Banking Regulations

Banking regulations play a critical role in ensuring the stability and integrity of the financial system. These regulations are a set of rules and guidelines that govern the operations of banks and financial institutions, aimed at protecting consumers, maintaining confidence in the banking system, and preventing financial crimes. Recently, the landscape of banking compliance has evolved significantly, shaped by emerging technologies, heightened cybersecurity threats, and increasing emphasis on environmental, social, and governance (ESG) considerations. Understanding the latest financial regulations is essential for banks to navigate compliance requirements successfully and avoid potential penalties. The importance of banking regulations is underscored by key legislative frameworks, including the Bank Holding Company Act, the Dodd-Frank Act, and the Federal Deposit Insurance Act. These laws not only establish regulatory requirements but also influence how banks manage risks and governance structures. With the rapid rise of fintech and digital banking, regulatory bodies like the Federal Reserve and the Office of the Comptroller of the Currency (OCC) are focusing on new risk management strategies to address challenges unique to the digital landscape. As regulatory divergence becomes more prevalent across regions, it is paramount for banks to stay informed and agile in their compliance strategies, ensuring they meet both local and global regulatory standards. In summary, banking regulations are vital to maintaining financial stability and consumer protection. The evolving nature of these regulations requires banks to continuously adapt their governance and compliance frameworks, particularly in light of the challenges posed by technology and the increasing importance of ethical considerations in finance. Staying ahead of regulatory changes is crucial for banks aiming to maintain competitiveness and trust in an ever-changing environment.

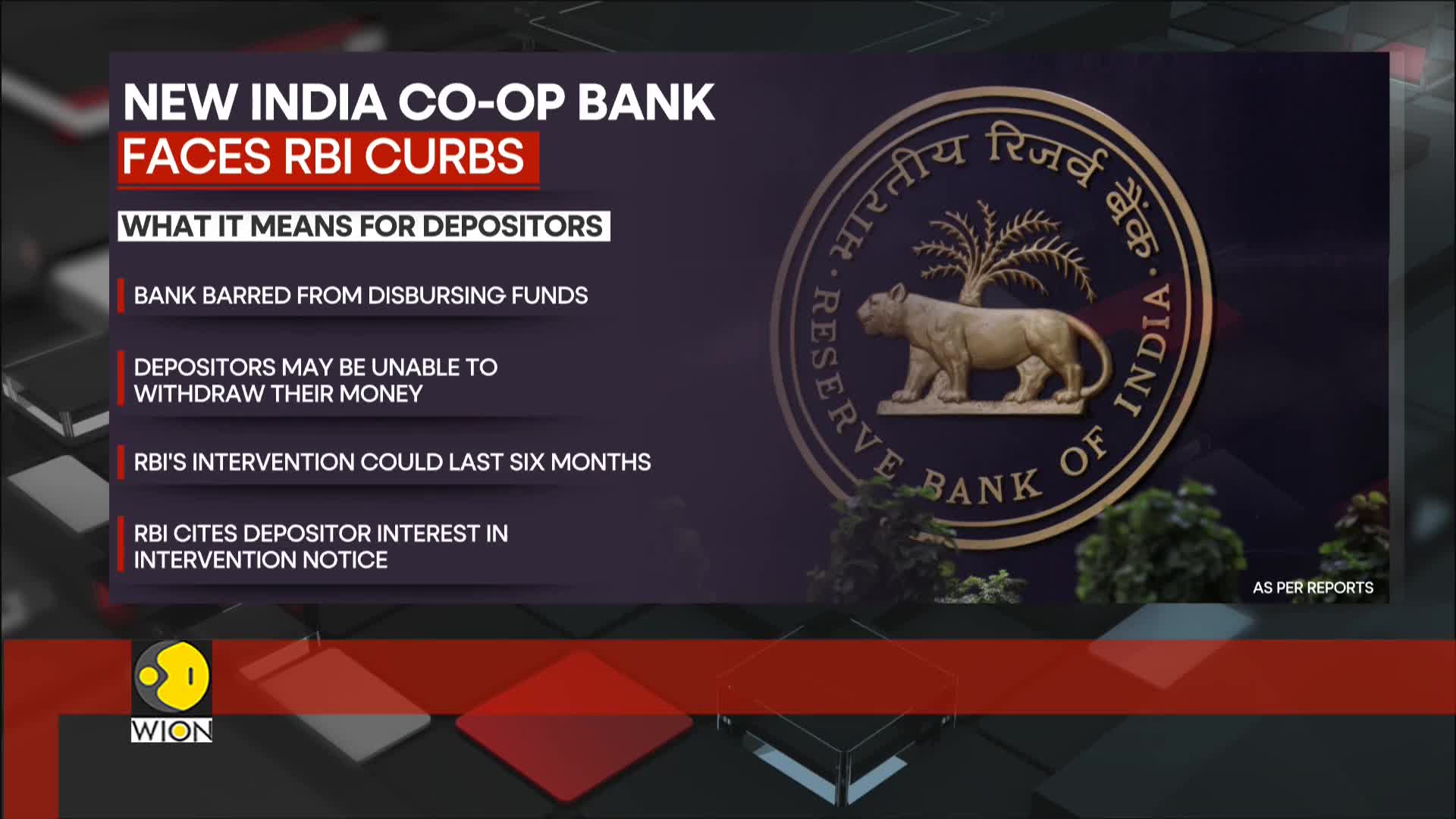

What restrictions has the RBI imposed on the New India Cooperative Bank?

The RBI has imposed restrictions on the New India Cooperative Bank effective from February 13, which will remain in place for six months pending review. The central bank cited material developments as the reason for this intervention, with the primary aim of protecting depositor interests and ensuring financial stability. During this period, the bank is prevented from disbursing funds, which has caused concern among depositors who have been lining up outside bank branches worried about accessing their savings. This regulatory action highlights the RBI's role in maintaining stability in the cooperative banking sector.

Watch clip answer (00:13m)How are depositors affected by the RBI's restrictions on New India Cooperative Bank?

Depositors are experiencing immediate financial distress due to their inability to access funds following RBI's restrictions on New India Cooperative Bank. With monthly interest payments and daily expenses to manage, many account holders face severe financial hardship as they cannot withdraw their money beyond the imposed limits. The bank's deteriorating financial health, which has been under significant pressure, has directly impacted customers who rely on these funds for their everyday needs. This situation highlights the vulnerability of depositors when regulatory actions are taken against struggling cooperative banks, leaving many in precarious financial circumstances.

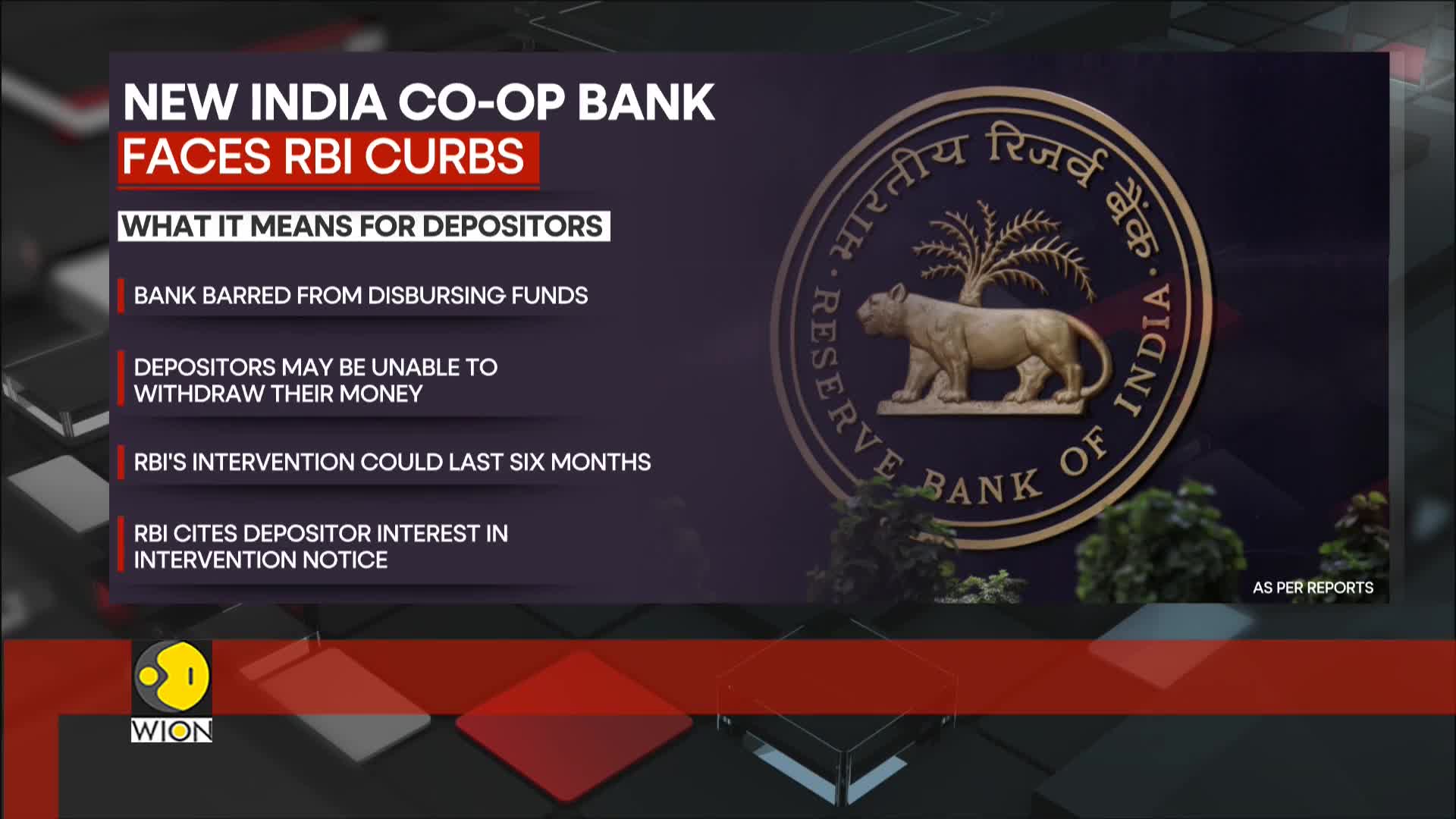

Watch clip answer (00:11m)What restrictions has the Reserve Bank of India imposed on New India Cooperative Bank and why?

The Reserve Bank of India has imposed strict restrictions on Mumbai-based New India Cooperative Bank due to liquidity concerns. The bank has been barred from disbursing funds, which has left depositors unable to withdraw their money, causing commotion outside the bank branches. This intervention by India's central bank highlights the fragility of smaller financial institutions in emerging markets like India. The situation has created significant turbulence in India's banking sector as customers find themselves cut off from accessing their savings, demonstrating the vulnerabilities that exist within the country's cooperative banking system.

Watch clip answer (00:36m)How did customers react to the Reserve Bank of India's restrictions on New India Cooperative Bank?

Following the announcement of RBI restrictions on New India Cooperative Bank, customers immediately rushed to the bank's branches in a state of panic. They were primarily motivated by fears that their savings could be at risk due to the bank's liquidity issues. The restrictions, effective from February 13 for six months, have significantly impacted depositors who are now unable to access their savings. This situation highlights the vulnerability of smaller financial institutions in emerging markets and has created considerable anxiety among account holders who face financial uncertainty.

Watch clip answer (00:05m)Why did the Reserve Bank of India intervene with New India Cooperative Bank?

The Reserve Bank of India intervened with New India Cooperative Bank citing 'material developments' as the reason for their action. The central bank's primary aims were to protect depositor interests and ensure financial stability amid liquidity concerns at the bank. This intervention was implemented as a protective measure to safeguard customers' savings, though it triggered immediate panic among account holders. Following the announcement, customers rushed to bank branches fearing their savings were at risk, with many expressing frustration over the lack of prior warning about the situation.

Watch clip answer (00:18m)What regulatory action has the Reserve Bank of India taken against New India Cooperative Bank, and how has it affected depositors?

The Reserve Bank of India (RBI) has imposed regulatory curbs on New India Cooperative Bank due to supervisory concerns, creating significant disruption for the institution's operations. This regulatory intervention has directly impacted the bank's branches in Mumbai and Pune, where depositors are now experiencing difficulties accessing their funds. The RBI's supervisory action has triggered a funding panic among customers, as depositors face substantial issues when attempting to withdraw their deposits. This situation reflects broader concerns about the bank's financial stability and regulatory compliance, highlighting the central bank's role in maintaining banking sector integrity through decisive supervisory measures when institutions fail to meet required standards.

Watch clip answer (00:26m)