Banking Industry

The banking industry is currently experiencing a transformative period shaped by rapid technological advancements and evolving consumer expectations. Digital banking has emerged as a prominent feature of this sector, enabling financial institutions to offer more efficient services at lower costs. With the rise of digital-only banks, traditional banks are adapting by enhancing their own digital services or partnering with fintech companies. Moreover, the integration of artificial intelligence (AI) and automation into banking operations is revolutionizing customer service, fraud detection, and risk management, enabling banks to provide personalized financial advice and improve operational efficiency. In recent months, banks have been focusing on stimulating loan growth to increase net interest income amid stabilizing economic conditions. This trend is expected to drive a 6% increase in loan volume as banks address challenges like compliance with Environmental, Social, and Governance (ESG) standards and enhancing cybersecurity measures. Additionally, the landscape for investment services is evolving, with banks adjusting to fluctuating interest rates and navigating regulatory uncertainties that may affect mergers and acquisitions (M&A) activities in the future. As the industry continues to adapt to both opportunities and challenges, it remains critical for banks to balance innovation with compliance and risk management to maintain competitiveness in a fast-evolving financial environment.

How has the career path for MBA graduates changed over the years?

The career landscape for MBA graduates has shifted dramatically. While 10-15 years ago Wall Street and investment banking were the dominant paths for MBAs, today's graduates are increasingly choosing consulting careers instead. According to Dimitri, consulting has become the biggest industry for MBA students, offering opportunities to analyze financials, manage risks, and work on special projects for various companies. This shift reflects changing priorities among business graduates, with many no longer interested in traditional Wall Street careers. Notably, MBA graduates are now earning more money in consulting and technology fields than in traditional finance roles.

Watch clip answer (01:14m)What reforms are needed to support Small and Medium-sized Enterprises (SMEs) in Europe?

Europe needs comprehensive reforms to support SMEs, which are the engines of growth, particularly in countries like Spain and Italy. First, labor and fiscal reforms are essential foundations. More critically, Europe's financial structure must change - currently, 70% of corporate funding comes from banks (versus 30% from capital markets), the opposite of the U.S. model. This bank dependency creates vulnerability when banks delever or face capital problems. To address this, Madeline Antonik proposes two key solutions: having the European Central Bank (ECB) accept SME loans as collateral, and reopening the securitization market for SMEs. These measures would help restore capital flow to these vital businesses, enabling job creation and economic growth even as Europe's banks face ongoing challenges.

Watch clip answer (01:38m)Why should investors buy gold and gold mining stocks now instead of waiting for pullbacks?

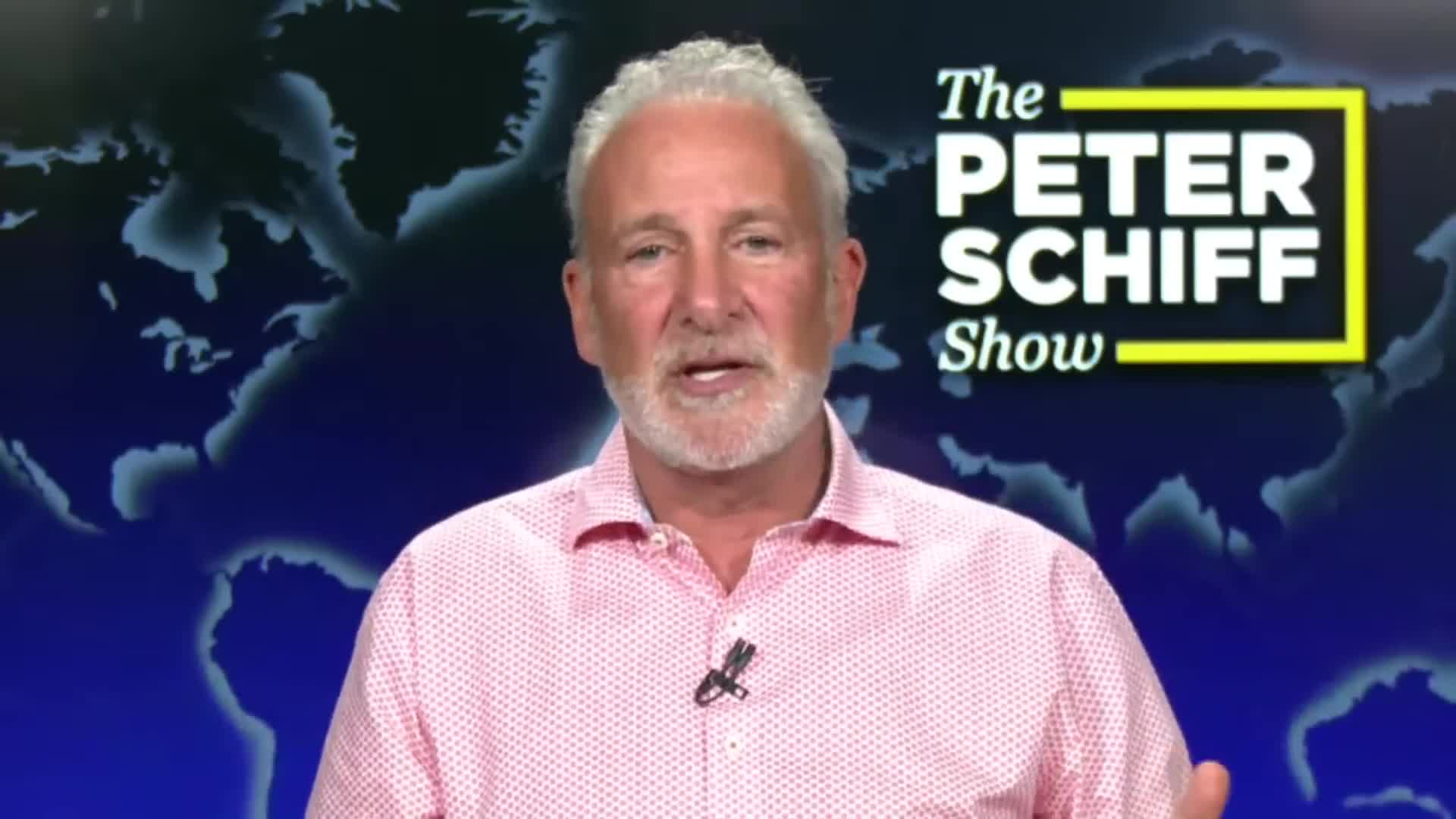

Peter Schiff advises investors not to wait for pullbacks in gold prices, emphasizing that pullbacks will likely be quick and shallow. He notes that gold has reached new highs ($2,204 per ounce) and predicts gold mining stocks could explode higher by 10-20% in a single day as the market recognizes the Fed's inevitable rate cuts. Schiff argues that rate cuts are coming not because inflation is defeated, but because the country is broke and facing potential financial and banking crises. This environment creates a strong bullish case for precious metals as inflation will continue. His key message is clear: the sooner investors buy gold and silver, the cheaper it will be, as these assets have a long upward trajectory ahead.

Watch clip answer (01:45m)Do you think the S&P 500 is a sell at its current record high, particularly with the upcoming election?

No, Leon Cooperman doesn't believe the S&P 500 is a sell at its current level. He notes that conditions typically preceding market downturns (recession, accelerating inflation, hostile Fed, geopolitical events) are not present. The market appears stable with consumer confidence high, strong retail sales and employment, and decent corporate profits. Cooperman does express concern about two factors: the alarming rate of debt buildup in the country and the political shift to the left. He's also worried about market structure changes, including the elimination of the uptick rule and reduced stabilizing forces. Despite these concerns, he believes the market is 'okay' for the near future.

Watch clip answer (02:51m)How has debt shifted from banks to fund management in recent years?

From 2009 to 2016, a significant shift occurred in the management of corporate and foreign debt. Direct household investments in debt decreased from 22% to 8.6%, while fund-managed investments increased from 8.5% to 18.3%. This transfer was driven by monetary policies and regulatory constraints on banks to hold more liquid assets and less corporate debt, especially lower-rated debt. This migration of debt investments from banks to funds has created critical interconnections between these financial entities. The shift makes it increasingly important to understand the relationships between banks and non-banks, including exposure through credit lines, derivatives transactions, and overlapping portfolio holdings. This evolving landscape requires continual risk evaluation and adaptive regulatory approaches.

Watch clip answer (03:57m)What is the significance of the Capital One and Discover merger?

The merger represents a significant consolidation in the financial sector, with shareholders recently approving a $35 billion deal between Capital One and Discover. Upon completion, this strategic combination will transform Capital One into the largest credit card issuer in the United States, marking a pivotal shift in the credit card industry landscape. This development is noteworthy not just for the companies involved but potentially for consumers as well. As the merged entity gains increased market share and greater economies of scale, it may lead to expanded payment access options and possibly lower interest rates for credit card users.

Watch clip answer (00:12m)