Financial Markets

Financial markets play a pivotal role in the global economy, serving as platforms where buyers and sellers can trade financial assets, including stocks, bonds, currencies, and derivatives. These markets facilitate essential transactions between capital providers such as investors and savers, and capital seekers like corporations and governments. The dynamics of financial markets influence investment strategies and stock market analysis, making understanding their mechanics vital for both individual and institutional investors. Recent trends indicate that as the global economy continues to evolve, the significance of online trading platforms has surged, with a keen focus on identifying the best trading platforms to optimize trading strategies. In recent assessments, financial markets have demonstrated resilience amidst challenges such as inflationary pressures and geopolitical uncertainties. A cautious yet optimistic environment has emerged, especially in mergers and acquisitions (M&A) and initial public offerings (IPOs), signaling potential opportunities for growth. With demand for investment-grade private credit and asset-backed finance on the rise, along with notable activity in equity markets, understanding the state of financial markets involves navigating a complex landscape of opportunities and risks. Key players in these markets are increasingly leveraging technology and integrating artificial intelligence into their operations, ensuring that they remain competitive in a rapidly changing financial landscape. Overall, the mechanisms of trading platforms and profound effects of market fluctuations continuously shape investment strategies and opportunities within financial markets.

What are investors concerned about in commodity markets?

Investors are demonstrating caution regarding the potential intensification of trade wars and their impact on commodity markets. The financial community appears to be monitoring signs of escalating trade tensions that could disrupt global commodity flows and pricing. This wariness comes amid a mixed market landscape where Asian shares show muted performance while European markets, particularly defense and banking sectors, reach new highs. Meanwhile, key commodities like Brent oil and gold are experiencing notable price fluctuations, reflecting the underlying uncertainty in global trade relations.

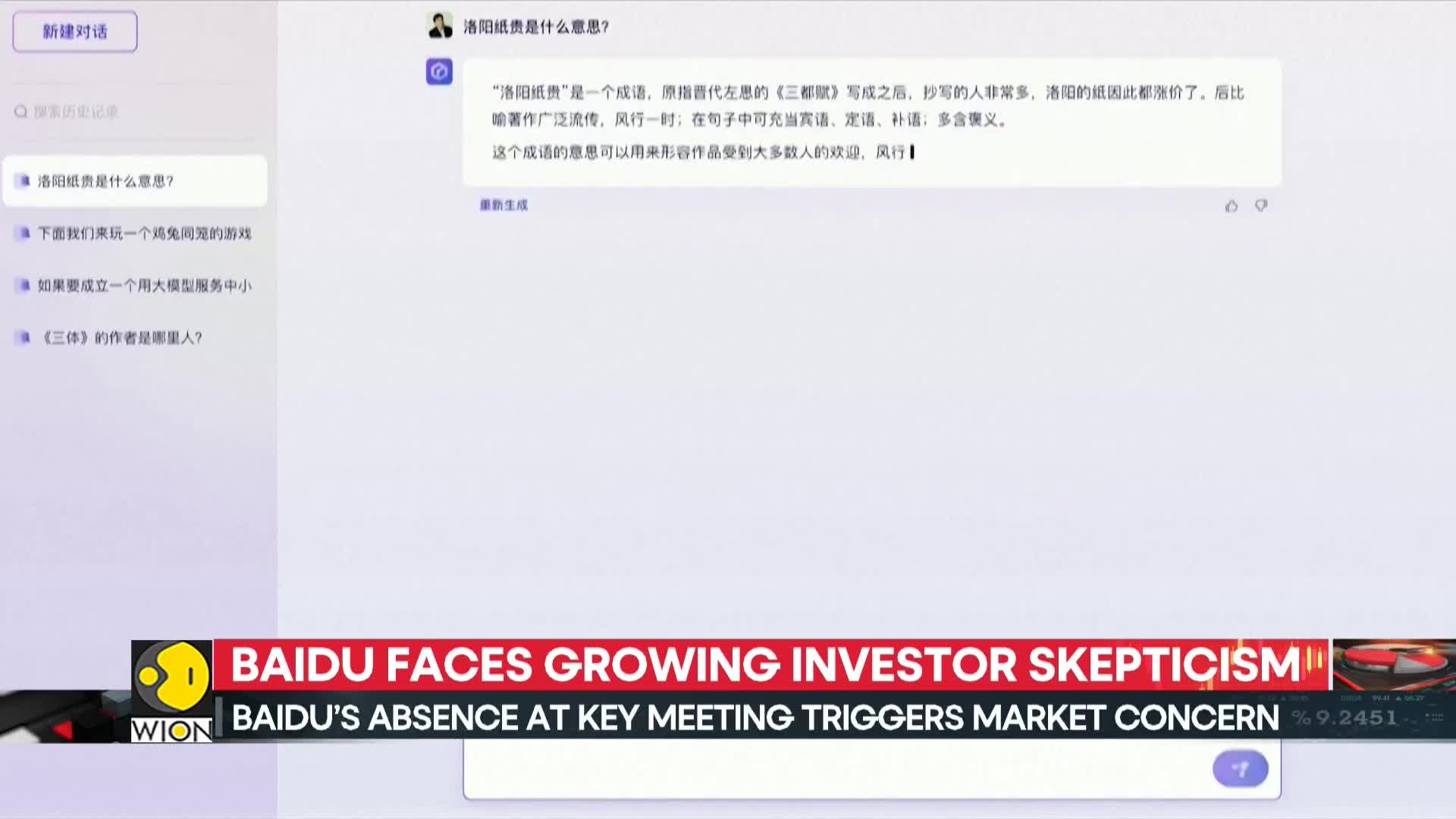

Watch clip answer (00:04m)What happened to Baidu's stock and how much market value did the company lose?

Baidu's Hong Kong shares experienced a significant decline on Monday, plummeting by as much as 8.8% before settling with a 7% loss at market close. This sharp downturn had substantial financial consequences, wiping out approximately $2.4 billion from the company's overall market value in a single trading day. The dramatic stock movement reflects serious investor concerns about the company's position in the competitive landscape, particularly regarding its AI initiatives and leadership presence.

Watch clip answer (00:10m)Why are investors concerned about Baidu's AI strategy?

Investors are concerned about Baidu's AI strategy due to several key factors. The company's plan to integrate its search engine with AI startup Deepseek and its own ERNIE language model raised fears that Baidu, once a leader in AI, could be losing ground to newer competitors. Despite Baidu claiming its ERNIE model rivals OpenAI's GPT4, the market reaction reflects growing doubts about its position in China's technology sector. Analysts view Baidu's AI shift as necessary to reduce reliance on its core search engine business, but the significant stock price drop of nearly 8.8% indicates investors remain unconvinced by this strategy. The absence of founder Robin Lee at a major business symposium further intensified market skepticism about Baidu's future direction in the competitive AI landscape.

Watch clip answer (00:45m)What are the expected economic impacts of President Trump's newly implemented tariffs on Chinese imports, steel, aluminum, and goods from Canada and Mexico?

President Trump has implemented a series of tariffs including a 10% levy on Chinese imports and 25% taxes on steel and aluminum, with additional 25% duties on Canadian and Mexican imports scheduled for early March. These trade policies are expected to significantly impact American consumers through higher prices across various sectors. Market analysts and manufacturers, from car dealerships in Detroit to parts manufacturers nationwide, anticipate that these tariffs will inevitably lead to increased consumer costs. While the administration suggests potential job growth could offset short-term economic fluctuations, experts emphasize the uncertainty surrounding these policies and their long-term effects on both consumer spending and investment markets.

Watch clip answer (00:52m)What are the economic implications and concerns surrounding President Trump's tariff policies and their impact on markets and businesses?

President Trump's fluctuating tariff announcements have created significant uncertainty in financial markets and business environments. While stocks initially rallied after Trump announced a temporary reprieve from global reciprocal tariffs, experts warn that his inconsistent approach—threatening tariffs one day and backing down the next—undermines business confidence and long-term investment planning. The broader economic concerns include potential price increases for consumers, disrupted global trade relationships, and unintended geopolitical consequences. Critics argue that Trump's "willy nilly" tariff threats may actually benefit competitors like China, as other countries seek alternative partnerships to avoid trade instability. Economists remain divided on whether tariffs serve as effective negotiation tools or simply create counterproductive market volatility that ultimately hurts American businesses and consumers.

Watch clip answer (00:55m)What is driving the recent record high in gold prices and their seven-week consecutive gains?

Gold prices have reached record highs and are experiencing their seventh consecutive week of gains, primarily driven by investor fears of an impending global trade war. This surge stems from concerns about Trump's aggressive tariff policies, which target any countries that impose fees on US imports, reflecting his zero-sum approach to international trade. The precious metal's rally demonstrates how geopolitical tensions and trade policy uncertainties can significantly impact financial markets. Gold traditionally serves as a safe-haven asset during times of economic uncertainty, making it particularly attractive when investors anticipate potential disruptions to global commerce and economic stability.

Watch clip answer (00:15m)