Economic Policy

Economic policy encompasses the strategies and actions undertaken by governments to influence their nation's economy. It is critical in steering economic growth, controlling inflation, reducing unemployment, and addressing income inequality. Broadly categorized into two main types—**fiscal policy**, which includes government spending and taxation, and **monetary policy**, which focuses on managing the money supply and interest rates—these policies serve as essential tools for economic stabilization and growth. Understanding the mechanisms and implications of these policies is vital, especially in a landscape marked by frequent shifts in global and domestic economic conditions. Recent discussions around economic policy have highlighted concerns over inflation, trade tensions, and the potential for recession, particularly in light of aggressive tariff strategies seen in various countries. These elements underscore a need for careful fiscal management and strategic decision-making to safeguard economic stability. Furthermore, policymakers are increasingly interested in sustainable practices, aimed at bolstering confidence and encouraging investment during periods of uncertainty. With international cooperation becoming vital amidst geopolitical strains, the relevance of sound economic policy frameworks cannot be overstated. As we navigate this complex environment, it remains crucial for both citizens and businesses to understand how economic policies impact their day-to-day lives and long-term prospects.

Why does Goldman Sachs consider gold a valuable investment?

Goldman Sachs emphasizes that gold serves as a crucial hedge against multiple economic challenges in today's volatile market. Specifically, gold provides protection against financial and recessionary risks that could impact investment portfolios. Additionally, gold's value as a strategic asset is enhanced during periods of trade tensions and Federal Reserve policy uncertainty. This protective quality explains why Goldman has raised its forecast to $3,100 per ounce by the end of 2025, with increased central bank purchasing expected to reach 50 tonnes monthly.

Watch clip answer (00:10m)What is Goldman Sachs' forecast for gold prices by the end of 2025?

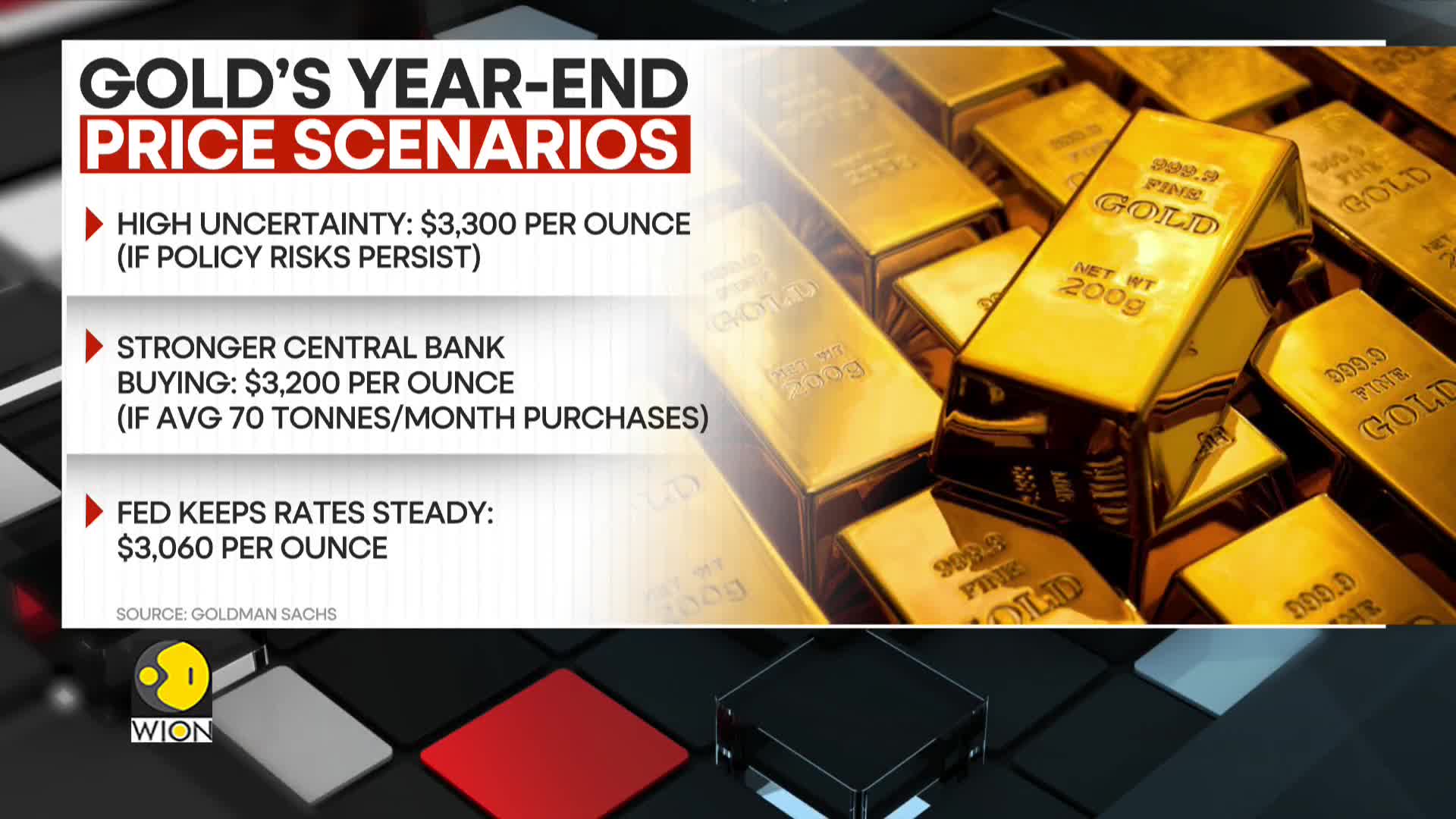

According to Goldman Sachs, gold prices could potentially surge to $3,300 per ounce by the end of the year, primarily driven by ongoing high uncertainty in the financial markets. This bullish forecast is specifically influenced by concerns regarding tariffs and monetary policy risks that are expected to persist. The investment bank believes that prolonged economic and policy uncertainties will create favorable conditions for gold's appreciation as investors seek safe-haven assets. This projection represents a significant potential upside from current gold prices as the precious metal continues to be viewed as a hedge against financial instability.

Watch clip answer (00:14m)What is Goldman Sachs' forecast for gold prices and what factors are driving this prediction?

Goldman Sachs has revised its gold price forecast upward, primarily due to sustained central bank demand, which is expected to add 9% to gold prices by the end of the year. The bank has increased its assumption for monthly central bank gold purchases to 50 tonnes, up from its previous estimate of 41 tonnes. According to Goldman, this structural demand, combined with gradually increasing ETF holdings as interest rates decline, should outweigh any potential price drag from normalizing investor positioning, supporting their bullish outlook for gold.

Watch clip answer (00:30m)What is Goldman Sachs' gold price projection for 2025 if the Federal Reserve keeps interest rates steady?

According to Goldman Sachs, if the Federal Reserve maintains steady interest rates, gold prices are expected to reach $3,060 by 2025. This bullish outlook is supported by several factors including ongoing central bank demand and anticipated ETF inflows. Goldman Sachs views gold as an important hedge against fiscal instability, inflation concerns, and trade tensions in the current economic climate. The bank has outlined various price scenarios based on monetary policy uncertainty and central bank purchasing trends, ultimately reinforcing a positive perspective on gold as an investment during economic fluctuations.

Watch clip answer (00:07m)What is Vietnam's new rail project and how will it impact trade relations with China?

Vietnam's parliament has approved an $8 billion rail link project that will connect the country's largest northern port city to the Chinese border. This significant infrastructure investment aims to strengthen the economic ties between Vietnam and China by creating a more efficient transportation corridor for goods. The rail link represents a strategic move to enhance bilateral trade relations, making cross-border commerce more streamlined and accessible. By improving connectivity between these neighboring countries, Vietnam is positioning itself to benefit from increased trade opportunities while developing its northern transportation network.

Watch clip answer (00:12m)What goods does India export to Qatar and what are their trade goals?

India's diverse exports to Qatar encompass a wide range of products including copper, construction materials, food items (cereals, vegetables, fruits, spices), electrical machinery, textiles and garments, chemicals, and precious stones. These products form the foundation of the current bilateral trade relationship between the two nations. Looking forward, both countries have established ambitious goals to strengthen their economic ties. India and Qatar aim to double their trade volumes to reach $28 billion within the next 55 years, highlighting the long-term commitment to their partnership and the significant potential for growth in their commercial relationship.

Watch clip answer (00:26m)