Business Finance

Business finance refers to the management, acquisition, and allocation of financial resources essential for the operations and growth of a business. This multifaceted discipline involves critical activities such as financial planning, budgeting, cash flow management, and investment decision-making. Effective business finance underpins organizations’ ability to secure funding through various means, including **business loans**, equity investment, and alternative financing solutions. For small businesses, acquiring **small business loans** and managing cash flow effectively is particularly vital, as it helps maintain liquidity and supports expansion initiatives. In the fast-evolving financial landscape, recent trends emphasize the integration of **Artificial Intelligence (AI)** in business finance processes, which enhances efficiency, particularly within small business lending and financial planning & analysis (FP&A) workflows. With a growing emphasis on data mastery and strategic business partnering, managing finances has become more complex, yet essential for navigating today's market challenges. As businesses aim for sustained growth, optimizing cash flow management and understanding funding options are crucial for informed decision-making. Without proper financial oversight, companies risk failure due to poor cash flow or undercapitalization. Thus, business finance remains indispensable for startups, small enterprises, and established firms alike, serving as the foundation for innovative strategies and competitive advantage in an increasingly dynamic market.

What does American sports dystopia look like according to the commentator?

According to Pablo Torre, the American sports dystopia is directly associated with former President Trump's influence and business interests in sports. He specifically points to golf and mentions 'the cheating' as elements of this dystopia. Torre's tone suggests serious concerns about how the intermingling of Trump's political power and sports business ventures represents a troubling direction for American athletics. His direct statement that 'It looks like that' indicates he believes this dystopian scenario is already manifesting in the current landscape where politics and sports business interests are increasingly entangled.

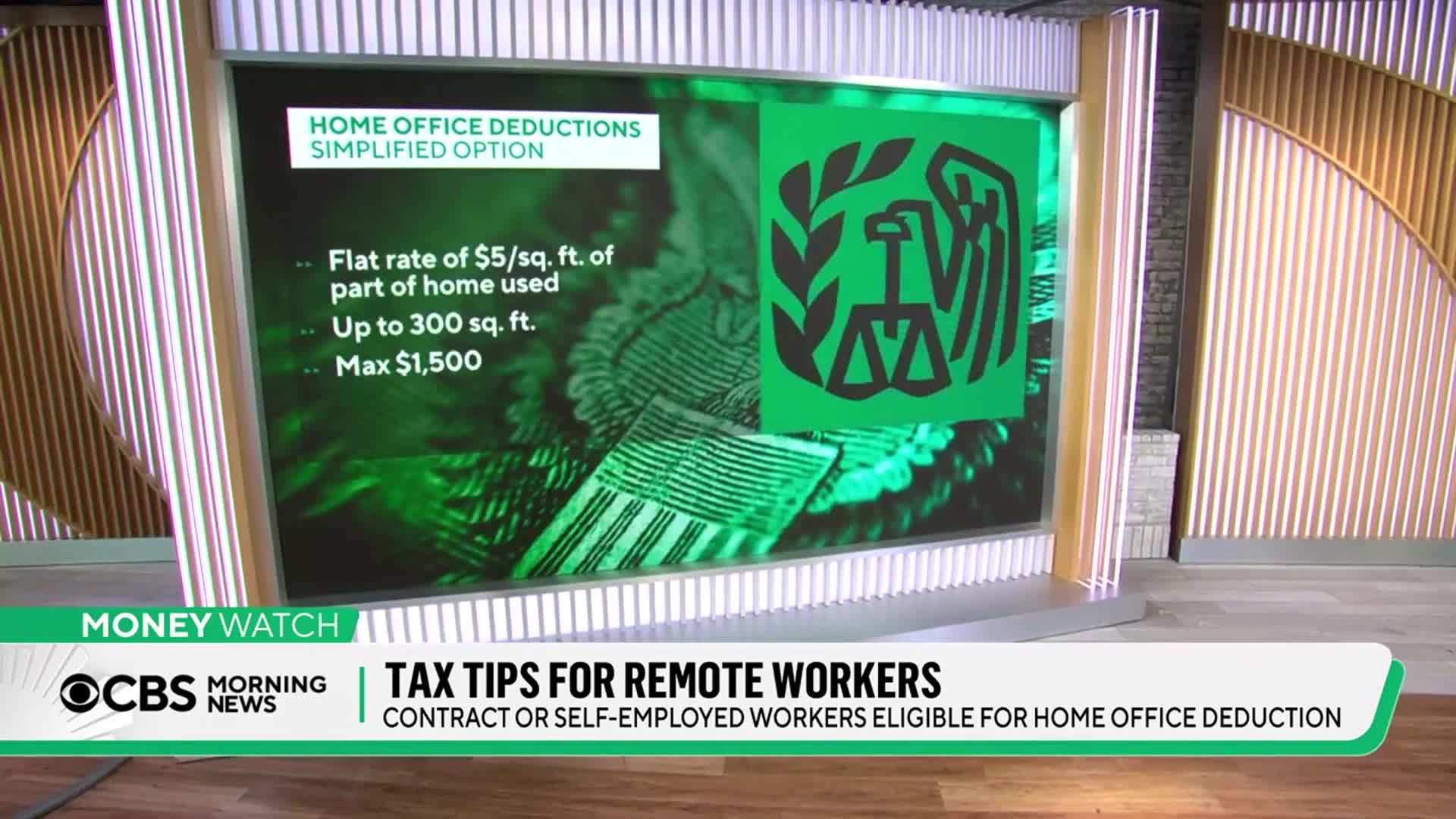

Watch clip answer (00:10m)What expenses can self-employed remote workers deduct from their taxes for a home office?

Self-employed remote workers can deduct much more than just basic office equipment. Beyond cell phones, laptops, printers and supplies, they can deduct a portion of their rent or mortgage, real estate taxes, homeowners insurance, and utilities based on the percentage of home used exclusively for business. For example, if 20% of your home serves exclusively as an office, you can deduct 20% of these housing-related expenses from your taxes. Proper documentation is essential when claiming these deductions, as all expenses must be thoroughly recorded to support your tax claims.

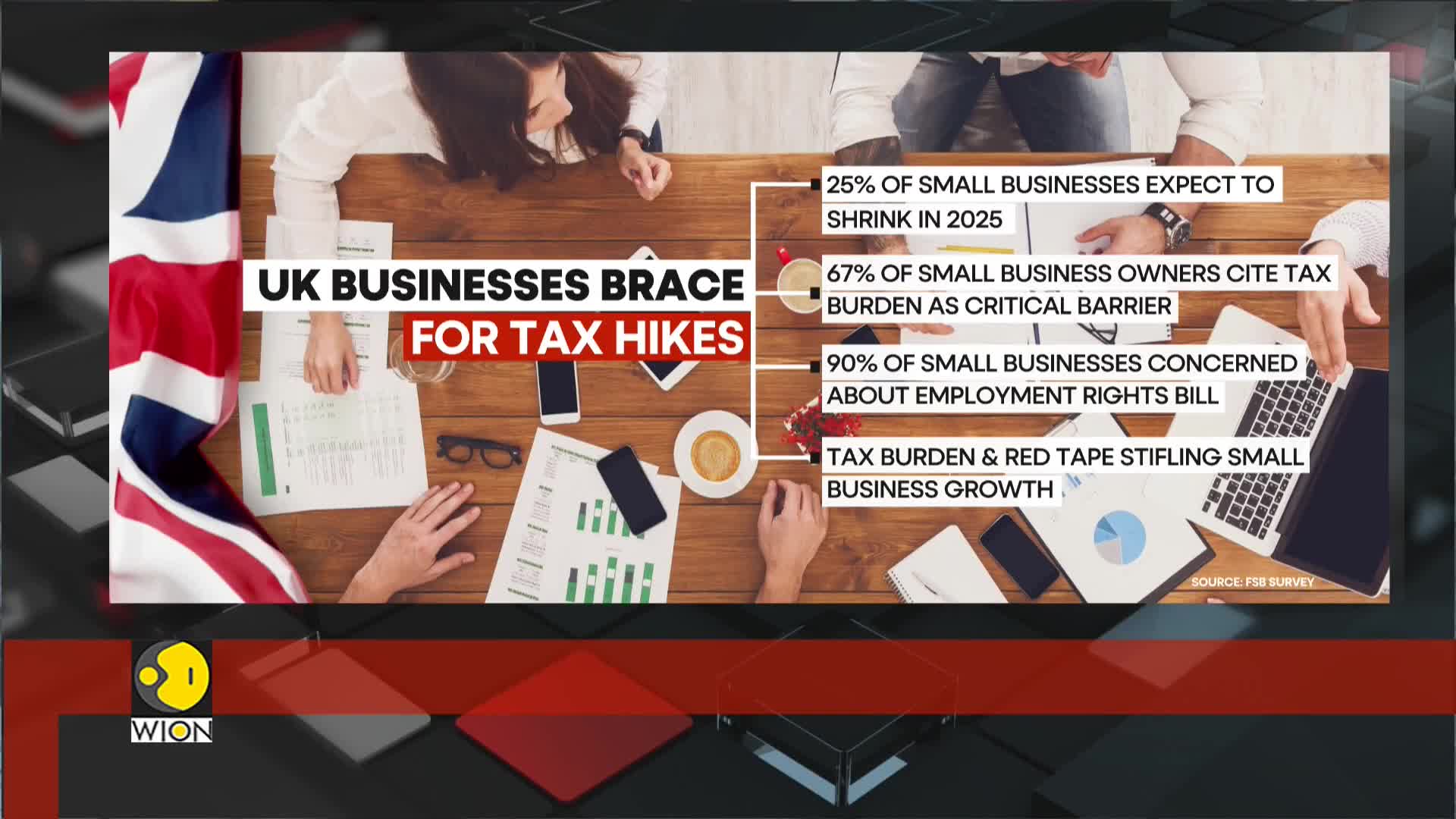

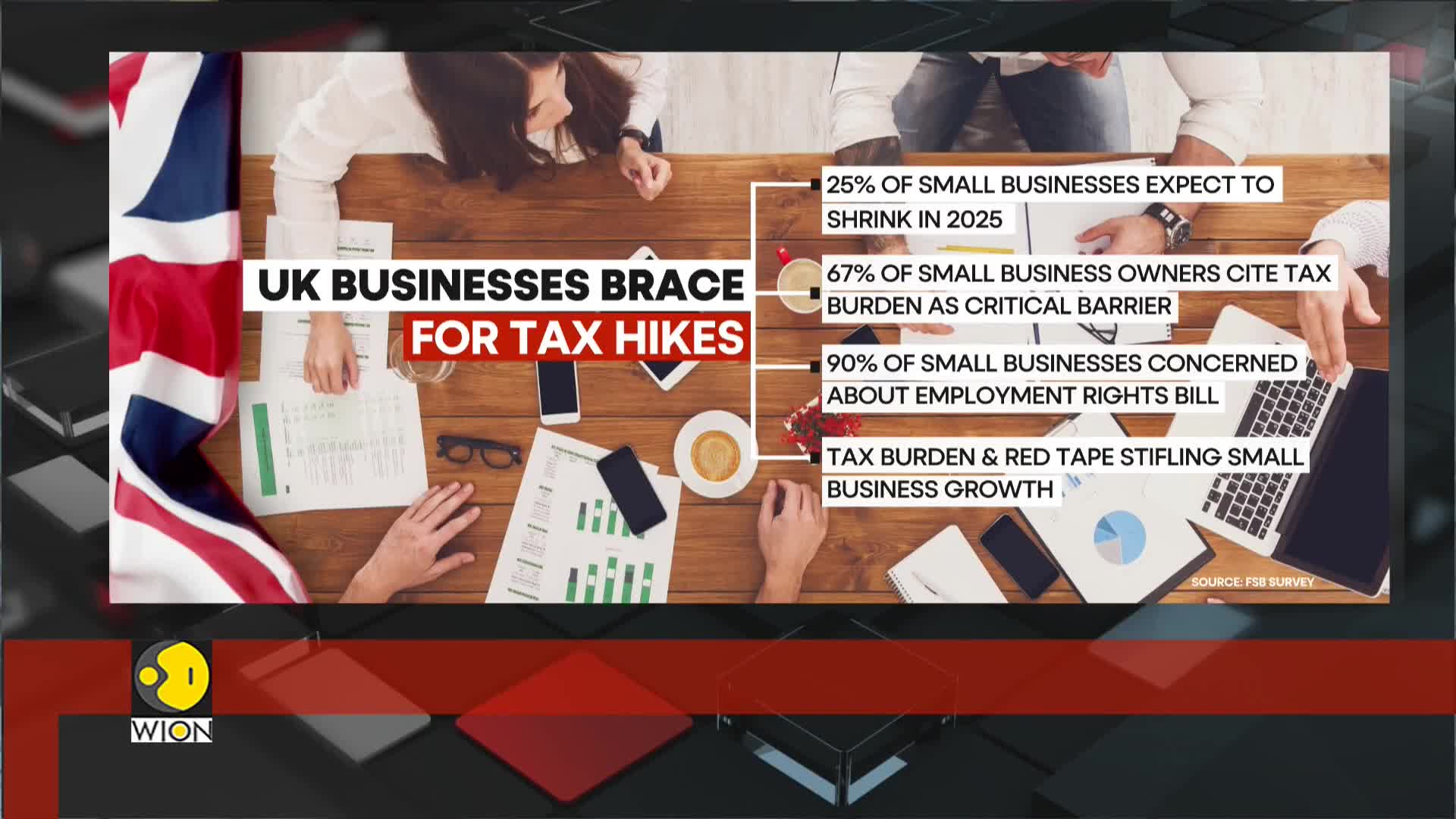

Watch clip answer (00:32m)How is the upcoming tax increase affecting UK businesses?

The major tax increase set to take effect in April is severely impacting UK business confidence, which has plummeted to its lowest level in a decade (outside pandemic periods). This unprecedented decline in employer confidence reflects widespread concerns about the sustainability of business operations under increased tax burdens. The situation represents a significant economic challenge, with businesses across various sectors preparing for financial strain that could potentially affect hiring decisions and growth strategies. This historically low confidence level suggests businesses are bracing for substantial negative impacts from the impending tax changes.

Watch clip answer (00:09m)Why are UK business leaders skeptical about economic recovery?

UK business leaders remain skeptical about economic recovery despite Treasury promises, primarily due to rising costs and increasing regulatory pressures. Companies are implementing hiring freezes and delaying investments as they struggle to manage mounting financial challenges. The economic outlook appears uncertain for many businesses as they attempt to navigate these obstacles. With one in four companies considering layoffs and employer confidence at its lowest in a decade, the private sector faces significant hurdles on the path to recovery amid stagnant GDP growth.

Watch clip answer (00:16m)What impact is the upcoming tax hike having on UK businesses?

The impending tax hike is causing significant disruption across UK businesses, with one in four companies planning to lay off staff. According to a survey by the Chartered Institute of Personnel and Development, this represents the highest proportion of employers considering redundancies in the past decade, excluding the pandemic period. The retail and hospitality sectors are particularly affected by rising national insurance rates and shrinking earnings thresholds. While the public sector remains somewhat insulated due to recent pay increases, small businesses are especially vulnerable, with many owners citing the tax burden as a major obstacle to growth and sustainability.

Watch clip answer (00:18m)How are the private and public sectors in the UK responding differently to rising tax burdens?

While the private sector struggles with increasing tax burdens, the public sector is experiencing a more optimistic outlook, benefiting from recent pay rises funded by tax increases. Small businesses are particularly vulnerable, with surveys showing a steep decline in confidence – more than a quarter expect to downsize in the first quarter of 2025, and over 67% cite the tax burden as a critical barrier to growth. This dichotomy highlights the uneven impact of fiscal policies, where public sector employees gain from increased government spending while private businesses face mounting challenges that threaten their sustainability and growth potential.

Watch clip answer (00:30m)