Taxpayer Relief

What new accountability measures has the Treasury Department implemented to improve financial transparency?

The Treasury Department has implemented new tracking systems that require identification on payments, addressing a previous lack of transparency. Before this change, trillions of dollars could be disbursed without names or identifiers. This accountability measure ensures that under the current administration, when money is earmarked by the Treasury, there will be clear tracking of where funds go. The initiative aims to combat potential fraud by bureaucrats who might be funneling money to NGOs or accumulating personal wealth disproportionate to their government salaries. This represents a critical step toward ensuring taxpayer money is properly tracked and spent responsibly.

Watch clip answer (00:51m)Why are the current budget cuts considered high risk and low reward?

The current budget cuts are considered high risk and low reward because they won't make a substantial impact on reducing the deficit or paying for Trump's proposed tax cuts. According to the analysis, these cuts fail to address the major drivers of national debt, which are defense spending, Medicare, Medicaid, Social Security, and interest on the debt—comprising 85% of the federal budget. Instead of targeting these significant expenditures, the administration is focusing on relatively minor areas, creating risk for vulnerable populations while producing minimal financial benefit. The deficit reduction achieved through these cuts doesn't even come close to covering the daily interest payments incurred from tax cuts, making the strategy economically ineffective while potentially harming essential services.

Watch clip answer (00:59m)How are the recent government cuts under Trump and Musk affecting Americans?

The government cuts are impacting essential services and functions that affect all Americans regardless of political affiliation. As described by Garrett Hake, these cuts involve people's livelihoods and key government functions, with rising concerns that these actions are not making the country safer. According to Mara Gay, there is minimal transparency in how this 'slashing and burning' is being implemented, suggesting these cuts are primarily designed to prepare for Trump's tax cuts for the wealthy rather than improving government efficiency.

Watch clip answer (00:55m)How will government cuts impact ordinary Americans beyond Washington?

The government cuts will impact ordinary Americans in profound ways beyond just affecting federal workers in Washington. These changes directly threaten essential services that citizens depend on daily, including tax processing through the IRS and Social Security benefits. As Mara Gay emphasizes, 'Nothing is secure right now.' The real consequences extend into people's financial security, affecting tax returns and social safety nets that millions rely upon. This situation creates uncertainty for citizens who may not yet realize how these changes will transform their lives in ways they cannot currently anticipate.

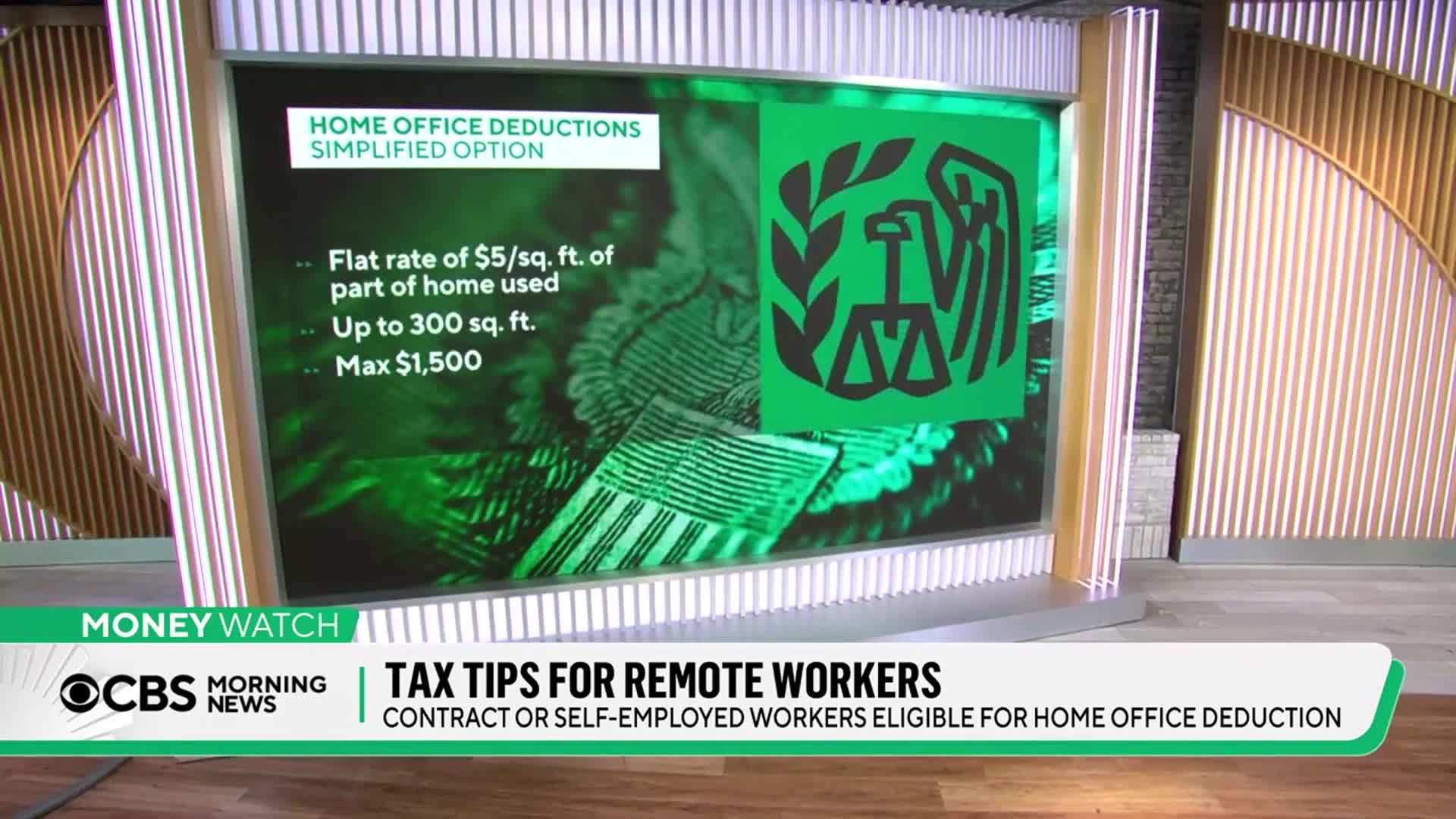

Watch clip answer (00:16m)What health insurance deductions are available for self-employed individuals?

Self-employed individuals who purchase their own health insurance can deduct all health insurance premiums not only for themselves, but also for their spouse and children. This is a significant tax benefit that helps offset the cost of obtaining private health coverage when you don't have employer-sponsored insurance. To properly claim this deduction, meticulous record-keeping is essential. Self-employed taxpayers must maintain organized documentation and save all receipts related to their health insurance premium payments. Unlike traditional employees who lost the ability to deduct unreimbursed expenses after the 2018 tax reforms, self-employed individuals retain this valuable tax advantage.

Watch clip answer (00:18m)What is the major source of government waste and fraud in the US taxpayer system?

According to the clip, foreign nationals using fake Social Security numbers and identities are stealing billions in taxpayer benefits. This organized fraud is occurring across multiple agencies including the FDA, Medicare, and Medicaid. The commentator suggests that by addressing this massive fraud in tax and entitlement systems, the government could potentially save over a trillion dollars over a 10-year budget window. Meanwhile, the Biden administration has focused on hiring 87,000 IRS agents rather than tackling these systemic issues.

Watch clip answer (00:48m)