Compliance and Regulations

Compliance and regulations are critical components in the operational framework of organizations across varied industries. They encompass the adherence to laws, standards, and guidelines set forth by government agencies and regulatory bodies. These requirements can range from sector-specific mandates like HIPAA in healthcare to broad legal frameworks such as the GDPR in data protection. Maintaining effective compliance is not just about avoiding fines; it builds trust with stakeholders, enhances business reputation, and mitigates risks associated with legal infractions. As businesses face an increasingly complex regulatory landscape influenced by rapid technological advancements and shifting geopolitical dynamics, the importance of compliance management has surged. Recent studies indicate that organizations are dedicating more resources to compliance technology, with a significant number adopting automation and AI to enhance their compliance strategies. This modernization allows for real-time regulatory responses and continuous compliance efforts rather than traditional periodic checks. Key challenges include navigating divergent regulatory standards across jurisdictions, particularly in areas like environmental, social, and governance (ESG) criteria and diversity, equity, and inclusion (DEI) policies. Furthermore, compliance is crucial for safeguarding sensitive information and ensuring operational integrity. Organizations that integrate robust compliance programs are better equipped to manage risks, ensuring they not only meet regulatory requirements but also adapt to the evolving demands of their industries. As the regulatory environment continues to evolve, businesses must proactively adjust their compliance strategies to stay ahead, using technology to ensure alignment with ever-changing rules and standards.

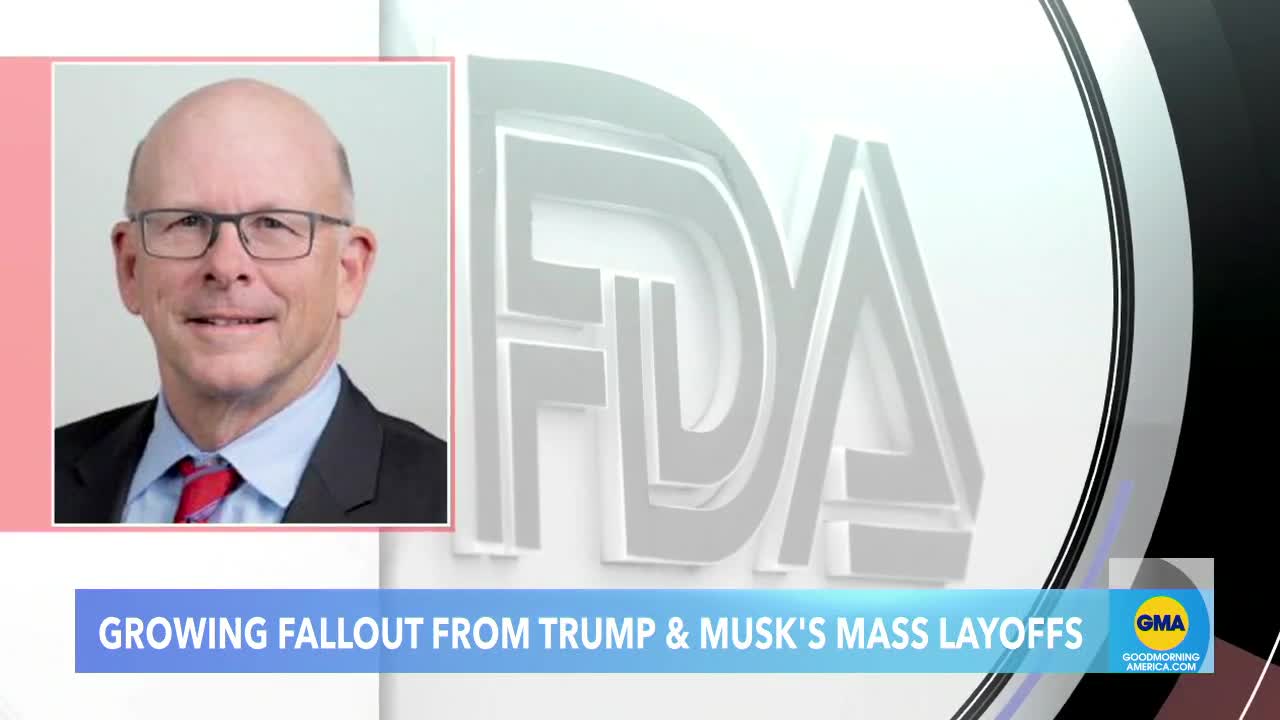

What led to the resignations of top officials at government agencies and how did the courts respond to challenges against Musk's data access?

Top officials at the Social Security Administration and Treasury Department resigned after Elon Musk's staff demanded access to sensitive information about millions of Americans. When challenged legally, a federal judge refused to immediately block Musk's team from accessing government data systems, stating that while there are legitimate questions about the unchecked authority of an unelected individual, the states who sued failed to demonstrate irreparable harm. The situation has raised significant concerns among Democrats and critics who argue there is insufficient oversight of this access to sensitive government data. The judge's ruling highlights the tension between government efficiency initiatives and the protection of sensitive information when private sector figures are granted access to federal data systems.

Watch clip answer (00:29m)What is the FAA requirement for airplane evacuation?

According to FAA requirements, a commercial aircraft must be completely evacuated within 90 seconds during an emergency. This strict timeline necessitates that flight attendants undergo weeks of intense training to handle the chaos of emergency situations effectively. Delta flight attendants, like those at other airlines, practice evacuation procedures repeatedly to ensure they can efficiently guide passengers off the aircraft as quickly as possible when necessary.

Watch clip answer (00:22m)What training do flight attendants undergo to ensure passenger safety during emergencies?

Delta flight attendants undergo weeks of intense training designed to simulate chaotic emergency conditions. The FAA requires that flight crews must be able to evacuate an entire aircraft in just 90 seconds, making thorough preparation essential. During training, attendants learn to issue concise, clear commands such as "grab ankles, heads down, stay low" and proper evacuation techniques including how passengers should position their limbs when using emergency slides. The ultimate goal is to efficiently evacuate passengers as quickly as possible from the aircraft, especially during emergencies.

Watch clip answer (00:31m)What issues of government spending is Trump highlighting in his discussion with Elon Musk?

Trump is highlighting significant issues of fraud, waste, and abuse within the federal government. He emphasizes that they're uncovering billions of dollars in fraud, which he predicts will eventually amount to 'hundreds of billions of dollars.' This indicates a systemic problem of financial mismanagement in government operations. Trump praises Musk's efforts to address these issues, noting he's doing 'an amazing job' in tackling government inefficiency. He also mentions that Musk is effective because he attracts 'young, very smart' people to work on these problems, suggesting that innovative approaches from outside traditional government are needed to address entrenched financial waste.

Watch clip answer (00:22m)What is President Trump's stance on potential conflicts of interest between Elon Musk's business interests and government regulation?

President Donald Trump has stated that he is unaware of any conflicts of interest between Elon Musk's business interests and the government agencies he's regulating. This statement comes amid significant developments where a US Judge declined a request to block Musk and his Department of Government Efficiency from potentially firing federal employees and accessing agency data. Despite concerns raised by 14 Democratic states about unlawful access to federal data, Trump and Musk appear committed to their agenda of reducing government spending and enhancing efficiency.

Watch clip answer (00:21m)What are the major legal and financial risks associated with meme coin investments?

Meme coins face multiple risks including market manipulation, where 'market makers' artificially inflate trading volumes and prices through fake transactions to lure unsuspecting investors. Additionally, 'pump and dump schemes' artificially inflate prices before major sell-offs, leaving late investors at a loss. In October 2024, US authorities charged 18 people and major crypto firms for various frauds targeting everyday investors. Beyond manipulation, meme coins experience unpredictable price volatility and lack real-world applications or long-term viability. Investors also face potential legal crackdowns that could impact market presence, and exposure to hackers and criminal operators. For these reasons, extreme caution is advised when considering meme coin investments.

Watch clip answer (01:11m)