Digital Assets

Digital assets have become a cornerstone of the modern economy, encompassing a diverse range of items that exist solely in digital form and hold intrinsic value. This category includes traditional media such as photographs and videos, as well as emerging innovations like cryptocurrencies, non-fungible tokens (NFTs), and tokenized real-world assets (RWAs). The significance of digital assets has surged with the maturation of blockchain technology, which provides the necessary infrastructure for secure transactions and ownership verification. Currently, digital assets account for a substantial portion of market capitalization, reflecting their growing importance both as investment vehicles and as facilitators of innovation across various sectors. The relevance of digital assets has also escalated due to increasing institutional interest and evolving regulatory environments globally. Recent reports indicate that over 75% of institutional investors plan to boost their exposure to digital assets, highlighting a shift towards integrating cryptocurrencies and blockchain technology into traditional finance. This wave of adoption is further supported by the explosive growth of stablecoins, surpassing major payment networks and transforming payment structures, while the approval of cryptocurrency exchange-traded funds (ETFs) has enhanced market liquidity and accessibility. As businesses and individuals increasingly navigate this digital landscape, understanding the complexities and potential of digital assets becomes imperative for harnessing their value effectively.

How will regulatory changes impact businesses, especially in the digital asset space?

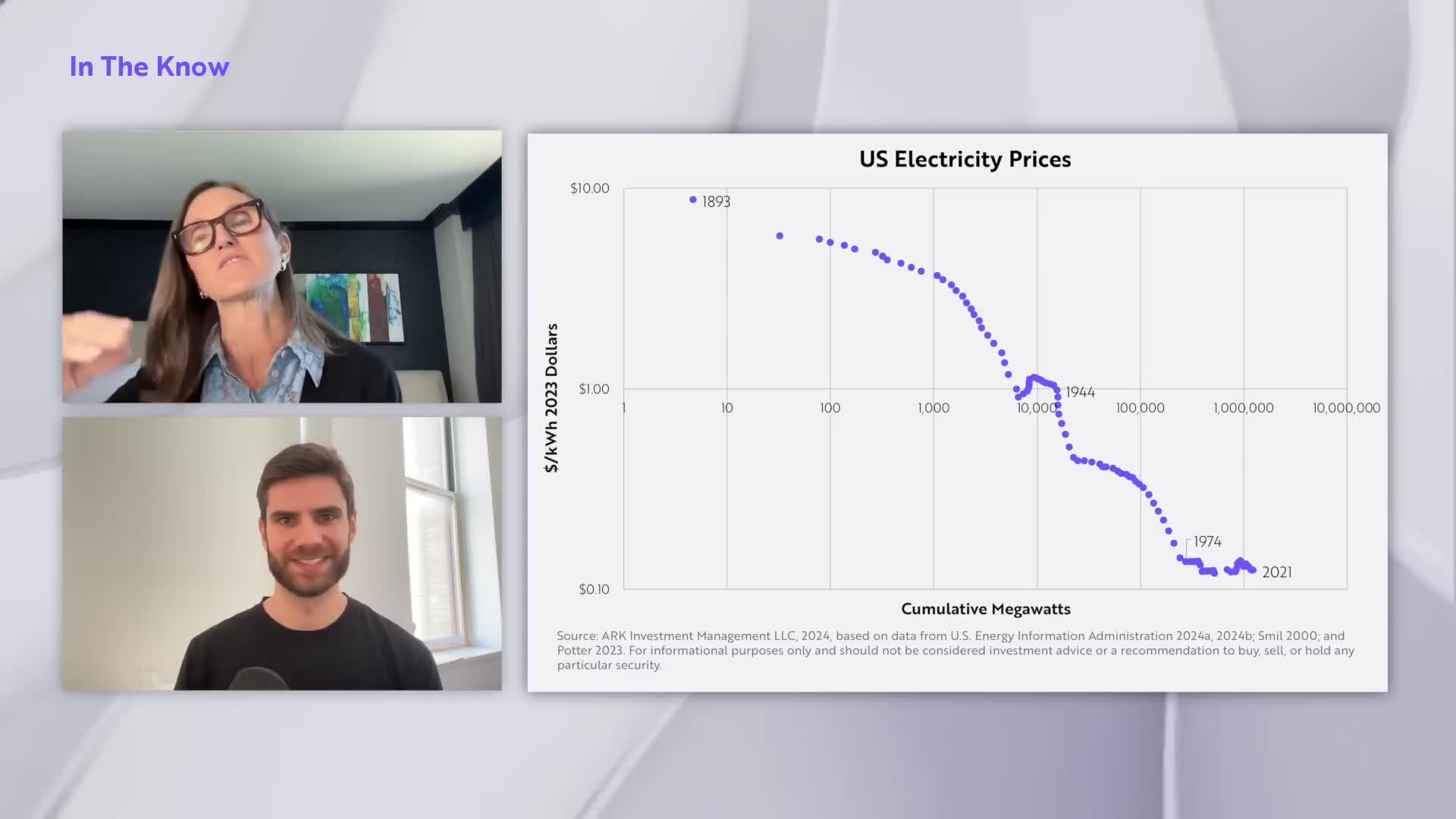

The current regulatory environment has created a morass that has had a stranglehold on businesses, particularly small and medium enterprises. According to Cathie Wood, we're approaching a significant shift as SEC Chairman Gary Gensler has announced his departure on January 20th, which will likely remove regulatory shackles that have hindered business growth and innovation. Wood predicts these changes will be especially transformative for the digital asset world, which she believes is now poised to 'take off and thrive.' While acknowledging the need for appropriate regulations for safety, she emphasizes that the current system has become overly burdensome as regulators continue building their 'empires' and creating more regulations.

Watch clip answer (01:06m)Is it better to invest in Bitcoin directly or in mining companies after the 2024 Bitcoin halving?

The 2024 Bitcoin halving presents a complex investment landscape. Despite cutting miner revenue by 50%, Bitcoin's expected rising demand makes it an attractive long-term investment option. However, mining companies face significant challenges with reduced revenue per unit of hash power. For investors, this creates a fundamental decision between investing directly in Bitcoin, which benefits from increasing scarcity and demand, or in mining companies that extract it. While Bitcoin itself may offer more straightforward exposure to price appreciation, mining investments require considering operational challenges alongside potential industry consolidation opportunities in the post-halving environment.

Watch clip answer (00:31m)What legal actions have been taken against Argentina's President Javier Milei regarding the meme coin scandal?

Lawyers have filed complaints of fraud in Argentina's criminal court on Sunday against President Javier Milei in connection with a meme coin promotion scandal. The legal action appears serious enough to include potential impeachment proceedings, as mentioned in the description. When confronted about the situation on Monday, Milei distanced himself from the state's role in the scandal. When directly asked if he acknowledged making a mistake, Milei denied any wrongdoing, stating, 'I didn't because I acted in good faith,' suggesting he refuses to take responsibility for the actions that reportedly led to financial losses for investors.

Watch clip answer (00:17m)What are meme coins?

Meme coins are highly volatile cryptocurrencies inspired by popular internet or cultural trends. They carry no intrinsic value but can dramatically soar or plummet in price. Initially created as jokes or parodies, they've evolved into multi-billion dollar assets attracting both casual investors and major financial institutions. These cryptocurrencies are generally viewed as indicators of retail investor interest and risk appetite in the cryptocurrency market. Despite their origins as internet jokes, meme coins like Dogecoin have gained significant traction due to speculative interest, transforming from humorous concepts into serious investment vehicles, albeit highly unpredictable ones.

Watch clip answer (00:45m)What exactly are meme coins?

Meme coins are highly volatile cryptocurrencies inspired by popular internet or cultural trends. They carry no intrinsic value but can dramatically soar or plummet in price, making them particularly risky investments. These digital assets are generally viewed as indicators of retail investor interest in the cryptocurrency market. Despite their popularity, investors should approach meme coins with caution due to their lack of fundamental value and extreme price volatility, as highlighted by recent scandals involving significant investor losses.

Watch clip answer (00:22m)What are the concerns regarding meme coins in the cryptocurrency space?

Meme coins present significant risks that investors should be wary of, as highlighted by recent political scandals. Argentina's president Javier Milei's endorsement of a meme coin resulted in substantial financial losses for investors, even triggering impeachment calls, demonstrating the volatile nature of these digital assets. Meme coins typically lack intrinsic value and are susceptible to market manipulation, making them particularly dangerous investments despite attracting both casual and institutional investors. The cryptocurrency landscape continues to evolve, but the fundamental concern with meme coins remains their vulnerability to scams and dramatic value fluctuations, requiring investors to exercise extreme caution.

Watch clip answer (00:10m)