Economic Trends

Economic trends play a crucial role in understanding the dynamic landscape of global finance, shaping everything from market behavior to policy decisions. These trends encompass a variety of economic indicators, including inflation rates forecasts, employment figures, and trade balances, which collectively inform stakeholders about the health of economies worldwide. Recently, there has been a notable trend of slowing growth across major markets, with projections indicating a decline in global GDP growth rates to approximately 2.4-3.2%. Policymakers face the challenge of navigating heightened uncertainties stemming from geopolitical tensions, particularly between the U.S. and China, which further complicate economic forecasting. As businesses and investors seek clarity, market trends analysis becomes essential. Understanding leading economic indicators, such as consumer confidence and inflation rates, allows for more strategic planning and investment. Recent reports highlight critical factors influencing these trends, including the impact of rising protectionism and tariff pressures on international trade dynamics. For instance, tariff increases have raised production costs and disrupted supply chains, leading to increased concerns about potential stagflation—a period characterized by stagnant economic growth combined with inflation. By monitoring these economic indicators and broader trends, analysts and stakeholders can better position themselves to respond to ongoing shifts in the global economy, ensuring they are equipped to adapt and thrive in an increasingly complex environment.

What does the decline in homebuilder sentiment mean for the housing market and potential home buyers?

The drop in homebuilder sentiment to a five-month low indicates that homebuilders don't see incentives to build more houses, resulting in even less supply in an already constrained market. This directly impacts potential home buyers who are facing a triple challenge: high interest rates that aren't expected to decrease soon, persistently high prices, and now a further reduction in housing supply. The homebuilder sentiment index, which measures current sales, buyer traffic, and future sales expectations, suggests that supply relief isn't coming anytime soon, leaving the housing market in a difficult position where the only solution - increased supply - appears increasingly unlikely.

Watch clip answer (00:45m)How have egg prices changed in recent years in the United States?

Egg prices in the U.S. have experienced dramatic fluctuations, rising from $1.55 in 2019 to a peak average of $4.82 in 2023 during the 'eggflation' crisis. This significant price increase represented more than a 200% jump in just four years, substantially impacting grocery costs for American households. However, relief eventually came as prices later dropped to $2.52, though still remaining higher than pre-inflation levels. This volatility in egg prices has influenced consumer behavior, pushing some Americans toward alternative protein sources like ground beef and tofu while reflecting broader inflation challenges in the economy.

Watch clip answer (00:05m)What are the three priority areas driving China's economic growth?

China has designated three key sectors as drivers of its economic growth. These priority areas are electric vehicles, lithium ion batteries, and solar cells, collectively known as the 'new three.' The industry's expansion has been primarily fueled by strong domestic demand within China's market. Additionally, Chinese manufacturers have successfully increased their global market share, extending their reach internationally. This strategic focus on green technology demonstrates China's commitment to sustainable development while positioning the country as a leader in the renewable energy and electric transportation sectors.

Watch clip answer (00:17m)How has the European Union's energy dependence on Russia changed in recent years?

The European Union has drastically reduced its reliance on Russian energy through systematic policy changes. Previously importing 40% of its natural gas from Russia, the EU has significantly decreased this dependency since 2022 following Russia's actions that triggered international responses. As part of its strategy, the EU has implemented 15 rounds of sanctions against Russia and maintains control over approximately 300 billion euros in frozen Russian reserves. This shift represents a major restructuring of European energy policy, as the bloc diversifies its energy sources to reduce vulnerability to geopolitical pressures from Russia.

Watch clip answer (00:19m)What economic impact has Bitcoin mining had in the United States?

Bitcoin mining in the US has become a significant economic force, generating over 31,000 jobs nationwide and contributing more than $4.1 billion annually to the nation's gross product. Texas leads with approximately $1.7 billion in gross product and 12,200 jobs, followed by Georgia ($316.8 million and 2,300 jobs) and New York ($225.9 million and 1,600 jobs). Beyond direct economic contributions, Bitcoin miners enhance local communities through charitable giving, event sponsorships, and infrastructure investments. These activities improve living standards while offering specialized training programs, making Bitcoin mining not just a digital revolution but a transformative economic driver reshaping communities across America.

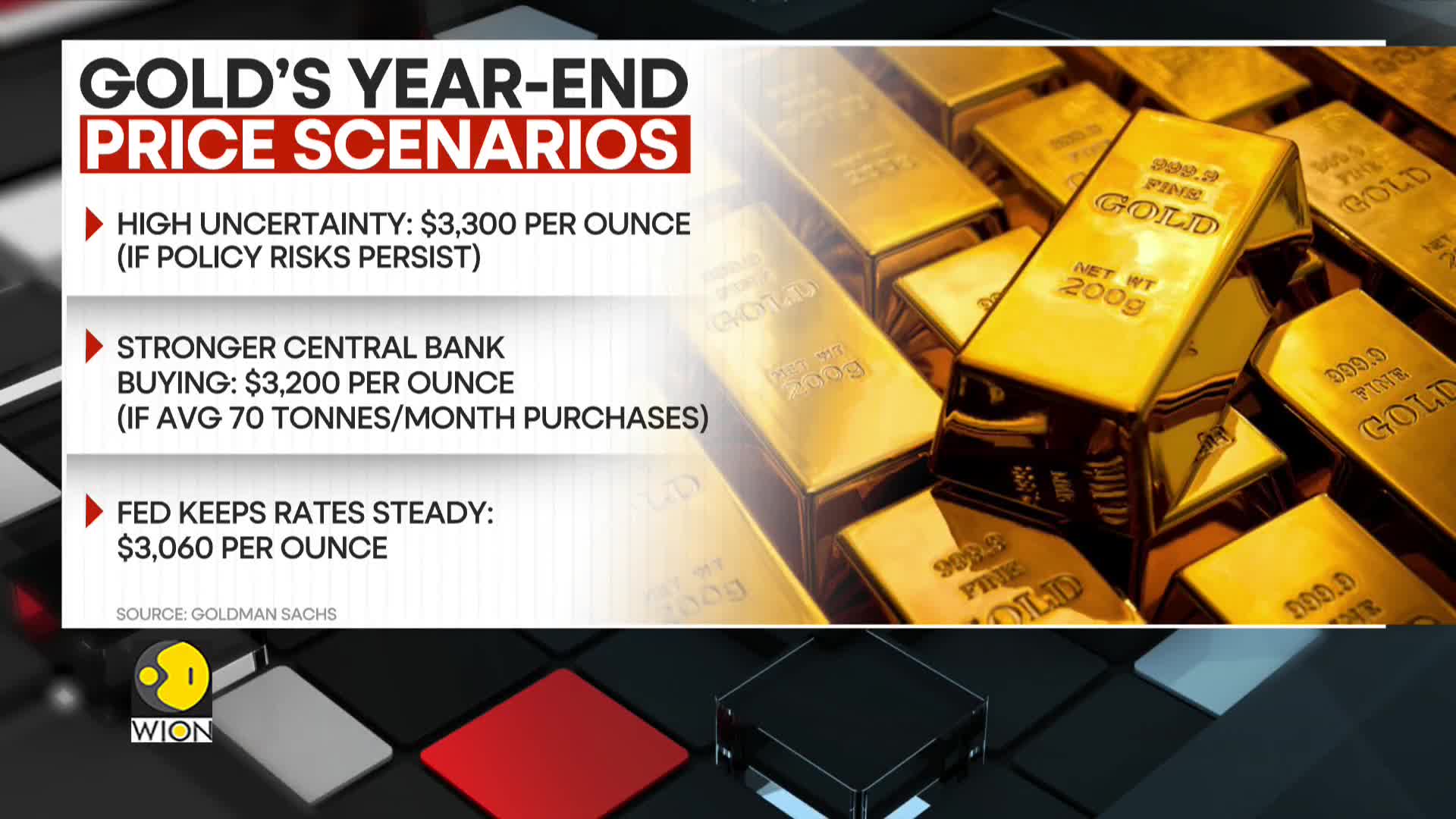

Watch clip answer (01:29m)Why does Goldman Sachs consider gold a valuable investment?

Goldman Sachs emphasizes that gold serves as a crucial hedge against multiple economic challenges in today's volatile market. Specifically, gold provides protection against financial and recessionary risks that could impact investment portfolios. Additionally, gold's value as a strategic asset is enhanced during periods of trade tensions and Federal Reserve policy uncertainty. This protective quality explains why Goldman has raised its forecast to $3,100 per ounce by the end of 2025, with increased central bank purchasing expected to reach 50 tonnes monthly.

Watch clip answer (00:10m)