Business Finance

Business finance refers to the management, acquisition, and allocation of financial resources essential for the operations and growth of a business. This multifaceted discipline involves critical activities such as financial planning, budgeting, cash flow management, and investment decision-making. Effective business finance underpins organizations’ ability to secure funding through various means, including **business loans**, equity investment, and alternative financing solutions. For small businesses, acquiring **small business loans** and managing cash flow effectively is particularly vital, as it helps maintain liquidity and supports expansion initiatives. In the fast-evolving financial landscape, recent trends emphasize the integration of **Artificial Intelligence (AI)** in business finance processes, which enhances efficiency, particularly within small business lending and financial planning & analysis (FP&A) workflows. With a growing emphasis on data mastery and strategic business partnering, managing finances has become more complex, yet essential for navigating today's market challenges. As businesses aim for sustained growth, optimizing cash flow management and understanding funding options are crucial for informed decision-making. Without proper financial oversight, companies risk failure due to poor cash flow or undercapitalization. Thus, business finance remains indispensable for startups, small enterprises, and established firms alike, serving as the foundation for innovative strategies and competitive advantage in an increasingly dynamic market.

How do you select the right automation testing tool for your project?

Selecting the right testing tool is crucial for the success of your test automation strategy. First, thoroughly understand your project requirements and identify which testing scenarios to automate. Then, shortlist tools that support these requirements while considering your budget constraints. Further refinement should be based on parameters like licensing costs, maintenance expenses, training and support, tool extensibility, performance, and stability. This systematic approach helps navigate through the numerous automation tools available in the market to find the one that best fits your specific project needs.

Watch clip answer (01:16m)What are the different types of revenue streams and why are they important for businesses?

Revenue streams represent the various ways businesses generate income, categorized as operating revenues (from core business activities like Coca-Cola selling drinks) and non-operating revenues (from side activities like interest, rent, and dividends). These streams follow different models: transaction-based (one-time payments), service (time-based billing), project (large one-time tasks), and recurring revenue (subscription or licensing fees). Understanding these revenue streams is crucial for financial analysts as they significantly impact business evaluation and forecasting. Each type has unique implications for cash flow predictability—recurring revenues provide consistent income, while transaction-based and project revenues fluctuate with demand. This knowledge helps analysts accurately evaluate business sustainability and develop appropriate forecasting models for different revenue types.

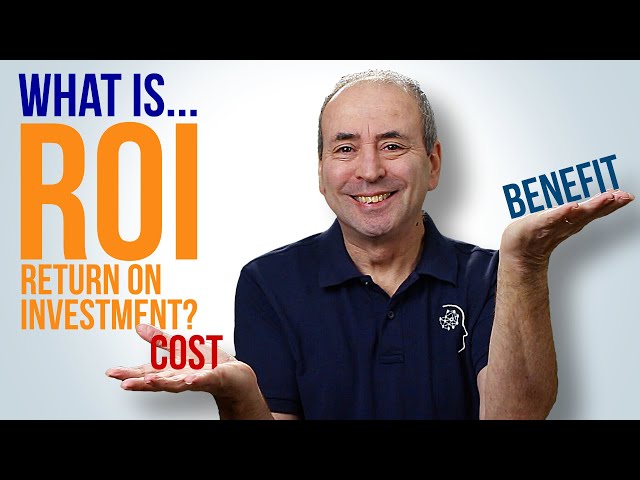

Watch clip answer (04:18m)What is ROI and how is it calculated in project management?

Return on Investment (ROI) is a widely used measure of investment value in project management. It's calculated as the ratio of net income to total cost—specifically, (total income minus total cost) divided by total cost. This is typically expressed as a percentage by multiplying the fraction by 100. An ROI greater than 100% represents a positive return, indicating you get more out than you put in, while an ROI less than 100% represents a loss. Despite its popularity across business, public, and non-profit sectors, ROI has a key limitation: it doesn't account for the timing of costs and profits, which is especially important for long-term projects.

Watch clip answer (03:26m)What unique financing solutions does Santander offer to entrepreneurs beyond traditional loans?

Santander offers entrepreneurs more than just traditional loans through programs like Breakthrough, which was launched in the UK and is now expanding to Spain and other countries. They provide growth capital, which according to Botín is rare in Europe, and help small and medium-sized businesses with international expansion. The bank leverages its unique position between Europe and the Americas to facilitate trade, organizing trade missions that have connected small companies from places like London to Boston, Dubai, and India. These specialized services help entrepreneurs with revenues of 1-3 million who want to rapidly expand globally.

Watch clip answer (01:21m)How does Norway's SME loan scheme empower women entrepreneurs in the Middle East?

Norway's SME loan scheme empowers women entrepreneurs in the Middle East through multiple components. The program trains bank staff to assess creditworthiness of small and medium-sized businesses while providing grants and risk-sharing mechanisms that reduce the bank's lending risk. This approach particularly benefits female entrepreneurs who have previously been excluded from financial services. The initiative has proven highly successful, as once these women business owners receive and repay their first loan, they establish creditworthiness that allows them to access future financing without requiring special guarantees. This creates sustainable financial inclusion for women running small shops and other enterprises, helping them overcome historical barriers to accessing capital.

Watch clip answer (00:55m)What are the opportunities and challenges for women entrepreneurs in emerging markets?

Women entrepreneurs in emerging markets are experiencing increasing opportunities, as noted by Raghuram Rajan who mentions successful female business owners in India, including a prominent biotech entrepreneur. However, significant challenges remain, including limited access to capital, insufficient infrastructure, and lack of peer support communities. David Wessel highlights how microfinance initiatives, pioneered by Muhammad Yunus, have been instrumental in empowering poor women by helping them gain financial independence and business skills. Despite these positive developments, certain regions like Saudi Arabia continue to restrict women's participation, demonstrating how some countries deny themselves economic growth by limiting women's entrepreneurial potential.

Watch clip answer (02:37m)