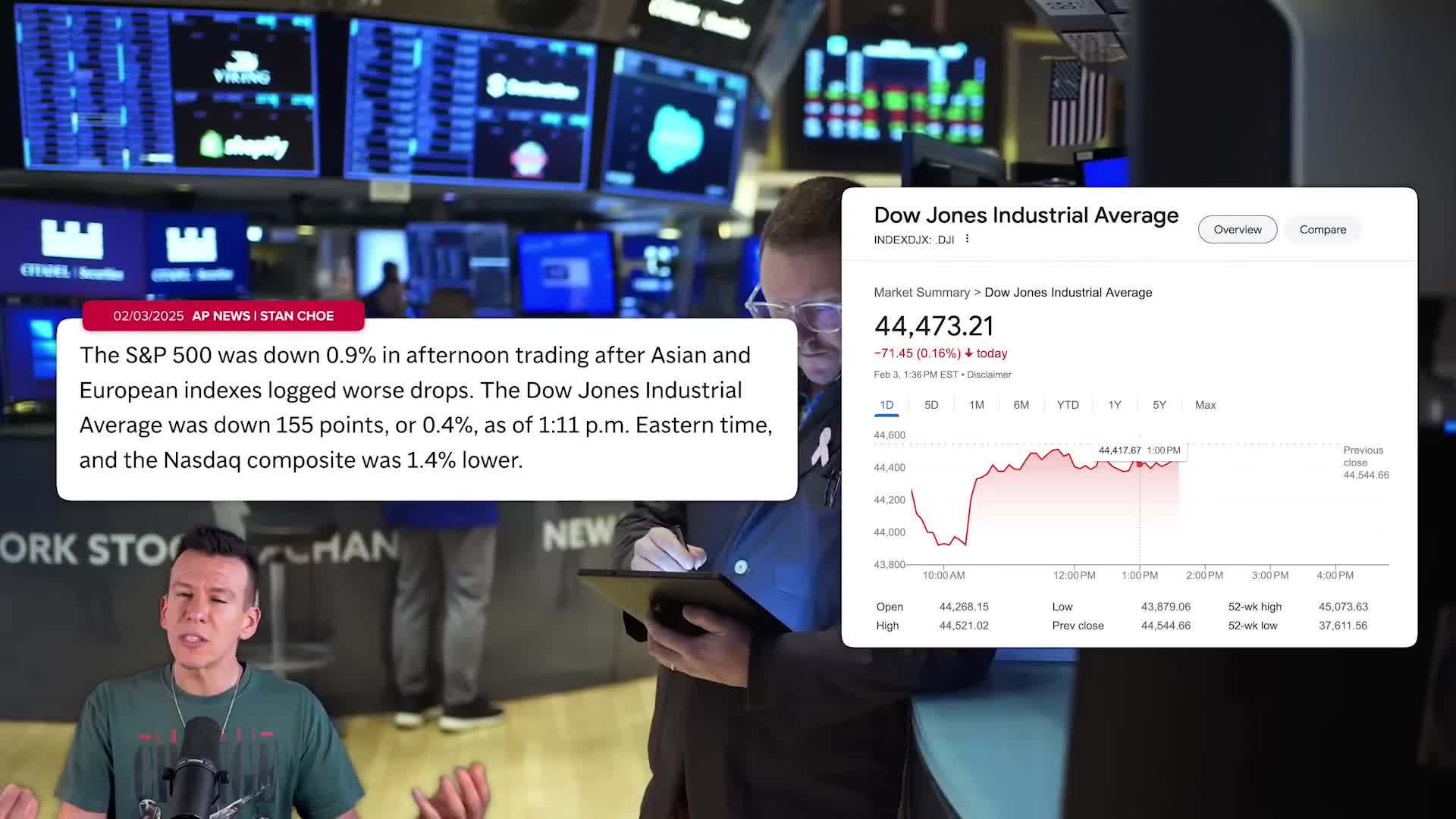

Trade Deficit

How do Trump's 25% tariffs on Chinese imports protect American automakers?

Trump's 25% tariff on Chinese imports protects American automakers by reducing the price gap between Chinese and American vehicles. By adding approximately $8,750 to a $35,000 Chinese car (making it $43,750), the tariff narrows the difference with American-made vehicles (priced around $45,000) to only $1,250. This smaller price gap gives American manufacturers a much better chance to compete against Chinese imports. The tariff strategy aims to prevent China from flooding the US market with cheaper vehicles, ultimately helping to preserve American manufacturing jobs and domestic production capacity in the automotive sector.

Watch clip answer (00:31m)How is Canada responding to recent U.S. trade actions?

Canadian Prime Minister Justin Trudeau announced retaliatory measures against U.S. trade actions, implementing 25% tariffs on $155 billion worth of American goods. The plan includes immediate tariffs on $30 billion worth of products, followed by additional tariffs on $125 billion in goods after 21 days to allow Canadian companies to find alternatives. While implementing these protective economic measures, Trudeau emphasized the historically strong partnership between the U.S. and Canada, highlighting their successful economic, military, and security relationship that has been 'the envy of the world.'

Watch clip answer (03:13m)What is Donald Trump's strategy for attracting foreign investment through auto tariffs?

Donald Trump's strategy involves implementing an auto tariff (likely around 25%) on foreign companies that could increase significantly throughout the year. However, the key element is that foreign manufacturers who establish plants or factories within the United States would be exempt from these tariffs entirely. This approach is designed to give foreign companies time and incentive to relocate their manufacturing operations to American soil. As Trump states, "when they come into the United States and they have their plant or factory here, there is no tariff." The policy aims to boost domestic manufacturing and create American jobs while giving foreign companies a reasonable transition period.

Watch clip answer (00:10m)Why is the US government's $21 million USAID funding for voter turnout in India being questioned?

The $21 million USAID funding for voter turnout in India is being questioned because India is perceived as having sufficient financial resources of its own. The speaker points out that India is one of the highest taxing countries in the world and has 'a lot of money,' suggesting that external financial aid for voter turnout is unnecessary. Another concern highlighted is the trade relationship between the US and India, with the speaker noting that high Indian tariffs make it difficult for US businesses to enter the Indian market. This raises questions about providing financial aid to a country that maintains trade barriers against US interests.

Watch clip answer (00:15m)How has Sudan's sugar trade evolved over time?

Sudan has long been importing sugar from countries like Brazil and Cuba, even when its local factories were operational. However, in recent years, the country's strategy shifted significantly. Sudan began trading its raw sugar for larger quantities of refined white sugar from countries like India and other nations. This trade evolution represents a fundamental shift in priorities, essentially exchanging quality for quantity. The change reflects Sudan's adaptation to economic pressures and shifting market dynamics amid ongoing conflict and instability that has affected local production capabilities.

Watch clip answer (00:21m)What are the proposed tariff rates for autos, semiconductors, and pharmaceuticals?

President Trump indicates that the auto tariff rate will be around 25%, which he plans to officially announce on April 2. For semiconductors and pharmaceuticals, he states the tariffs will start at 25% and increase 'substantially higher over a course of a year.' Trump emphasizes that these tariffs will not apply to companies that manufacture within the United States. His policy aims to give foreign companies time to establish plants or factories in America, as he notes, 'when they come into the United States and they have their plant or factory here, there is no tariff.'

Watch clip answer (00:34m)