Business Tax

Business tax refers to the financial obligations imposed by governments on businesses to fund public services and infrastructure. These taxes encompass various categories, including income tax, self-employment tax, employment taxes, sales and use tax, and property tax. Importantly, the structure and rate of business taxes can vary significantly depending on the type of business entity and its location. For instance, in the United States, corporate income tax rates differ at the federal and state levels, affecting C Corporations and S Corporations differently. This understanding is crucial for small business taxes and corporate tax planning, as it directly impacts profitability and compliance. Recently, the landscape of business taxes has witnessed noteworthy changes, particularly through the introduction of the One Big Beautiful Bill Act (OBBBA), which aims to benefit small business owners by maximizing available tax deductions and reducing taxable income. Additionally, the latest updates to corporate tax regulations emphasize the importance of staying informed, as they include modifications to the Base Erosion and Anti-Abuse Tax (BEAT) and changes to the federal foreign tax credit. As businesses navigate the complexities of tax compliance, including critical deadlines for filing and varying local regulations, being aware of the latest developments in business tax deductions and preparation methods is essential for strategic financial management. By optimizing tax strategies effectively, businesses can ensure robust financial health while fulfilling their obligations to local and federal authorities.

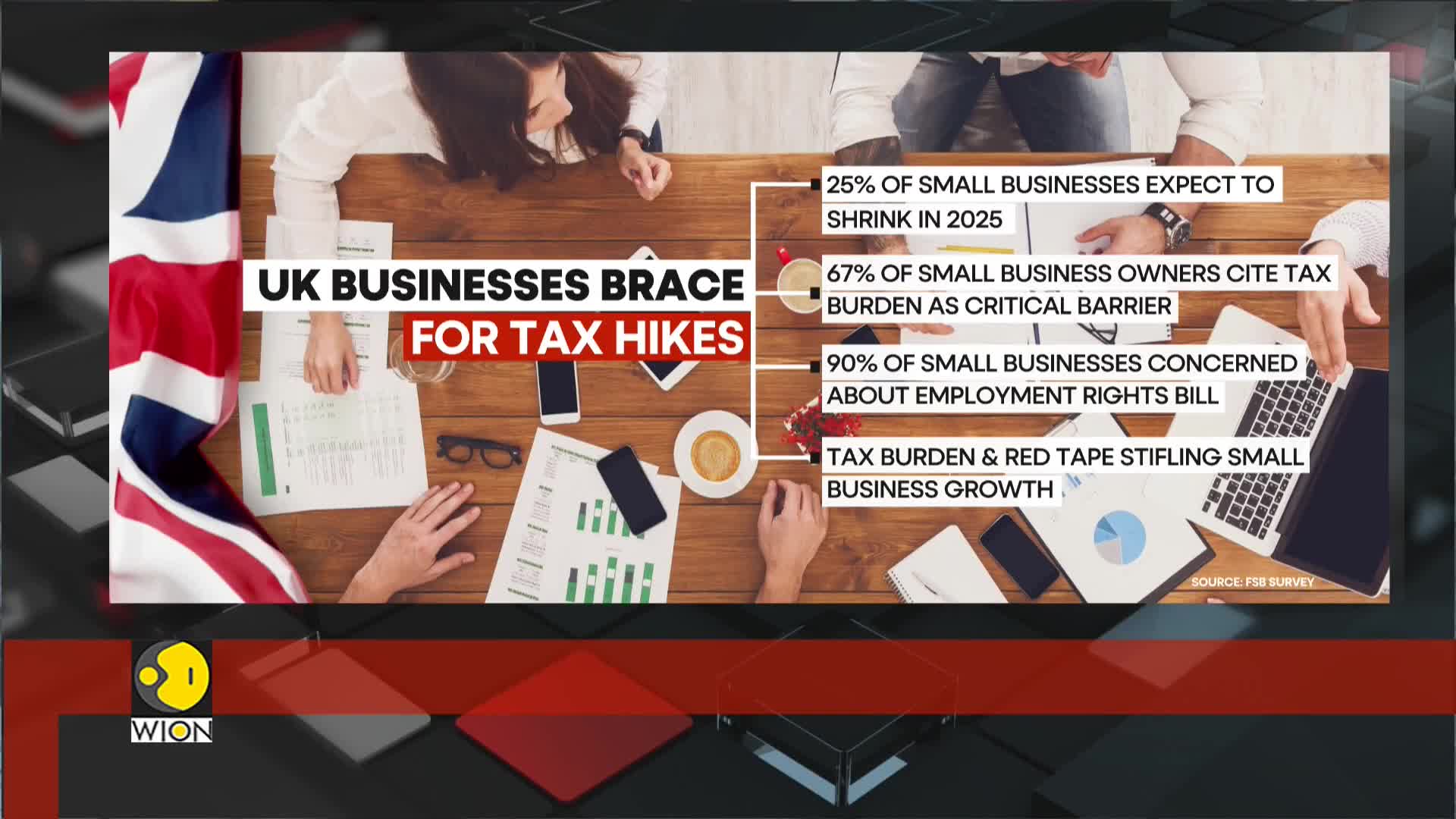

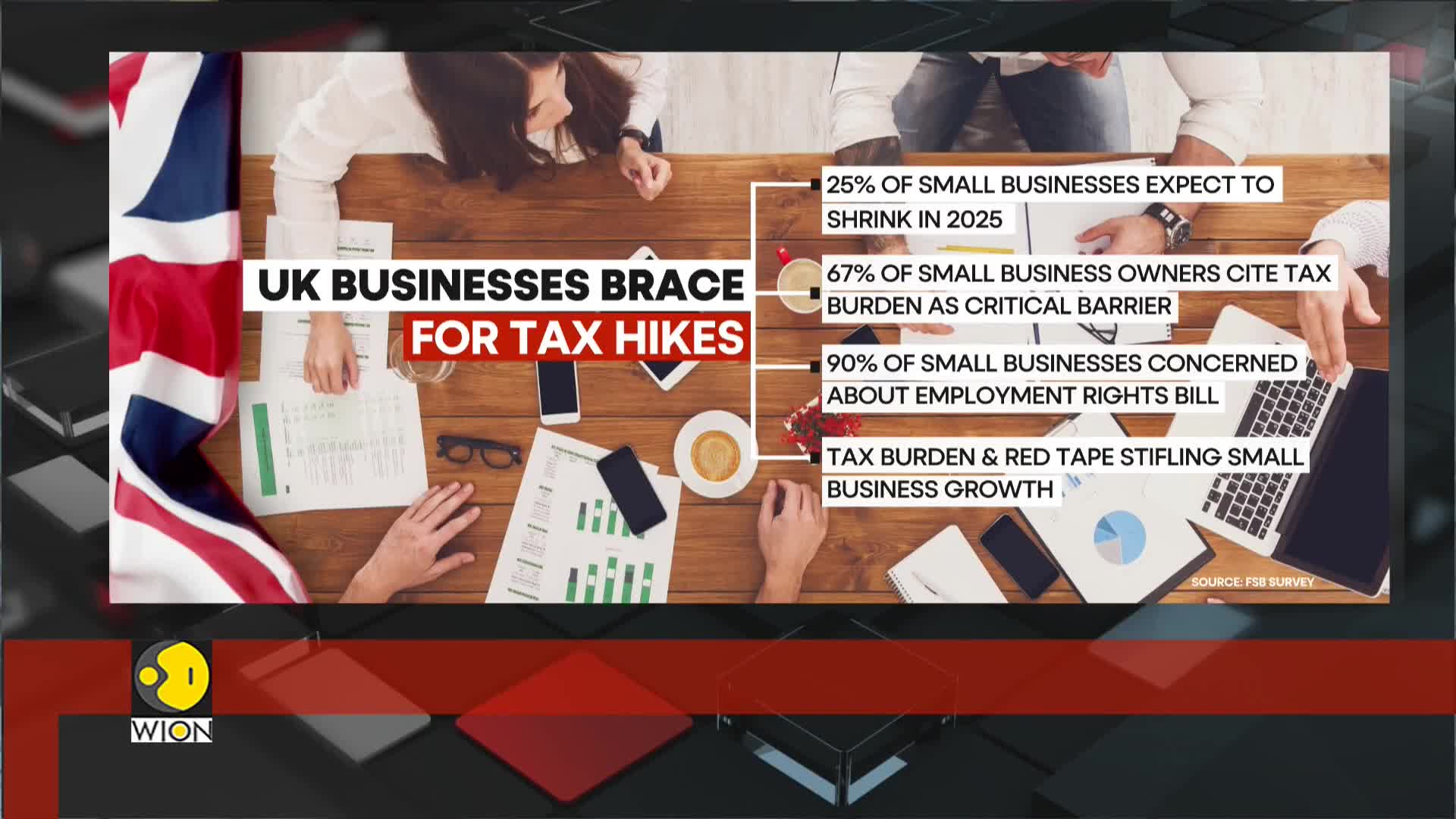

How is the £25 billion tax burden affecting UK small businesses in a stagnating economy?

The £25 billion tax burden is severely impacting UK small businesses amid economic stagnation, with GDP growth nearly flat at just 0.1% in the final quarter of 2025. Small businesses already spend an estimated £25 billion annually on tax compliance alone, creating a double financial pressure on these enterprises. These tax burdens are exacerbating the economic situation as the private sector struggles while government spending and borrowing continue to drive minimal growth. Experts suggest that reducing this tax compliance burden could significantly improve productivity, allowing small businesses to allocate resources more effectively rather than being hindered by excessive regulatory costs.

Watch clip answer (00:25m)How are the private and public sectors in the UK responding differently to rising tax burdens?

While the private sector struggles with increasing tax burdens, the public sector is experiencing a more optimistic outlook, benefiting from recent pay rises funded by tax increases. Small businesses are particularly vulnerable, with surveys showing a steep decline in confidence – more than a quarter expect to downsize in the first quarter of 2025, and over 67% cite the tax burden as a critical barrier to growth. This dichotomy highlights the uneven impact of fiscal policies, where public sector employees gain from increased government spending while private businesses face mounting challenges that threaten their sustainability and growth potential.

Watch clip answer (00:30m)How is the UK government's tax policy affecting small businesses?

The UK government's 25 billion pound tax is severely impacting small businesses, exacerbating economic stagnation across the country. With one in four companies planning layoffs—the highest rate in a decade—small business confidence has plummeted, with 67% citing tax burdens as a major barrier to growth. This financial pressure is particularly devastating retail and hospitality sectors, which are experiencing lower earnings while facing higher costs. New regulations, including the Employment Rights Bill, are adding further strain to businesses already struggling with rising national insurance rates, creating a perfect storm of economic challenges.

Watch clip answer (00:12m)How are UK businesses responding to the upcoming tax hike?

UK businesses are facing significant challenges due to an upcoming tax hike, with one in four companies planning to lay off staff. This marks the highest proportion of employers considering redundancies in a decade (excluding the pandemic period), according to a survey by the Chartered Institute of Personnel and Development. The rising national insurance rates and lower earnings threshold are particularly impacting retail and hospitality sectors, which are expected to be the hardest hit as they already struggle with higher costs. Employer confidence has fallen to its lowest point in 10 years outside the pandemic, with the tax increase set to take effect in April further undermining business outlook.

Watch clip answer (00:40m)How are tax burdens affecting UK businesses in the current economic climate?

UK businesses, particularly small ones, are struggling with significant tax compliance costs that amount to an estimated £25 billion annually. Despite treasury promises, business leaders remain skeptical due to rising costs and increasing regulatory pressures. As the private sector faces these financial burdens, many companies are implementing hiring freezes and delaying investments. This economic pressure is occurring while government spending continues to drive minimal growth, making the path to economic recovery uncertain for many businesses in the final quarter of 2025.

Watch clip answer (00:34m)