Business Confidence

Business confidence is a critical economic measure that encapsulates the level of optimism or pessimism expressed by business leaders regarding the current and future state of the economy. Typically quantified through the Business Confidence Index (BCI), this index aggregates insights gathered from various consumer confidence surveys and economic confidence indicators. A BCI reading above 100 typically signifies optimism, whereas scores below this threshold denote a more pessimistic outlook, which can directly affect investment, hiring, and expansion decisions by companies. This measure serves as a barometer for the economic climate, influencing aggregate demand and signaling potential economic growth or decline. Recently, trends in business confidence highlight a notable decline in optimism across global markets. The latest updates reveal a significant decrease in the Business Confidence Index, falling to levels not seen in more than a decade due to factors such as macroeconomic uncertainties, regulatory shifts, and weakening global demand. Emerging economies, in particular, are grappling with sharper downturns than their advanced counterparts, raising concerns about the continuity of supply chains and overall economic stability. Additionally, conditions affecting consumer confidence have mirrored business sentiments, with key indices plummeting as stakeholders remain cautious about job availability and broader economic conditions. Understanding these dynamics is vital for analysts and policymakers as they navigate the ever-evolving landscape of global commerce.

What might be revealed if an official audit of Fort Knox's gold reserves takes place?

If an official audit of Fort Knox proceeds, it could potentially reveal critical information about one of America's most guarded financial assets, which has not undergone a comprehensive external review in over 50 years. With gold reserves valued at approximately $425 billion, the findings would address public skepticism and transparency concerns raised by figures like Elon Musk. The audit results would have significant implications for public trust and could impact broader U.S. financial practices. As discussions continue, the focus remains not just on whether the audit will happen, but on what truths it might uncover about this highly secured national treasure that many Americans know little about.

Watch clip answer (00:13m)What challenges is China's property sector currently facing?

China's property sector is currently under significant pressure from high debt levels and insolvency among major developers. This crisis has resulted in a substantial 12.9% drop in property sales by floor area in 2024, indicating a severe downturn in the market. The property decline has wide-ranging effects, particularly impacting the middle class through falling rental income and diminished consumer confidence throughout the Chinese economy.

Watch clip answer (00:16m)How is China's real estate decline affecting the middle class?

China's underperforming real estate market is significantly impacting its middle class population. Property income, which forms a crucial component of household earnings, is declining, indicating asset depreciation for numerous homeowners across the country. This financial setback is particularly concerning as property has traditionally been a key wealth-building mechanism for China's middle class. The diminishing returns from real estate are contributing to weakened consumer confidence and creating financial strain on middle-class households who have invested substantially in property.

Watch clip answer (00:14m)How has China's consumer confidence changed recently?

China's consumer confidence has declined dramatically, with the consumer confidence index plummeting from 121.5 in January 2022 to just 86.4 by December 2023. This sharp drop of approximately 29% over a two-year period signals significantly weakening sentiment among Chinese consumers. This declining confidence coincides with broader consumption weakness in the Chinese economy. The trend is particularly concerning as it reflects deteriorating consumer outlook amid challenges in sectors like real estate, where property income growth has reached decade-low levels according to the clip's description.

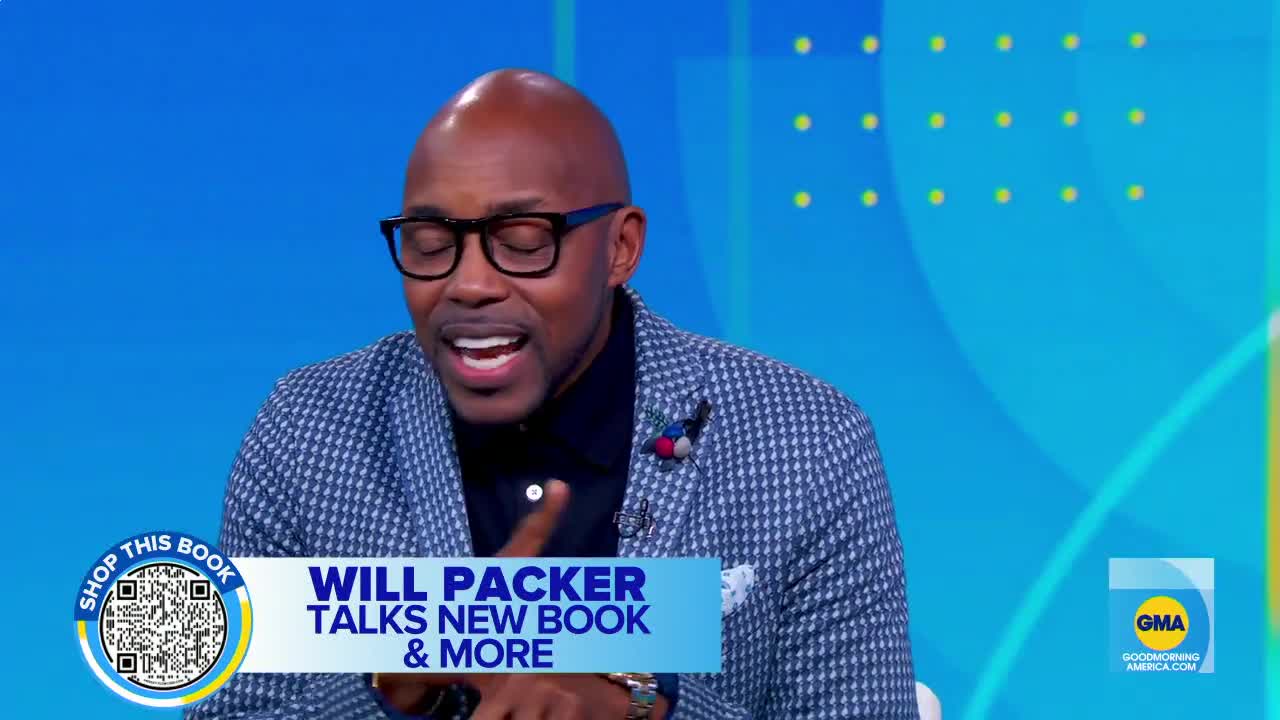

Watch clip answer (00:14m)Why did Will Packer decide to write his book 'Who Better Than You?'?

After spending 30 years in Hollywood, Will Packer drew upon his extensive experience working with diverse personalities in the entertainment industry to create his book. Throughout his career, he has collaborated with some of the biggest egos and most impressive talents, while also encountering toxic individuals along the way. His book 'Who Better Than You?' leverages these experiences to share insights on self-confidence, resilience, and navigating professional challenges, particularly in a complex environment like Hollywood.

Watch clip answer (00:13m)What does Will Packer emphasize as important in his Hollywood journey?

Will Packer emphasizes the power of healthy arrogance and persistence as crucial elements in his successful Hollywood journey. As a producer behind blockbuster hits like 'Girls Trip' and 'Straight Outta Compton,' he advocates for maintaining self-confidence while pursuing ambitious dreams. In his book 'Who Better Than You?', Packer explores themes of resilience and the importance of positive influences. His 30-year career has taught him transferable skills about navigating challenges and maintaining unwavering belief in one's capabilities, encouraging others to pursue their dreams unapologetically.

Watch clip answer (00:08m)