Business Tax

Business tax refers to the financial obligations imposed by governments on businesses to fund public services and infrastructure. These taxes encompass various categories, including income tax, self-employment tax, employment taxes, sales and use tax, and property tax. Importantly, the structure and rate of business taxes can vary significantly depending on the type of business entity and its location. For instance, in the United States, corporate income tax rates differ at the federal and state levels, affecting C Corporations and S Corporations differently. This understanding is crucial for small business taxes and corporate tax planning, as it directly impacts profitability and compliance. Recently, the landscape of business taxes has witnessed noteworthy changes, particularly through the introduction of the One Big Beautiful Bill Act (OBBBA), which aims to benefit small business owners by maximizing available tax deductions and reducing taxable income. Additionally, the latest updates to corporate tax regulations emphasize the importance of staying informed, as they include modifications to the Base Erosion and Anti-Abuse Tax (BEAT) and changes to the federal foreign tax credit. As businesses navigate the complexities of tax compliance, including critical deadlines for filing and varying local regulations, being aware of the latest developments in business tax deductions and preparation methods is essential for strategic financial management. By optimizing tax strategies effectively, businesses can ensure robust financial health while fulfilling their obligations to local and federal authorities.

What tax settlement did Google agree to with Italy and why?

Google has agreed to pay 326 million euros to Italy following an investigation into alleged unpaid taxes. The settlement stems from Italian authorities' accusations that Google failed to properly declare and pay taxes in the country between 2015 and 2019. This case represents part of a broader trend of European countries increasing scrutiny on major tech companies' tax practices and demanding corporate accountability from global technology giants operating within their borders.

Watch clip answer (00:17m)What was Google's tax settlement with Italy and why was it required?

Google agreed to pay 326 million euros to Italy following an investigation into unpaid taxes. Italian authorities accused the tech giant of failing to declare and pay taxes in the country between 2015 and 2019, which prompted the settlement. This case highlights the ongoing scrutiny that major technology companies face regarding their tax obligations in various countries where they operate. The significant settlement demonstrates Italy's commitment to enforcing tax compliance from multinational corporations operating within its borders.

Watch clip answer (00:17m)How do high tax rates and government regulations affect businesses and the housing market?

According to Ben Shapiro, high tax rates and government regulations often harm the very businesses that create employment opportunities. He explains that confiscatory tax rates can kill businesses people need to work for, effectively undermining economic growth and job creation. Shapiro uses rent control as a specific example, arguing that government intervention in real estate markets tends to increase housing prices rather than reduce them. When policymakers attempt to punish wealthy developers by controlling rents, the unintended consequence is reduced housing production and supply, which ultimately leads to higher prices and less construction overall.

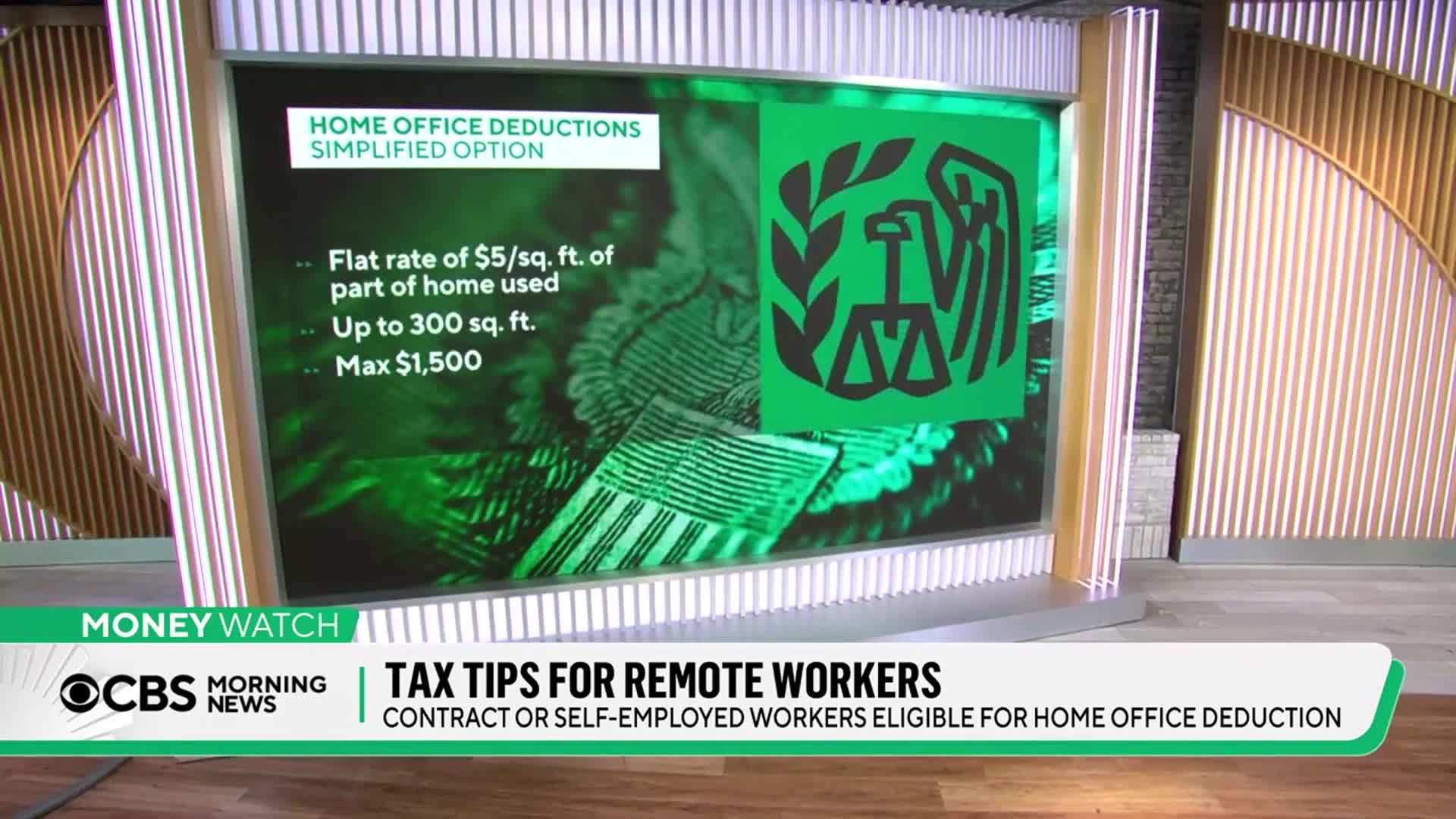

Watch clip answer (00:25m)Who is eligible for home office deductions after the 2018 tax reforms?

After the 2018 tax reforms, home office deductions are no longer available to regular remote workers who are W2 employees. These deductions are now limited to self-employed individuals who are not employed by a company, or those who have a second job outside their primary W2 position. To qualify, individuals must exclusively use a specific space in their home for work purposes. This means the area must be dedicated solely to business activities. These eligibility requirements significantly narrowed who can claim home office expenses, making it primarily a benefit for freelancers, independent contractors, and those with side businesses.

Watch clip answer (00:26m)What health insurance deductions are available for self-employed individuals?

Self-employed individuals who purchase their own health insurance can deduct all health insurance premiums not only for themselves, but also for their spouse and children. This is a significant tax benefit that helps offset the cost of obtaining private health coverage when you don't have employer-sponsored insurance. To properly claim this deduction, meticulous record-keeping is essential. Self-employed taxpayers must maintain organized documentation and save all receipts related to their health insurance premium payments. Unlike traditional employees who lost the ability to deduct unreimbursed expenses after the 2018 tax reforms, self-employed individuals retain this valuable tax advantage.

Watch clip answer (00:18m)Can remote workers claim home office tax deductions?

Since the 2018 tax reforms, most remote workers cannot claim deductions for unreimbursed expenses or home office costs. This change significantly impacts employees working from home who might have previously expected to receive tax benefits for their home workspace arrangements. While many remote workers may be considering office deductions as tax season approaches, the current tax code restricts these benefits, regardless of whether you're working from your couch, bed, or a dedicated home office space as an employee. Self-employed individuals, however, may still qualify for certain home office deductions under different rules.

Watch clip answer (00:17m)