Economic Stagnation

Economic stagnation is defined as a protracted period of little to no economic growth, typically characterized by GDP growth rates falling below 2-3%, alongside rising unemployment, stagnant wages, and diminished consumer spending. This phenomenon poses significant challenges for economies and societies as it tends to create cycles of decreased investment and innovation, further perpetuating the stagnation. Causes of economic stagnation can vary widely, including poor monetary policy, unexpected economic shocks (such as pandemics and wars), and structural issues within mature economies that evolve over time. The implications of stagnation reach deep into labor markets and can lead to increased employment difficulties, wage disparity, and a decline in consumer confidence. The relevance of understanding economic stagnation is underscored by recent projections and analyses from economists indicating that several economies are grappling with stagnant growth due to a confluence of factors like trade tensions, rising bond yields, and uncertain fiscal policies. Reports highlight that U.S. inflation remains a persistent concern, influencing both consumer behavior and business investment while other countries struggle with low inflation rates in contrast. The fear of recession looms large, with analysts estimating a considerable chance of downturns in the near future. Addressing these challenges may require proactive measures from governments, such as implementing effective fiscal policies, increasing infrastructure spending, and fostering favorable conditions for investment, as these strategies aim to revive economic activity and mitigate the risks associated with prolonged stagnation.

What is the current state of venture capital liquidity in Silicon Valley?

Silicon Valley is experiencing a serious liquidity crisis. While the 1990s averaged 130 IPOs per year for emerging growth companies, recent statistics show only three venture-backed IPOs in the first half of this year. Over 5,000 venture-backed companies funded since 2004 have had no exits (either through IPOs or acquisitions). This represents a broken liquidity cycle that typically operated on a four to six-year timeframe. The situation reflects the impact of the deep recession, which has affected both financial markets and the real economy, creating a liquidity drought in the venture capital sector.

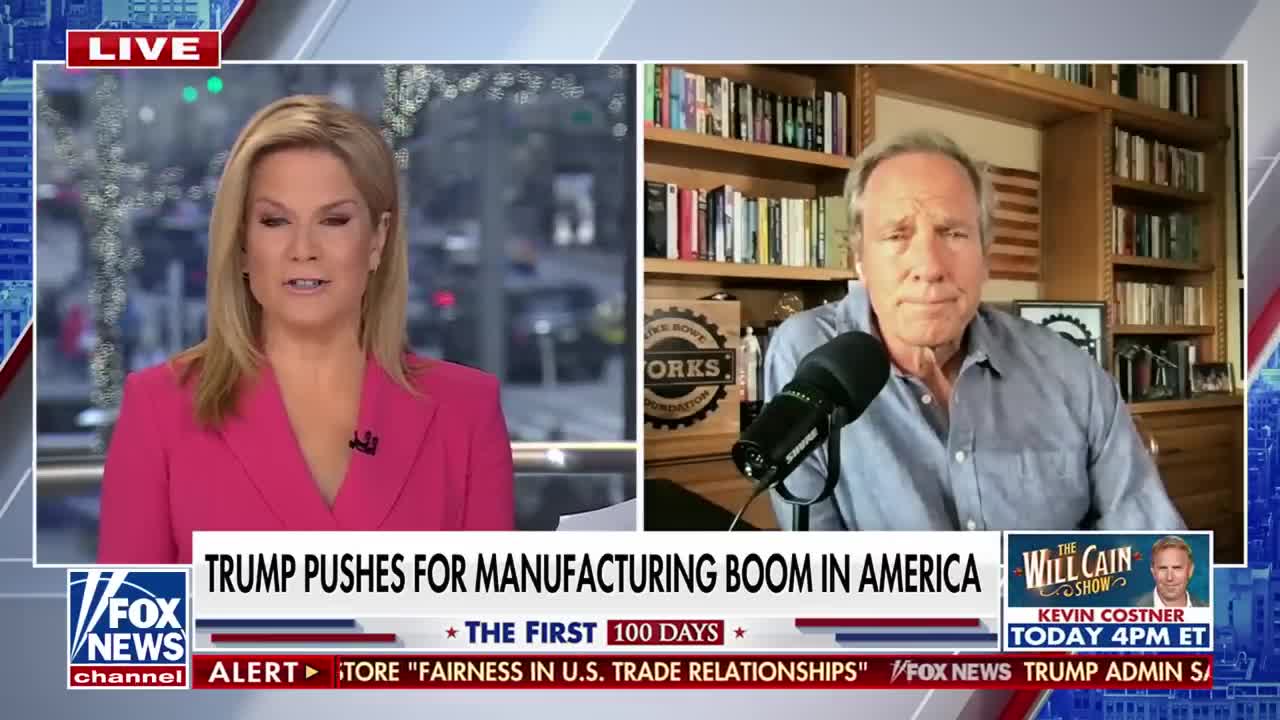

Watch clip answer (02:29m)How has the American textile industry changed since 1979?

In 1979, 70% of the clothing worn by Americans was made domestically by American workers. Today, that figure has dramatically declined to less than 2%. This represents one of the most significant shifts in U.S. manufacturing over the past several decades. This change is part of what Mike Rowe describes as the "giant sucking sound" that Ross Perot once warned about - the massive outsourcing of American manufacturing jobs. The textile industry appears to be at the forefront of this trend, but Rowe notes that this decline has "impacted virtually everything" in American manufacturing.

Watch clip answer (00:24m)What has been the economic impact of sanctions on Russia and Western companies?

The economic impact of sanctions has been mixed. While Russia's economy remains under pressure, Western companies have also faced significant setbacks, especially those that exited the Russian market. This two-sided effect has created complications for both economies involved in the conflict. If Washington decides to ease sanctions, it could allow US businesses to regain access to the Russian market they abandoned, potentially helping them recover from losses estimated at $300 billion. This possible shift in policy reflects the complex economic considerations at play in the ongoing Ukraine peace talks.

Watch clip answer (00:23m)How is Trump's approach to the Russia-Ukraine conflict affecting U.S. foreign policy?

The current U.S. president is undermining the Ukrainian president and siding with Russia, representing a significant shift in American foreign policy. This alignment with Russia over Ukraine raises concerns about America's global security role and relationships with allies. While this foreign policy stance may be perplexing to many observers who cannot discern the strategic endgame, some domestic voters might prioritize local economic concerns like inflation and rising grocery prices over international relations. This tension between foreign policy decisions and domestic economic challenges is creating a complex political dynamic for American voters.

Watch clip answer (00:24m)What is the estimated cost of damage to Sudan's sugar industry due to the conflict?

The devastation to Sudan's sugar industry is extremely extensive, with an estimated cost of at least $350 million in damages. Sudan has six sugar factories with a combined production capacity of nearly half a million tons per year, but these facilities have been severely impacted by the conflict. Even before the current violence, decades of political turmoil, economic mismanagement, and US sanctions had already taken their toll on the factories and turned farms into wastelands. A committee has been established to develop a plan for addressing this crisis in a sector vital to Sudan's economy and culture.

Watch clip answer (00:28m)What is Tamiz's daily coffee ritual?

Tamiz has a daily afternoon ritual where he stops at Mosdelife's open-air cafe on his way back from work. His beverage of choice is distinctive: black coffee sweetened with three large spoons of sugar, a preparation he considers essential to his enjoyment. This ritual is more than just a coffee break—it represents a moment of consistency and pleasure in Tamiz's daily routine. He is adamant about his preference, stating he cannot imagine drinking coffee any other way, highlighting how personal taste and cultural habits shape even the simplest daily practices.

Watch clip answer (00:19m)