Tax Filing Deadlines

Can remote workers claim home office tax deductions?

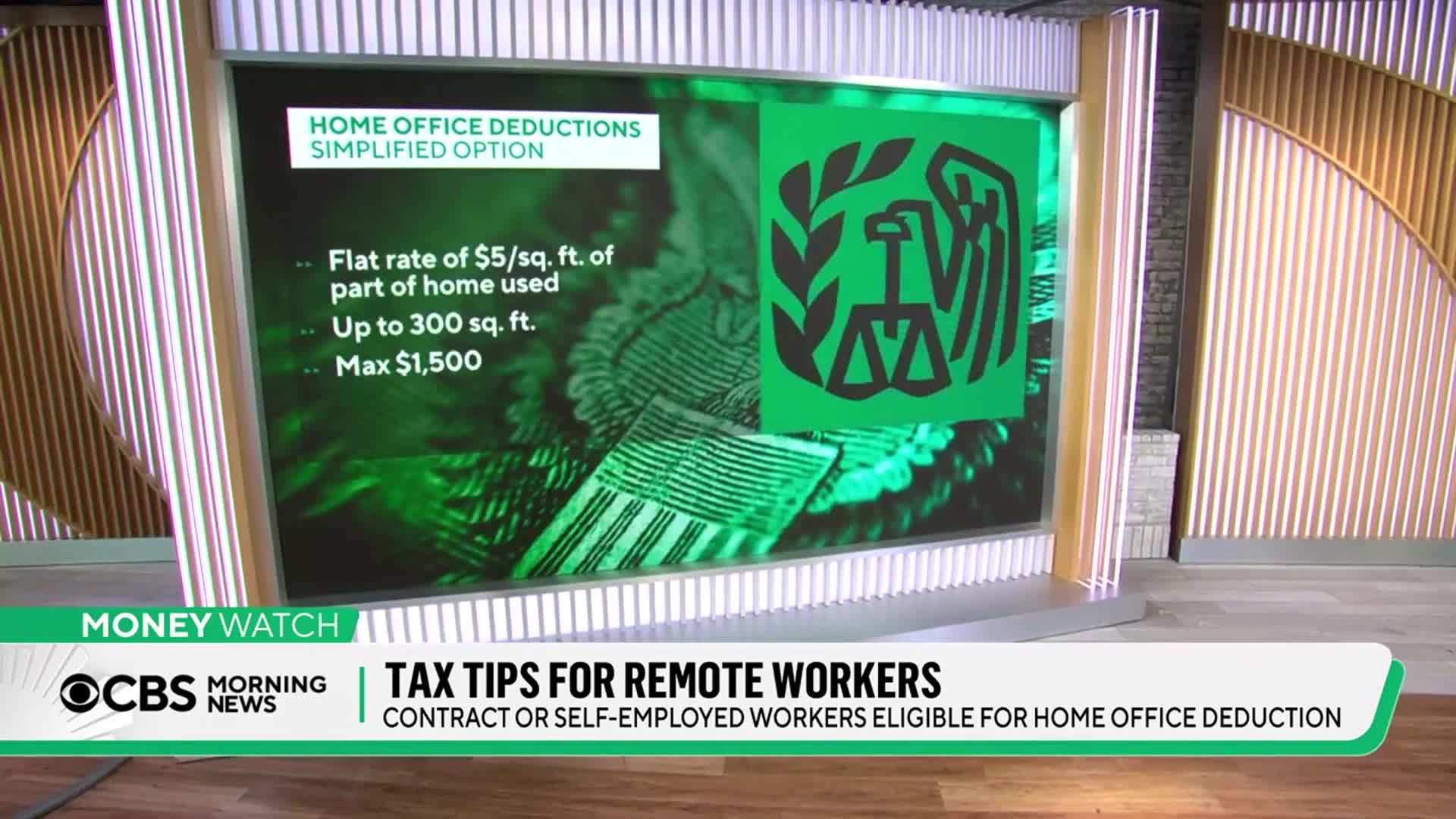

Since the 2018 tax reforms, most remote workers cannot claim deductions for unreimbursed expenses or home office costs. This change significantly impacts employees working from home who might have previously expected to receive tax benefits for their home workspace arrangements. While many remote workers may be considering office deductions as tax season approaches, the current tax code restricts these benefits, regardless of whether you're working from your couch, bed, or a dedicated home office space as an employee. Self-employed individuals, however, may still qualify for certain home office deductions under different rules.

Watch clip answer (00:17m)