Banking Regulations

Banking regulations play a critical role in ensuring the stability and integrity of the financial system. These regulations are a set of rules and guidelines that govern the operations of banks and financial institutions, aimed at protecting consumers, maintaining confidence in the banking system, and preventing financial crimes. Recently, the landscape of banking compliance has evolved significantly, shaped by emerging technologies, heightened cybersecurity threats, and increasing emphasis on environmental, social, and governance (ESG) considerations. Understanding the latest financial regulations is essential for banks to navigate compliance requirements successfully and avoid potential penalties. The importance of banking regulations is underscored by key legislative frameworks, including the Bank Holding Company Act, the Dodd-Frank Act, and the Federal Deposit Insurance Act. These laws not only establish regulatory requirements but also influence how banks manage risks and governance structures. With the rapid rise of fintech and digital banking, regulatory bodies like the Federal Reserve and the Office of the Comptroller of the Currency (OCC) are focusing on new risk management strategies to address challenges unique to the digital landscape. As regulatory divergence becomes more prevalent across regions, it is paramount for banks to stay informed and agile in their compliance strategies, ensuring they meet both local and global regulatory standards. In summary, banking regulations are vital to maintaining financial stability and consumer protection. The evolving nature of these regulations requires banks to continuously adapt their governance and compliance frameworks, particularly in light of the challenges posed by technology and the increasing importance of ethical considerations in finance. Staying ahead of regulatory changes is crucial for banks aiming to maintain competitiveness and trust in an ever-changing environment.

What is the main concern regarding the Consumer Financial Protection Bureau (CFPB) funding structure?

According to Ben Shapiro, the primary concern with the CFPB is that it operates independently from congressional funding oversight. As Shapiro points out, the bureau "would have no mandate to protect the safety and soundness of the financial institutions it regulates" and "would not rely on Congress for funding." This independence from Congress creates a situation where the CFPB lacks proper accountability mechanisms, potentially leading to an unregulated financial regulatory body. The funding structure essentially allows the bureau to operate outside the normal checks and balances that apply to other government agencies, raising questions about its effectiveness and constitutional legitimacy.

Watch clip answer (00:05m)Why are Elon Musk and Russ Vought trying to dismantle the Consumer Financial Protection Bureau?

According to Elizabeth Warren, Musk and Vought's efforts to eliminate the CFPB represent a payoff to wealthy donors who invested in Trump's campaign. Despite Trump campaigning on helping working people, Warren suggests this move would benefit rich supporters who want to operate without regulatory oversight. If successful, this dismantling would allow CEOs and Wall Street to 'trick, trap and cheat' consumers by removing the agency designed to protect them in financial matters. Warren characterizes this as a scam that prioritizes wealthy interests over consumer protections.

Watch clip answer (00:44m)What were some of Kamala Harris's notable actions as California's Attorney General?

As California's Attorney General, Kamala Harris fought against the death penalty and took on big banks following the 2008 housing crisis, securing $18 billion in relief for California homeowners. She also won a billion dollars for victims of predatory for-profit universities, specifically Corinthian Colleges that took advantage of Californians seeking to achieve the American dream. Perhaps her most nationally recognized moment came when she directed the clerk of Los Angeles to begin issuing marriage licenses to same-sex couples during the contentious debate around Proposition 8, which challenged the legality of gay marriage. These actions demonstrated her commitment to criminal justice reform, consumer protection, and civil rights.

Watch clip answer (00:45m)How did customers react to the RBI's restrictions on New India Cooperative Bank?

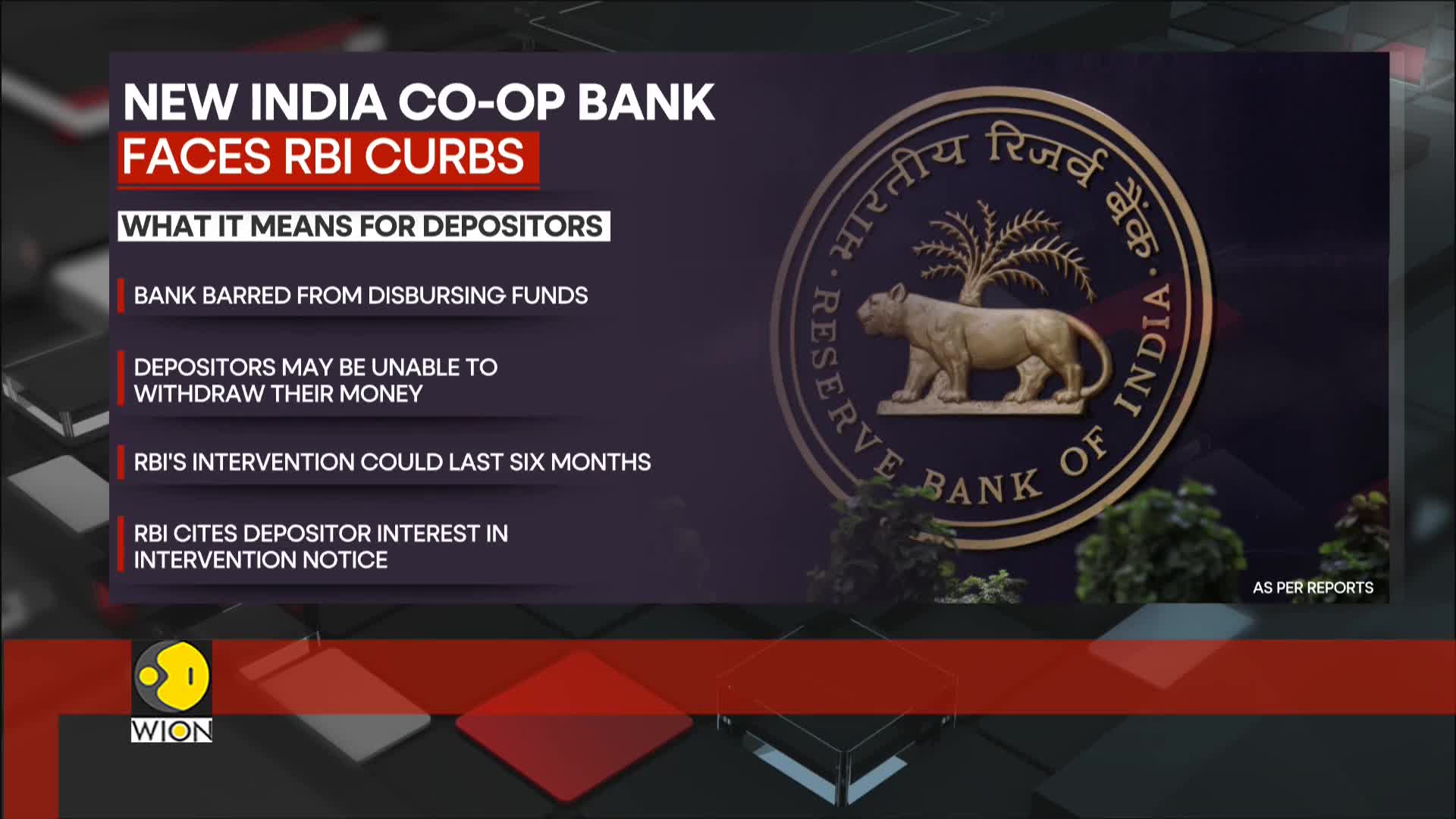

Following the announcement of restrictions by the Reserve Bank of India, customers rushed to New India Cooperative Bank's branches in panic, fearing their savings were at risk. Many depositors expressed frustration over the lack of prior warning about these limitations. The situation created immediate financial distress for customers who depend on regular access to their funds for monthly interest payments and daily expenses. This reaction highlights the vulnerability of depositors in smaller financial institutions when regulatory actions are implemented suddenly.

Watch clip answer (00:17m)What challenges are depositors facing due to the RBI restrictions on New India Cooperative Bank?

Depositors are experiencing significant financial distress due to the sudden RBI restrictions on New India Cooperative Bank. Many have expressed frustration over the lack of prior warning from the bank, leaving them unprepared for the fund disbursement limitations imposed for six months. With monthly interest payments and daily expenses to manage, customers face immediate financial hardship as they can't access their savings. The situation is particularly concerning because the bank's financial health has been under substantial pressure, yet depositors weren't adequately informed before the restrictions took effect.

Watch clip answer (00:15m)What restrictions has the Reserve Bank of India imposed on the New India Cooperative Bank and how are depositors affected?

The Reserve Bank of India has imposed strict restrictions on the Mumbai-based New India Cooperative Bank due to liquidity concerns. The bank has been barred from disbursing funds, which has left depositors unable to withdraw their money, causing commotion outside bank branches as worried customers seek access to their savings. This regulatory action highlights the fragility of smaller financial institutions in emerging markets like India. The situation underscores the challenges faced by depositors when banking institutions face liquidity issues, leaving them in financial limbo until the restrictions are lifted or alternative arrangements are made.

Watch clip answer (00:36m)