Financial Control

Financial control refers to a systematic approach that organizations adopt to monitor, manage, and safeguard their financial resources effectively. It encompasses a variety of processes, policies, and procedures tailored to ensure accurate financial reporting, effective cash flow management, and adherence to regulatory compliance. The significance of financial control has grown in recent times, particularly as businesses face increasing pressures to enhance transparency, prevent fraud, and maximize operational efficiency. Key components of financial control include preventive measures like segregation of duties, detective tools such as account reconciliations and internal audits, and corrective actions to address discrepancies promptly. As businesses transition into a more technology-driven landscape, tools such as budgeting software and expense tracking applications have become indispensable. These software solutions not only streamline financial monitoring but also improve the accuracy of financial forecasts and reporting. Moreover, organizations are prioritizing continuous employee training and robust risk management practices to ensure that the financial control systems remain effective amid rapidly changing market conditions. Implementing these controls creates a sustainable financial framework that supports informed decision-making and enhances long-term profitability. By understanding and applying strong financial control measures, organizations can safeguard their assets, maintain compliance with regulations, and foster an environment conducive to growth and stability.

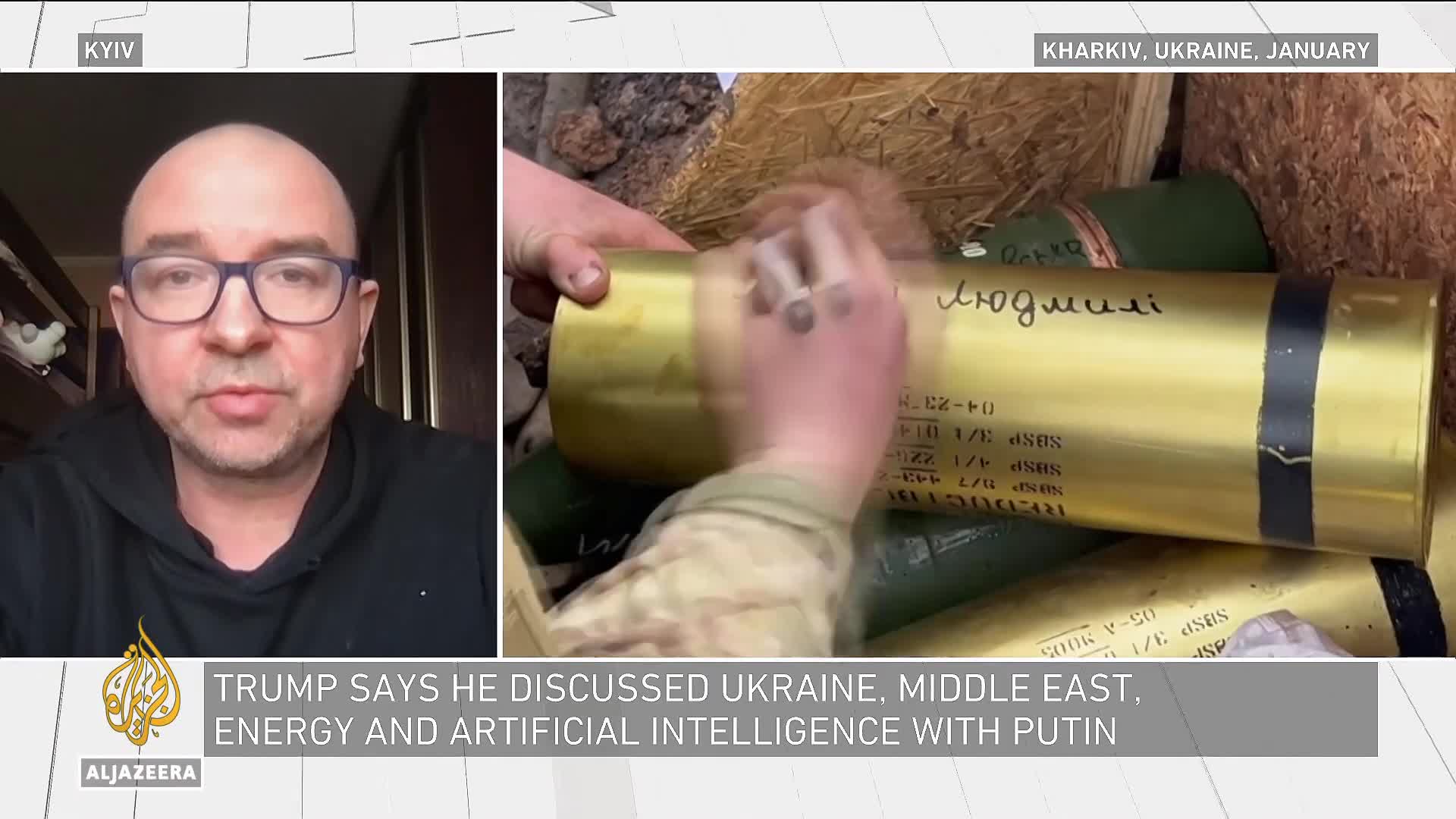

What financial and strategic challenges will Europe face if it has to bear the primary responsibility for Ukraine's post-conflict reconstruction while the United States withdraws from involvement?

Europe faces significant financial and strategic challenges if it becomes the primary financier of Ukraine's reconstruction. Without substantial U.S. involvement, European nations would need to shoulder enormous costs for reconstruction funds, arms supplies, and peacekeeping operations. This financial burden raises critical questions about Europe's leverage in post-conflict negotiations and its ability to secure lasting peace and stability. The situation creates a complex geopolitical dynamic where Europe must balance its financial capacity with strategic necessity, potentially affecting its dependency relationships and overall approach to regional security while managing the substantial economic implications of supporting Ukraine's recovery.

Watch clip answer (00:16m)How does media coverage differ when it comes to reporting on government corruption and influence buying?

Joe Rogan highlights a stark disconnect in media coverage regarding government corruption. He describes listening to left-wing podcasts that completely ignore obvious corruption and influence-buying schemes that are being uncovered by investigators like Mike Benz and Elon Musk's team of financial auditors. This media blindness creates separate information ecosystems where different audiences receive entirely different narratives about the same governmental issues. Rogan suggests that while some outlets focus on exposing USAID mismanagement and regulatory capture, others seem to operate in a completely different reality, failing to acknowledge these systemic problems. The result is a fragmented public discourse where citizens consuming different media sources have vastly different understandings of government accountability and corruption, making it difficult to achieve consensus on addressing these institutional problems.

Watch clip answer (00:43m)