Energy Industry Data

The energy industry data plays a crucial role in understanding the complex dynamics of global energy markets, encompassing a variety of sectors, including oil, gas, and renewable energy. Recent trends illustrate a marked shift toward clean energy, with renewable sources like solar and wind accounting for a substantial portion of new capacity. This transition is not only vital in meeting increasing energy demands—driven by industrial electrification, AI workloads, and the rapid expansion of data centers—but is also pivotal in addressing climate change impacts and enhancing energy security. The latest insights from reputable sources indicate that the clean energy investment landscape has grown, with record amounts allocated toward renewables, showcasing the industry's response to the escalating need for sustainable energy solutions. To effectively navigate this evolving energy landscape, stakeholders and decision-makers rely on accurate energy market data and analytics. This encompasses a wide array of statistics, including energy consumption patterns, production metrics, and emissions data, all of which inform policy, investment decisions, and environmental strategies. The integration of advanced data analytics in the oil and gas sector highlights its significance in optimizing operations and improving sustainability. Notably, the energy sector is increasingly leveraging big data technologies to enhance predictive maintenance, optimize resource allocation, and fundamentally transform energy usage patterns. Thus, comprehensive energy industry data not only informs stakeholders but is essential for fostering innovations that drive the future of energy consumption and production.

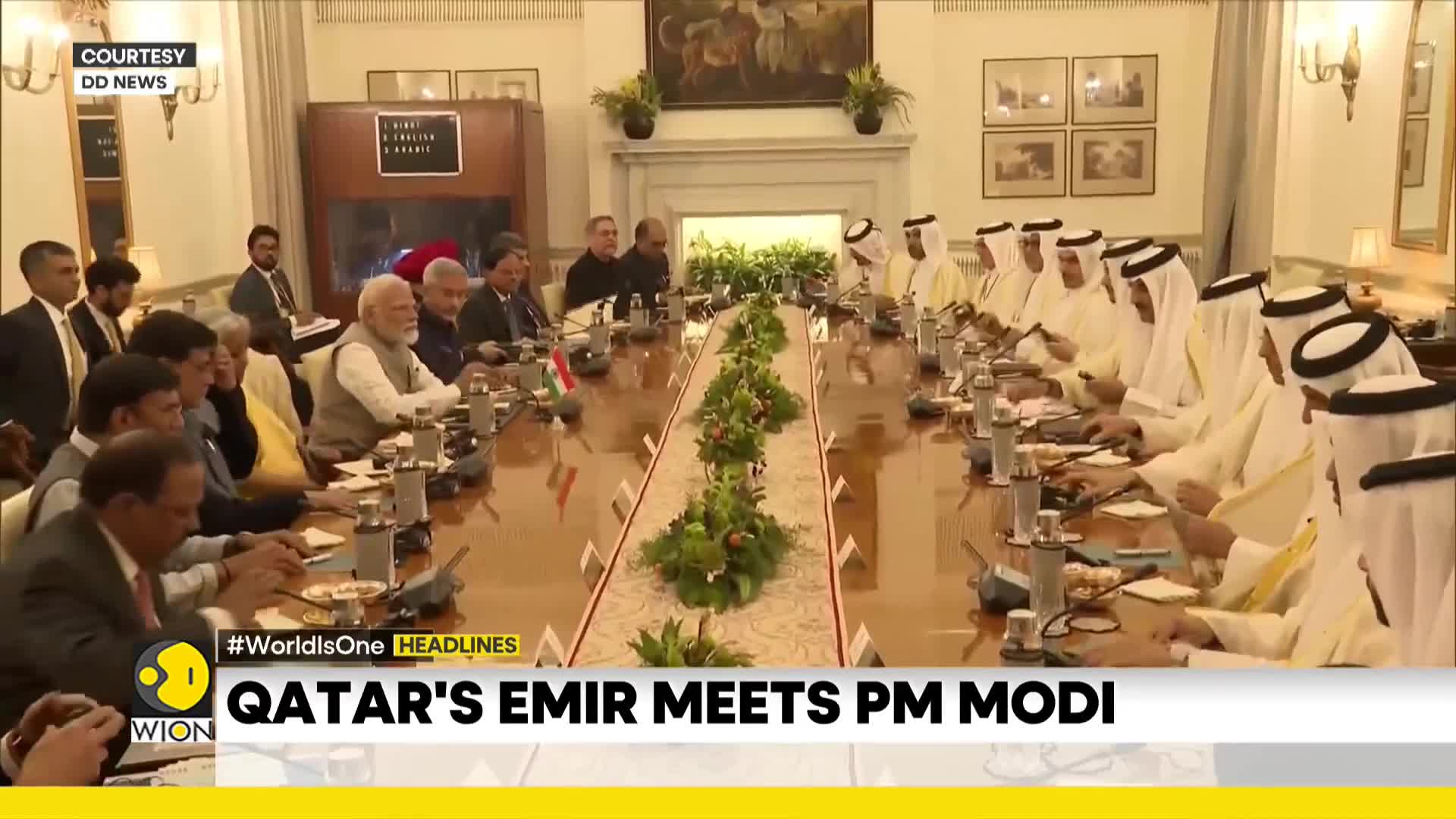

What is Qatar's role in India's energy strategy and what are India's future goals for gas consumption?

Qatar serves as India's largest supplier of liquefied natural gas (LNG), playing a critical role in India's energy supply chain by accounting for more than 40% of its global LNG imports. This significant supply relationship highlights Qatar's importance as a strategic energy partner for India. Looking forward, New Delhi has ambitious plans to transform its energy mix by doubling its gas consumption. India aims to increase natural gas to constitute 15% of its total energy needs by 2030, representing a substantial shift in the country's energy strategy and further strengthening the energy partnership between the two nations.

Watch clip answer (00:15m)What is the current state of EU-Russia economic relations and what challenges does the EU face?

The European Union controls the majority of Russia's frozen €300 billion in reserves and has implemented 15 rounds of sanctions, significantly reducing its reliance on Russian energy. Previously importing 40% of its natural gas from Russia, the EU has drastically decreased this dependency since 2022. However, economic pressures are mounting as European gas prices for March delivery fell by 10% after speculation around US-Russia talks. The EU's primary challenge will be maintaining unity among member states if the United States decides to soften its stance on Russia, potentially creating divisions in the Western approach to sanctions.

Watch clip answer (00:44m)What challenges will the European Union face if US-Russia relations improve?

The European Union's primary challenge will be maintaining unity if the United States softens its stance toward Russia. Major European corporations, particularly energy giants like BP and Total Energies, may push to re-enter Russian markets, especially if they perceive U.S. competitors gaining an advantage in these markets. With U.S. officials leveraging both economic and military factors in Ukraine negotiations, European cohesion could be tested as corporate interests potentially clash with political positions. The coming months will be crucial in determining whether these talks lead to a strategic realignment that could further complicate the EU's unified approach to Russia relations.

Watch clip answer (00:38m)How have US-Russia negotiation talks impacted European gas prices and what potential corporate shifts might follow?

European gas prices for March delivery fell by 10% following speculation around US-Russia talks, demonstrating immediate market sensitivity to potential diplomatic shifts. This price movement reflects broader economic implications of changing relations between these major powers. The situation presents significant challenges for EU unity if the US softens its stance on Russia. Major European corporations, including energy giants like BP and TotalEnergies, are positioning themselves for a possible return to Russian markets, especially if they perceive US competitors gaining an advantage. The coming months will be crucial in determining whether these negotiations lead to a strategic realignment in energy trade relationships.

Watch clip answer (00:33m)What resources and strategic importance make Western Sahara a significant geopolitical flashpoint?

Western Sahara contains enormous phosphate reserves critical for global agricultural supply chains and synthetic fertilizers, alongside potentially rich offshore natural gas deposits. The territory is increasingly recognized as a vital strategic crossroads for oil and gas pipelines from sub-Saharan Africa to Europe, making it crucial for energy trade routes to the European Union. Despite receiving less media coverage than other global conflicts, the dispute between Morocco and Algeria over Western Sahara carries enormous repercussions as the region's political status approaches a potential boiling point, threatening regional stability and resource access.

Watch clip answer (00:50m)What is OPEC's current stance on increasing oil supply despite market speculation?

OPEC remains committed to its plan to increase oil supply starting from April, despite market speculation about a possible delay in this strategy. Russian Deputy Prime Minister Alexander Novak has explicitly dismissed reports suggesting any reconsideration of the planned supply increase. Market insiders appear confident that the global oil market has sufficient capacity to absorb the additional supply without significant disruption. This stance indicates OPEC's assessment that current market conditions can accommodate the increased production levels while maintaining relative stability in global energy markets.

Watch clip answer (00:16m)