Business Confidence

Business confidence is a critical economic measure that encapsulates the level of optimism or pessimism expressed by business leaders regarding the current and future state of the economy. Typically quantified through the Business Confidence Index (BCI), this index aggregates insights gathered from various consumer confidence surveys and economic confidence indicators. A BCI reading above 100 typically signifies optimism, whereas scores below this threshold denote a more pessimistic outlook, which can directly affect investment, hiring, and expansion decisions by companies. This measure serves as a barometer for the economic climate, influencing aggregate demand and signaling potential economic growth or decline. Recently, trends in business confidence highlight a notable decline in optimism across global markets. The latest updates reveal a significant decrease in the Business Confidence Index, falling to levels not seen in more than a decade due to factors such as macroeconomic uncertainties, regulatory shifts, and weakening global demand. Emerging economies, in particular, are grappling with sharper downturns than their advanced counterparts, raising concerns about the continuity of supply chains and overall economic stability. Additionally, conditions affecting consumer confidence have mirrored business sentiments, with key indices plummeting as stakeholders remain cautious about job availability and broader economic conditions. Understanding these dynamics is vital for analysts and policymakers as they navigate the ever-evolving landscape of global commerce.

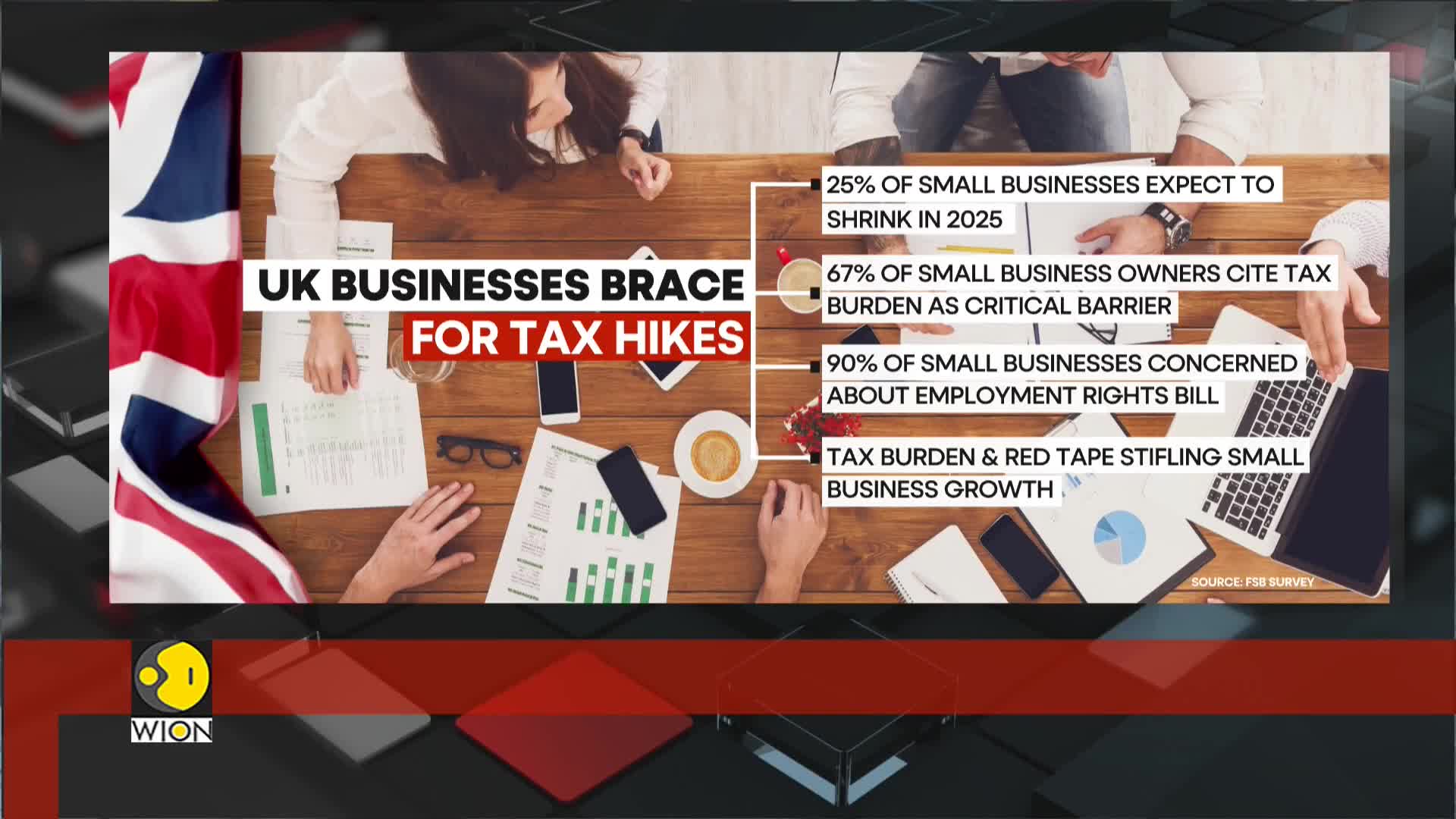

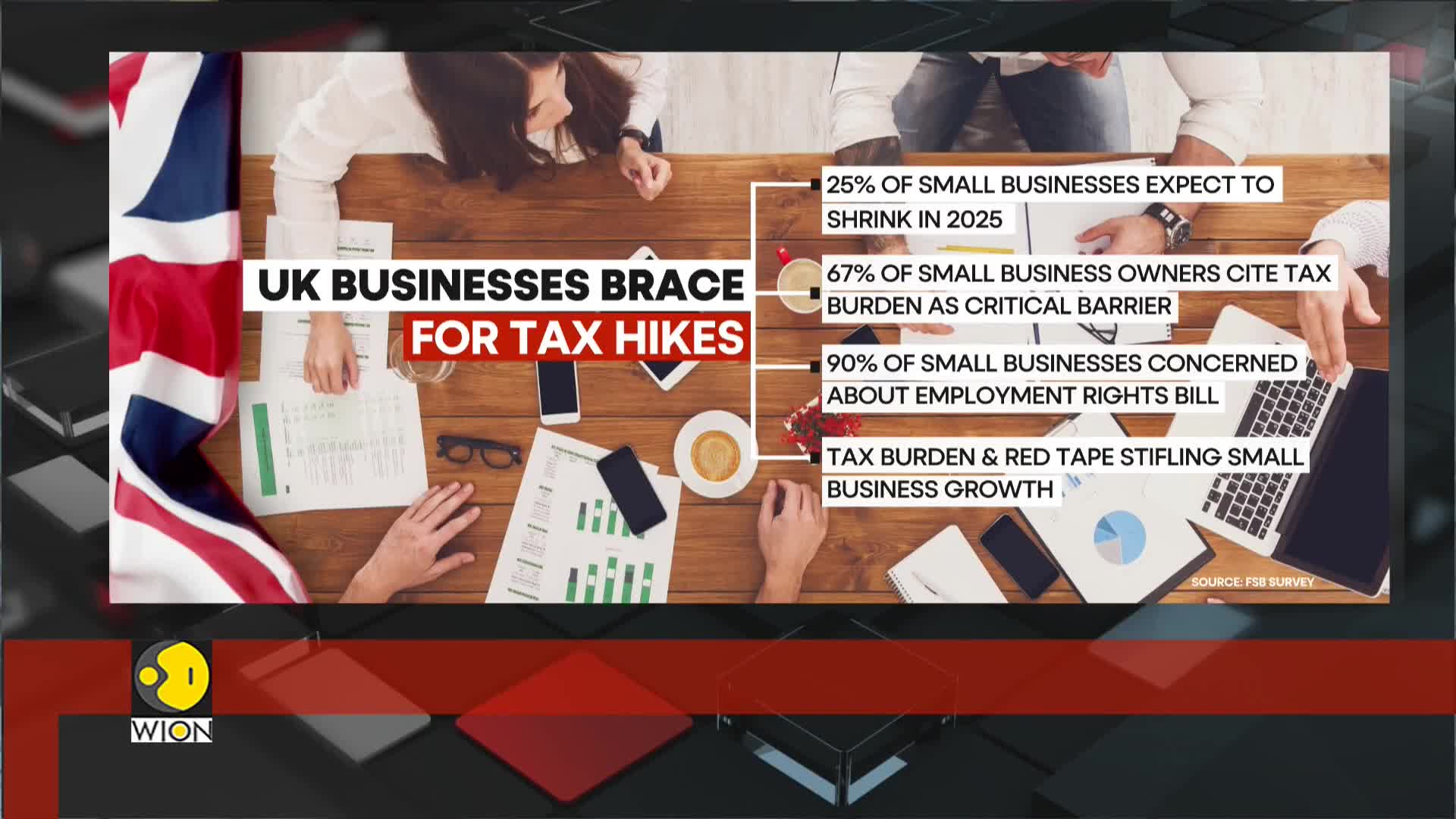

How are the public and private sectors responding differently to rising tax burdens in the UK?

While the private sector is struggling with the increasing tax burden, the public sector is experiencing a more optimistic outlook. This contrast stems from recent public sector pay rises that have been funded by tax increases, creating a divergent economic reality between the two sectors. Small businesses are particularly vulnerable in this environment, with a Federation of Small Businesses survey revealing a steep decline in confidence among business owners. This highlights the disproportionate impact of the current tax policy, where increased taxation is simultaneously funding public sector improvements while potentially hampering private sector growth and confidence.

Watch clip answer (00:19m)How will investors react to Germany's federal election amid concerns over Trump's trade tariffs?

Investors will maintain vigilant monitoring of Germany's federal election results within the context of broader market uncertainties, particularly those related to Trump's trade tariffs. The electoral outcome holds significance for market stability as it occurs during a period of potential trade disruptions that could impact European economies. With the DAX reaching record highs, investor sentiment remains cautiously optimistic but wary of political shifts that could affect market dynamics. The intersection of German political changes and international trade tensions creates a complex risk environment that investors must navigate carefully as they assess potential impacts on both European and global markets.

Watch clip answer (00:05m)What is driving the strong performance of the German stock market ahead of the election?

The German stock market's strong performance is largely driven by investor hopes that the upcoming German administration will secure a strong parliamentary majority capable of implementing economic reforms. The German stock index has outperformed both US and European peers since snap elections were announced, reflecting market optimism about potential economic revival under new leadership. Investors are particularly focused on the possibility of meaningful reforms that could revitalize Germany's economy following the election.

Watch clip answer (00:15m)How are the private and public sectors in the UK responding differently to rising tax burdens?

While the private sector struggles with increasing tax burdens, the public sector is experiencing a more optimistic outlook, benefiting from recent pay rises funded by tax increases. Small businesses are particularly vulnerable, with surveys showing a steep decline in confidence – more than a quarter expect to downsize in the first quarter of 2025, and over 67% cite the tax burden as a critical barrier to growth. This dichotomy highlights the uneven impact of fiscal policies, where public sector employees gain from increased government spending while private businesses face mounting challenges that threaten their sustainability and growth potential.

Watch clip answer (00:30m)How are UK businesses responding to the upcoming tax hike?

UK businesses are facing significant challenges due to an upcoming tax hike, with one in four companies planning to lay off staff. This marks the highest proportion of employers considering redundancies in a decade (excluding the pandemic period), according to a survey by the Chartered Institute of Personnel and Development. The rising national insurance rates and lower earnings threshold are particularly impacting retail and hospitality sectors, which are expected to be the hardest hit as they already struggle with higher costs. Employer confidence has fallen to its lowest point in 10 years outside the pandemic, with the tax increase set to take effect in April further undermining business outlook.

Watch clip answer (00:40m)