consumer benefits, including expanded payment access locations where customers can use their cards. Additionally, the combined entity may potentially offer lower interest rates to consumers, making credit more affordable. The deal marks a major shift in the credit card landscape that could reshape competition in the industry.

Watch clip answer (00:16m)