Economic Policy

Economic policy encompasses the strategies and actions undertaken by governments to influence their nation's economy. It is critical in steering economic growth, controlling inflation, reducing unemployment, and addressing income inequality. Broadly categorized into two main types—**fiscal policy**, which includes government spending and taxation, and **monetary policy**, which focuses on managing the money supply and interest rates—these policies serve as essential tools for economic stabilization and growth. Understanding the mechanisms and implications of these policies is vital, especially in a landscape marked by frequent shifts in global and domestic economic conditions. Recent discussions around economic policy have highlighted concerns over inflation, trade tensions, and the potential for recession, particularly in light of aggressive tariff strategies seen in various countries. These elements underscore a need for careful fiscal management and strategic decision-making to safeguard economic stability. Furthermore, policymakers are increasingly interested in sustainable practices, aimed at bolstering confidence and encouraging investment during periods of uncertainty. With international cooperation becoming vital amidst geopolitical strains, the relevance of sound economic policy frameworks cannot be overstated. As we navigate this complex environment, it remains crucial for both citizens and businesses to understand how economic policies impact their day-to-day lives and long-term prospects.

What could be the consequences if the United States decides to ease sanctions on Russia?

If Washington decides to ease sanctions, it could allow U.S. businesses to regain access to the Russian market they previously abandoned, potentially reversing some of the reported $300 billion in losses experienced by American companies due to Western sanctions. Furthermore, such a decision would likely alter Europe's economic strategy, forcing European nations to reconsider their approach to Russia. This potential thaw in U.S.-Russia economic relations would create ripple effects across the continent, influencing EU-Russia relations and corporate interests amid growing economic pressures.

Watch clip answer (00:10m)Could the US lift or ease economic sanctions on Russia?

The question of whether the US could lift or ease economic sanctions on Russia remains open. Previously, President Trump has expressed skepticism about economic sanctions while simultaneously suggesting they could be used as leverage in negotiations with Russian President Vladimir Putin. This creates a complex diplomatic situation with multiple potential outcomes. Though Trump has hinted at using sanctions as a negotiation tool, he has also signaled willingness to pursue a broader deal with Russia, suggesting potential flexibility in the US approach to economic restrictions depending on geopolitical developments and negotiation outcomes.

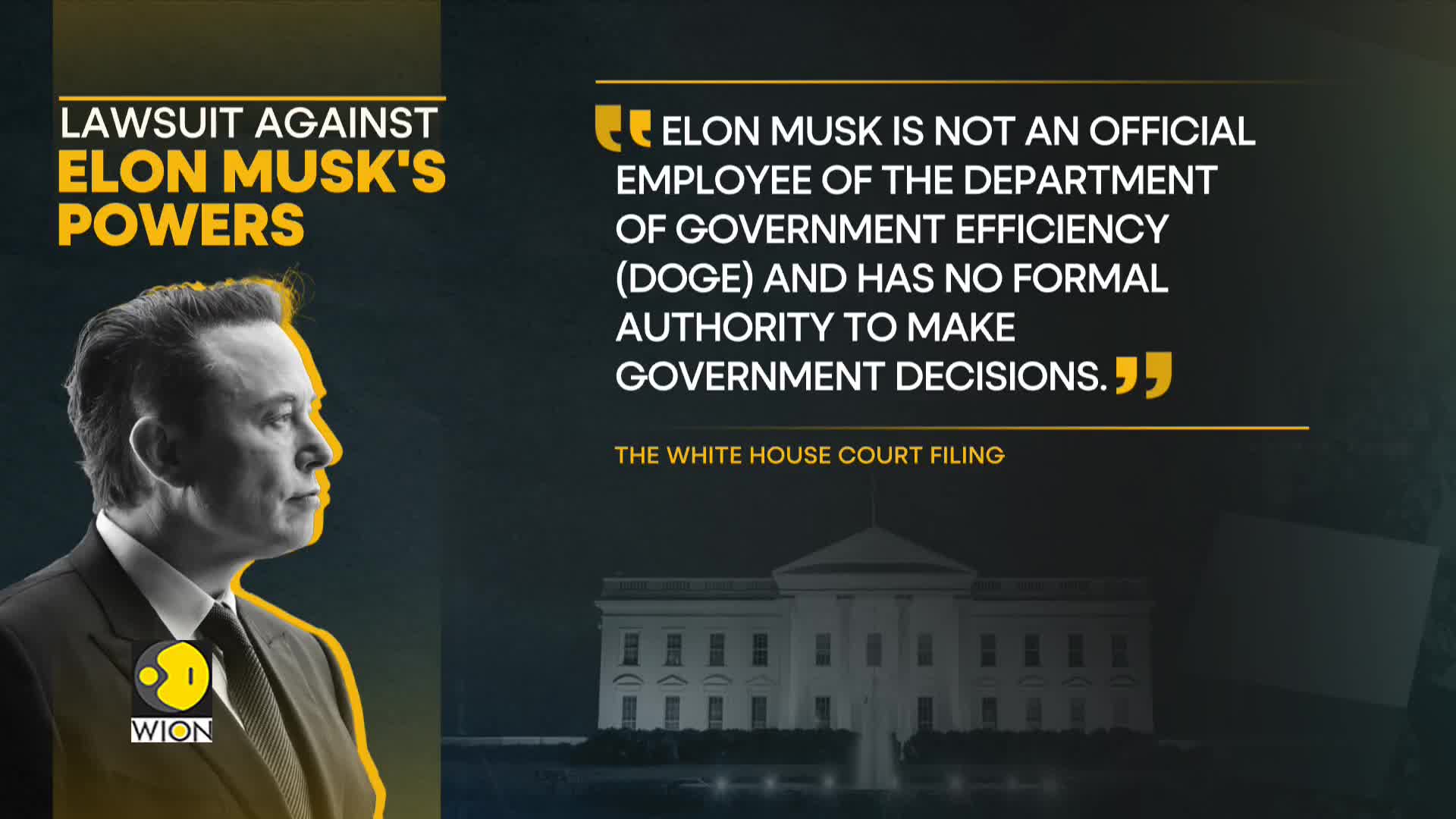

Watch clip answer (00:20m)What was the court's decision regarding Elon Musk's authority in the Department of Government Efficiency?

A federal court recently confirmed Musk's limited authority within the Department of Government Efficiency, dismissing attempts by 14 Democratic states to block him from managing federal employee data and services. The judge acknowledged legitimate concerns regarding Musk's oversight and potential impact on government spending, but ultimately ruled in favor of Trump and Musk's initiative. This legal battle highlights the political tension surrounding the Trump administration's mandate to reduce government waste. Despite Democratic opposition, particularly from Capitol Hill, the administration can proceed with its efficiency efforts as American voters supported Trump's promise to clean up wasteful spending in government.

Watch clip answer (00:19m)What is South Africa's controversial land expropriation bill about?

South Africa recently signed a controversial land expropriation bill that allows the government to seize land from owners without compensation under specific circumstances. These circumstances include property that isn't being used, land where there's no intention to develop or profit from it, and land that might pose a threat to people's safety. The law has rapidly transformed from a fringe topic to a major foreign policy priority for the Trump administration. A key concern is that landowners won't receive any compensation for seized property, making this legislation particularly contentious both within South Africa and internationally.

Watch clip answer (00:33m)How is China restricting the global lithium supply chain for electric vehicle batteries?

China has begun restricting exports of key equipment used to process lithium, particularly sorbents and filtration equipment essential for extracting lithium from brines. This follows Beijing's proposal for licensing requirements on battery technologies. China dominates over 60% of global lithium processing and holds a 70% market share in solvent production, making this a significant disruption for Western manufacturers. These restrictions come amid escalating trade tensions, affecting ongoing lithium projects globally. Chinese export controls could delay lithium extraction projects, potentially impacting the production of over 14 million EV batteries annually. Western companies are scrambling to develop alternative supply chains, but China's 20-year head start in lithium processing presents a substantial challenge to reducing dependence on Chinese supplies.

Watch clip answer (01:57m)How is China's real estate decline affecting the middle class?

China's underperforming real estate market is significantly impacting its middle class population. Property income, which forms a crucial component of household earnings, is declining, indicating asset depreciation for numerous homeowners across the country. This financial setback is particularly concerning as property has traditionally been a key wealth-building mechanism for China's middle class. The diminishing returns from real estate are contributing to weakened consumer confidence and creating financial strain on middle-class households who have invested substantially in property.

Watch clip answer (00:14m)