Commercial Banking

Commercial banking encompasses a wide range of financial services tailored to meet the needs of businesses, corporations, government entities, and various organizations. This sector focuses primarily on providing essential services such as accepting deposits, offering commercial loans, and delivering cash management solutions. Unlike investment banks that cater predominantly to large corporations and institutional clients, commercial banks are crucial for smaller businesses that require straightforward financial products to manage day-to-day operations and facilitate growth. As such, their role in fostering economic stability and supporting local enterprises cannot be underestimated, especially in today's dynamic financial landscape. Recent trends highlight the significant evolution within commercial banking, driven by advances in technology, changing customer behaviors, and emerging economic challenges. Institutions are increasingly adopting artificial intelligence (AI) and automation to enhance operational efficiency and improve customer experiences. Techniques such as predictive analytics and customized digital services are becoming standard, allowing banks to meet the complex demands of their clients promptly. Furthermore, the rise of neobanks is reshaping the competitive landscape, prompting traditional banks to innovate and refine their service offerings to retain relevance among tech-savvy customers. This competitive shift emphasizes the importance of speed and adaptability as key drivers for success in the commercial banking industry, where institutions must leverage data analytics and optimize their service delivery to sustain growth amidst escalating competition and regulatory complexities.

What reforms are needed to support Small and Medium-sized Enterprises (SMEs) in Europe?

Europe needs comprehensive reforms to support SMEs, which are the engines of growth, particularly in countries like Spain and Italy. First, labor and fiscal reforms are essential foundations. More critically, Europe's financial structure must change - currently, 70% of corporate funding comes from banks (versus 30% from capital markets), the opposite of the U.S. model. This bank dependency creates vulnerability when banks delever or face capital problems. To address this, Madeline Antonik proposes two key solutions: having the European Central Bank (ECB) accept SME loans as collateral, and reopening the securitization market for SMEs. These measures would help restore capital flow to these vital businesses, enabling job creation and economic growth even as Europe's banks face ongoing challenges.

Watch clip answer (01:38m)How has debt shifted from banks to fund management in recent years?

From 2009 to 2016, a significant shift occurred in the management of corporate and foreign debt. Direct household investments in debt decreased from 22% to 8.6%, while fund-managed investments increased from 8.5% to 18.3%. This transfer was driven by monetary policies and regulatory constraints on banks to hold more liquid assets and less corporate debt, especially lower-rated debt. This migration of debt investments from banks to funds has created critical interconnections between these financial entities. The shift makes it increasingly important to understand the relationships between banks and non-banks, including exposure through credit lines, derivatives transactions, and overlapping portfolio holdings. This evolving landscape requires continual risk evaluation and adaptive regulatory approaches.

Watch clip answer (03:57m)What would the Capital One and Discover merger mean for the credit card industry and consumers?

The merger would create scale and cost synergies, propelling Capital One to become the largest credit card issuer in the U.S. By acquiring Discover's payment network infrastructure, Capital One would reduce dependency on Visa and MasterCard, allowing them to better compete with these dominant players who control 76% of the market. For consumers, benefits include increased access to ATM locations and potentially better credit offers with lower rates. However, some analysts caution that reduced competition from consolidation could potentially have negative impacts, which is why regulatory approval remains a key hurdle for this significant industry transformation.

Watch clip answer (01:21m)What would the merger between Capital One and Discover mean for the credit card industry and consumers?

For the credit card industry, the merger would create scale and cost efficiencies, allowing Capital One to better compete with giants like Visa and MasterCard. Capital One would leverage Discover's payment network infrastructure instead of paying for Visa/MasterCard's services, resulting in significant cost savings and synergies. For consumers, the merger promises improved access to locations with combined ATM networks from both companies. Customers could potentially see better financial offers, lower rates, and improved financing options as the merged entity would need to attract customers to compete with industry leaders. However, some analysts raise concerns about reduced competition, which is why regulatory approval has already faced delays.

Watch clip answer (02:00m)What were some of Kamala Harris's notable actions as California's Attorney General?

As California's Attorney General, Kamala Harris fought against the death penalty and took on big banks following the 2008 housing crisis, securing $18 billion in relief for California homeowners. She also won a billion dollars for victims of predatory for-profit universities, specifically Corinthian Colleges that took advantage of Californians seeking to achieve the American dream. Perhaps her most nationally recognized moment came when she directed the clerk of Los Angeles to begin issuing marriage licenses to same-sex couples during the contentious debate around Proposition 8, which challenged the legality of gay marriage. These actions demonstrated her commitment to criminal justice reform, consumer protection, and civil rights.

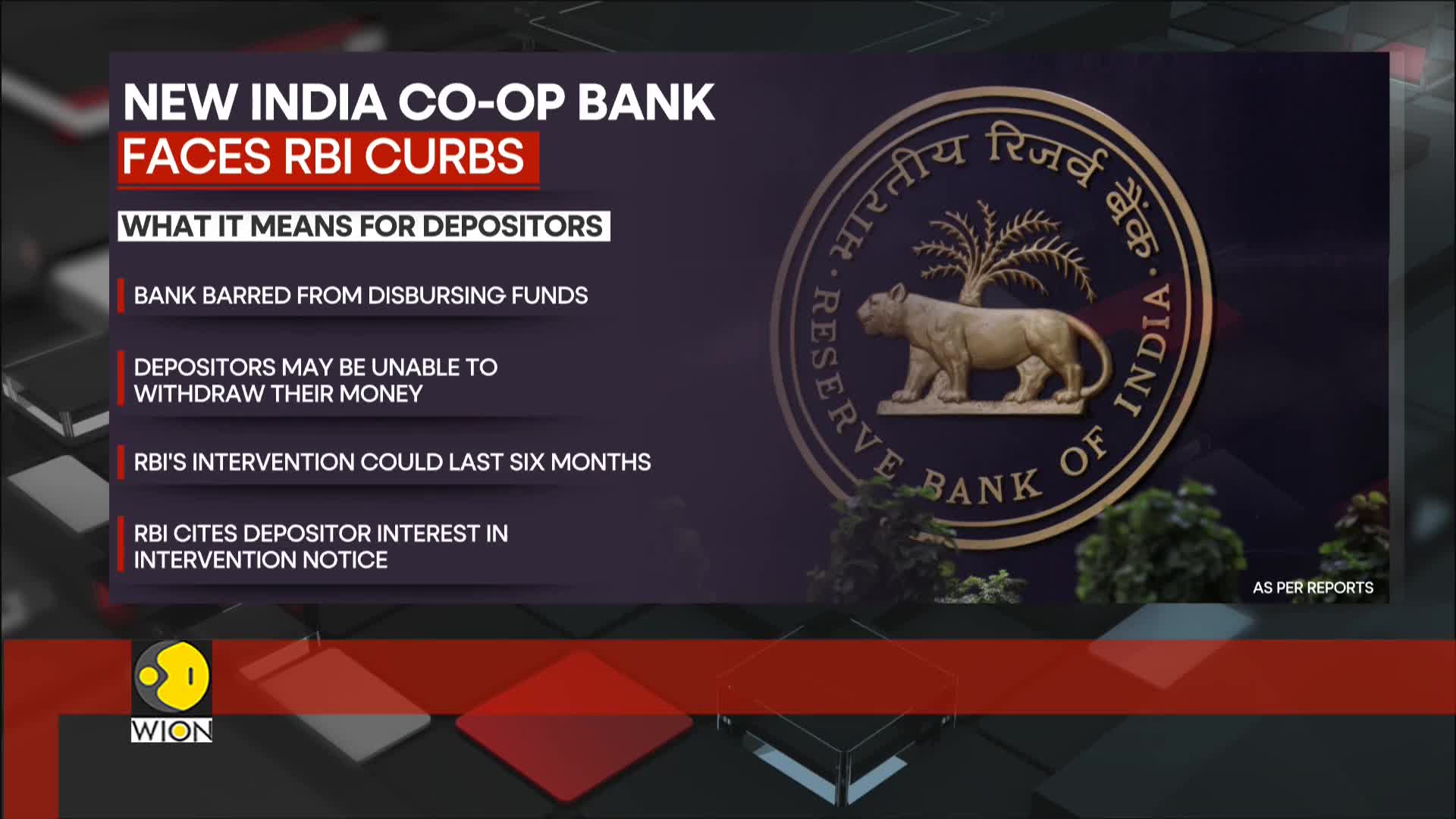

Watch clip answer (00:45m)What restrictions has the Reserve Bank of India imposed on the New India Cooperative Bank and how are depositors affected?

The Reserve Bank of India has imposed strict restrictions on the Mumbai-based New India Cooperative Bank due to liquidity concerns. The bank has been barred from disbursing funds, which has left depositors unable to withdraw their money, causing commotion outside bank branches as worried customers seek access to their savings. This regulatory action highlights the fragility of smaller financial institutions in emerging markets like India. The situation underscores the challenges faced by depositors when banking institutions face liquidity issues, leaving them in financial limbo until the restrictions are lifted or alternative arrangements are made.

Watch clip answer (00:36m)