Compliance and Regulations

Compliance and regulations are critical components in the operational framework of organizations across varied industries. They encompass the adherence to laws, standards, and guidelines set forth by government agencies and regulatory bodies. These requirements can range from sector-specific mandates like HIPAA in healthcare to broad legal frameworks such as the GDPR in data protection. Maintaining effective compliance is not just about avoiding fines; it builds trust with stakeholders, enhances business reputation, and mitigates risks associated with legal infractions. As businesses face an increasingly complex regulatory landscape influenced by rapid technological advancements and shifting geopolitical dynamics, the importance of compliance management has surged. Recent studies indicate that organizations are dedicating more resources to compliance technology, with a significant number adopting automation and AI to enhance their compliance strategies. This modernization allows for real-time regulatory responses and continuous compliance efforts rather than traditional periodic checks. Key challenges include navigating divergent regulatory standards across jurisdictions, particularly in areas like environmental, social, and governance (ESG) criteria and diversity, equity, and inclusion (DEI) policies. Furthermore, compliance is crucial for safeguarding sensitive information and ensuring operational integrity. Organizations that integrate robust compliance programs are better equipped to manage risks, ensuring they not only meet regulatory requirements but also adapt to the evolving demands of their industries. As the regulatory environment continues to evolve, businesses must proactively adjust their compliance strategies to stay ahead, using technology to ensure alignment with ever-changing rules and standards.

What was Google's tax settlement with Italy and why was it required?

Google agreed to pay 326 million euros to Italy following an investigation into unpaid taxes. Italian authorities accused the tech giant of failing to declare and pay taxes in the country between 2015 and 2019, which prompted the settlement. This case highlights the ongoing scrutiny that major technology companies face regarding their tax obligations in various countries where they operate. The significant settlement demonstrates Italy's commitment to enforcing tax compliance from multinational corporations operating within its borders.

Watch clip answer (00:17m)Why did the top official at the Social Security Administration resign?

The top official at the Social Security Administration resigned after DOGE employees attempted unauthorized access to sensitive personnel data. This confidential information included bank account details, Social Security numbers, and medical information of individuals who had applied for disability benefits, affecting millions of Americans. The official oversaw the system responsible for disbursing Social Security payments to approximately 70 million Americans. The breach attempt targeted highly sensitive personal and financial information, which ultimately led to the official's resignation from their position.

Watch clip answer (00:47m)Who is investigating the Delta Flight 4819 crash?

The crash of Delta Flight 4819 is being investigated by Canadian authorities with assistance from officials at the Federal Aviation Administration (FAA). The investigation is focused on determining the cause of the accident, which occurred during severe weather conditions causing the aircraft to flip and catch fire upon landing. Authorities are examining whether the crash resulted from weather challenges or mechanical failure. This collaborative international investigation comes amid concerns about aviation safety oversight due to recent government staff terminations.

Watch clip answer (00:05m)What is happening with air travel right now?

Air travel is facing serious safety concerns as evidenced by the crash of Delta Airlines Flight 4819 in Toronto. The flight crash-landed in treacherous weather conditions with gusty winds and an icy runway, flipping upside down upon landing and catching fire. Though all 80 passengers and crew survived, 18 were injured in the incident. This crash occurs amid growing concerns about aviation safety following employee terminations at the FAA, raising questions about current air travel regulations and oversight in 2025.

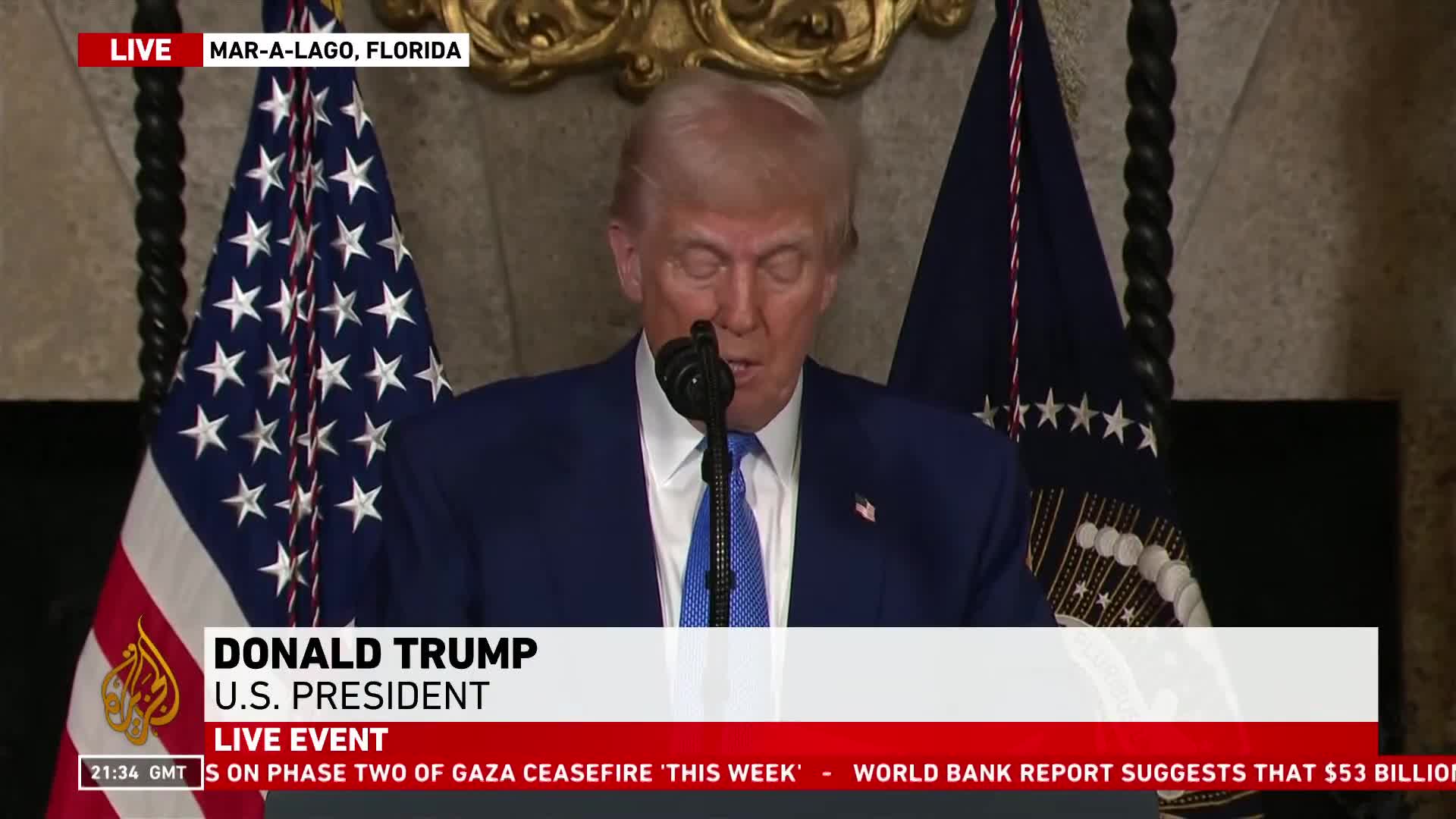

Watch clip answer (00:06m)What impact are Donald Trump's federal employee terminations having on critical areas of public safety?

Donald Trump has been firing thousands of federal government employees in what appears to be mass terminations that potentially violate the law in some cases. These widespread staff reductions carry significant implications across multiple critical sectors of public safety and national security. The firings specifically threaten aviation safety, public health services, and even the handling of the country's nuclear operations. These cuts represent more than just administrative changes—they pose potential risks to essential regulatory oversight and safety protocols that protect American citizens across various domains of public welfare.

Watch clip answer (00:15m)What concerns has Donald Trump raised about Social Security payments to centenarians?

Donald Trump expresses skepticism about reports indicating nearly 4 million people over 100 years old receiving Social Security benefits. He questions whether these payments are legitimate, citing implausible statistics of recipients ranging from 140-149 years old and even 150-159 years old, far exceeding human longevity records. Trump suggests these numbers warrant investigation for potential fraud, as he states they are "checking right now" whether these payments are actually being disbursed. His comments reflect broader concerns about fiscal accountability within the Social Security system.

Watch clip answer (00:32m)