Financial Control

Financial control refers to a systematic approach that organizations adopt to monitor, manage, and safeguard their financial resources effectively. It encompasses a variety of processes, policies, and procedures tailored to ensure accurate financial reporting, effective cash flow management, and adherence to regulatory compliance. The significance of financial control has grown in recent times, particularly as businesses face increasing pressures to enhance transparency, prevent fraud, and maximize operational efficiency. Key components of financial control include preventive measures like segregation of duties, detective tools such as account reconciliations and internal audits, and corrective actions to address discrepancies promptly. As businesses transition into a more technology-driven landscape, tools such as budgeting software and expense tracking applications have become indispensable. These software solutions not only streamline financial monitoring but also improve the accuracy of financial forecasts and reporting. Moreover, organizations are prioritizing continuous employee training and robust risk management practices to ensure that the financial control systems remain effective amid rapidly changing market conditions. Implementing these controls creates a sustainable financial framework that supports informed decision-making and enhances long-term profitability. By understanding and applying strong financial control measures, organizations can safeguard their assets, maintain compliance with regulations, and foster an environment conducive to growth and stability.

How much money is the federal government potentially losing to fraud annually?

According to government accounting organizations, the federal government could be losing between $233 billion and $521 billion annually to fraud. This estimate was released by the GAO (Government Accountability Office) last year, before recent investigations by Elon Musk and others. The issue of government fraud is significant and well-documented, with thousands of IRS investigations conducted yearly. Despite some media narratives attempting to downplay the problem, the existence of massive fraud in federal programs is not genuinely debatable.

Watch clip answer (01:50m)How did customers react to the RBI's restrictions on New India Cooperative Bank?

Following the announcement of restrictions by the Reserve Bank of India, customers rushed to New India Cooperative Bank's branches in panic, fearing their savings were at risk. Many depositors expressed frustration over the lack of prior warning about these limitations. The situation created immediate financial distress for customers who depend on regular access to their funds for monthly interest payments and daily expenses. This reaction highlights the vulnerability of depositors in smaller financial institutions when regulatory actions are implemented suddenly.

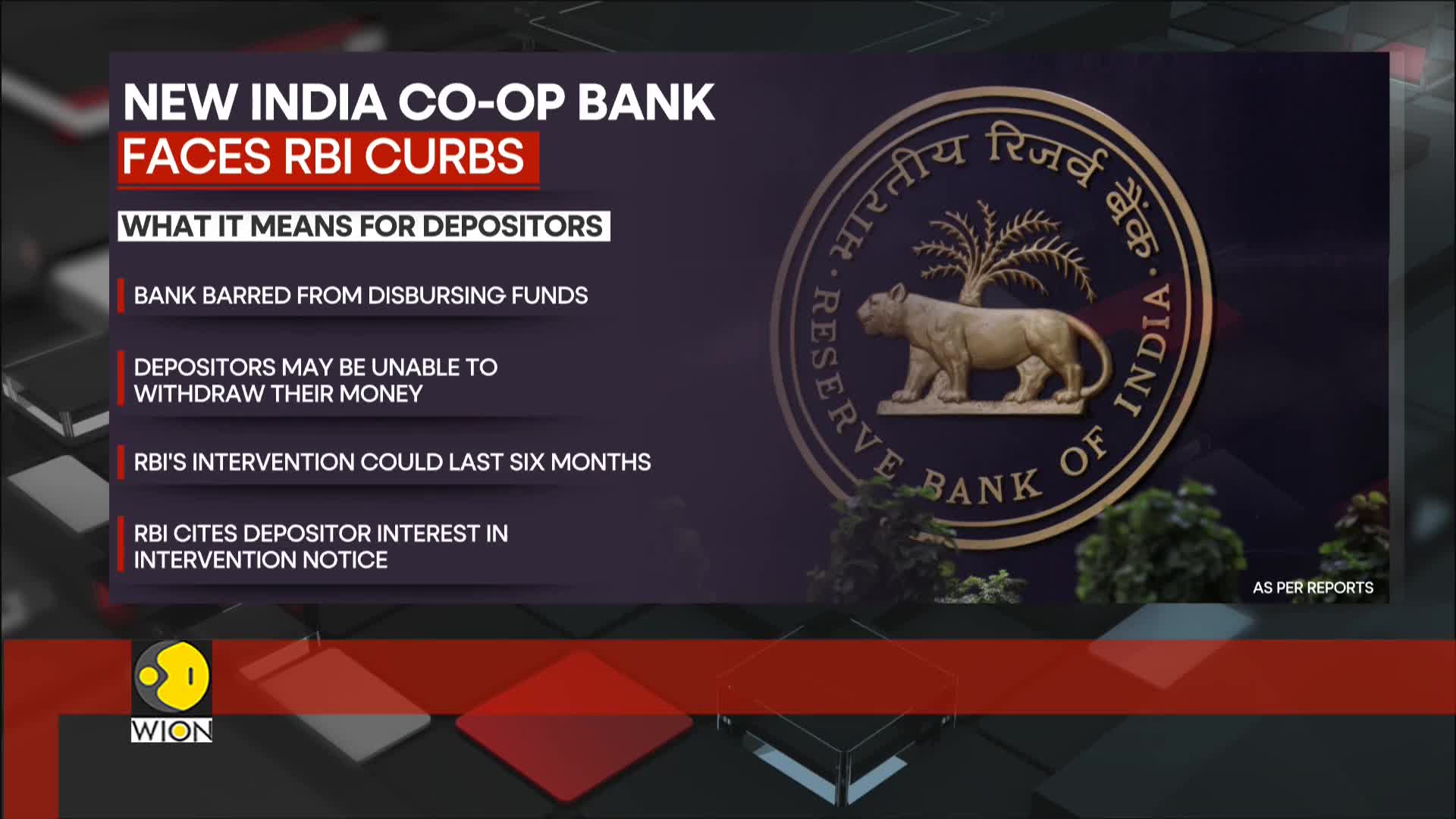

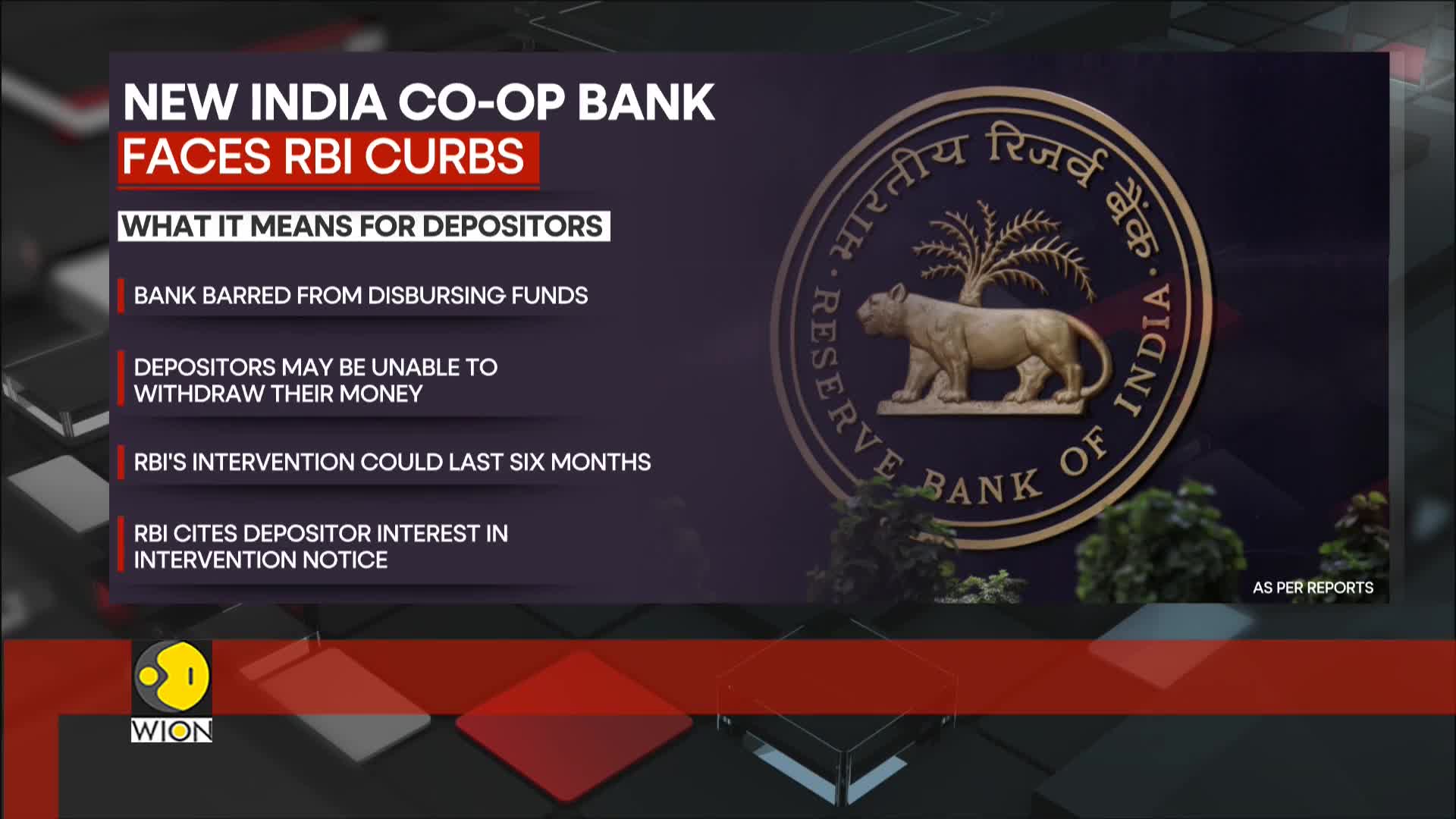

Watch clip answer (00:17m)What restrictions has the RBI imposed on the New India Cooperative Bank?

The RBI has imposed restrictions on the New India Cooperative Bank effective from February 13, which will remain in place for six months pending review. The central bank cited material developments as the reason for this intervention, with the primary aim of protecting depositor interests and ensuring financial stability. During this period, the bank is prevented from disbursing funds, which has caused concern among depositors who have been lining up outside bank branches worried about accessing their savings. This regulatory action highlights the RBI's role in maintaining stability in the cooperative banking sector.

Watch clip answer (00:13m)Why did the Reserve Bank of India intervene with New India Cooperative Bank?

The Reserve Bank of India intervened with New India Cooperative Bank citing 'material developments' as the reason for their action. The central bank's primary aims were to protect depositor interests and ensure financial stability amid liquidity concerns at the bank. This intervention was implemented as a protective measure to safeguard customers' savings, though it triggered immediate panic among account holders. Following the announcement, customers rushed to bank branches fearing their savings were at risk, with many expressing frustration over the lack of prior warning about the situation.

Watch clip answer (00:18m)What went wrong with the Biden administration's $160 million funding to a Canadian electric vehicle bus manufacturer, and what were the consequences for school districts?

The Biden administration made a critical error by providing the entire $160 million upfront to a Canadian electric vehicle bus manufacturer without implementing proper oversight or milestone-based payments. This poor financial management led to catastrophic results when the manufacturer declared bankruptcy, leaving 55 school districts without $95 million worth of promised electric school buses. EPA Administrator Lee Zeldin highlights this as a prime example of failed federal funding practices that lack accountability and proper safeguards to protect taxpayer money.

Watch clip answer (00:24m)What are the major oversight and accountability concerns that EPA Administrator Lee Zeldin has identified regarding the distribution of taxpayer funds at the Environmental Protection Agency?

EPA Administrator Lee Zeldin has raised serious concerns about the hasty distribution of $20 billion in taxpayer funds to eight private entities with minimal oversight. The administrator revealed that some entities were specifically created just to receive this funding, raising questions about accountability and proper vetting processes. Additionally, Zeldin has taken corrective action by canceling controversial grants, including a $50 million allocation to a climate advocacy group, and highlighted risks from mismanaged funds, particularly citing issues with a Canadian electric bus manufacturer's bankruptcy that could impact taxpayer investments.

Watch clip answer (00:17m)