Tariffs

What is the current state of Japan's economy and what challenges does it face?

Japanese trade data indicates a modest economic recovery is underway in the current quarter, highlighted by a significant jump in exports. This positive trend represents an important step in Japan's economic revitalization efforts. However, this recovery faces substantial challenges, particularly from potential US tariffs that are clouding the economic outlook. These looming trade restrictions could undermine export growth, which has been a key driver of Japan's current economic improvement, creating uncertainty in Japan's path toward sustained economic stability.

Watch clip answer (00:14m)What does the decline in homebuilder sentiment mean for the housing market and potential homebuyers?

The decline in homebuilder sentiment to a five-month low indicates that builders lack incentive to construct more houses, resulting in an even tighter housing supply. This sentiment index measures current sales, buyer traffic, and expected sales over the next six months—all of which are declining. For potential homebuyers, this creates a challenging market with persistently high interest rates and elevated prices. The situation is particularly problematic because increased housing supply is the key solution to high prices, but this reading suggests supply will remain constrained in the near future, further limiting options for those looking to purchase homes.

Watch clip answer (00:49m)What does the decline in homebuilder sentiment mean for the housing market and potential home buyers?

The drop in homebuilder sentiment to a five-month low indicates that homebuilders don't see incentives to build more houses, resulting in even less supply in an already constrained market. This directly impacts potential home buyers who are facing a triple challenge: high interest rates that aren't expected to decrease soon, persistently high prices, and now a further reduction in housing supply. The homebuilder sentiment index, which measures current sales, buyer traffic, and future sales expectations, suggests that supply relief isn't coming anytime soon, leaving the housing market in a difficult position where the only solution - increased supply - appears increasingly unlikely.

Watch clip answer (00:45m)How have US and EU tariffs impacted Chinese electric vehicle exports?

Under the Biden administration, the US increased tariffs on Chinese EVs to 100%, while President Trump recently announced an additional 10% levy on Chinese goods. These actions create significant barriers for Chinese electric vehicle manufacturers seeking to enter the American market. Similarly, after investigating subsidization in China's automotive industry, the European Union imposed taxes of up to 35% on Chinese EVs. These combined trade measures from major Western economies represent substantial challenges for Chinese EV manufacturers like Zeekr, forcing them to reconsider their export strategies and potentially focus on alternative markets in regions like Australia and Southeast Asia.

Watch clip answer (00:24m)How have exports affected China's economy despite challenges?

Despite various challenges, exports have emerged as a bright spot for China's economy recently. This positive performance has been bolstered by a strategic approach of deliberately reducing dependence on the US Market. As Jessica Washington reports, this export-driven growth has allowed China to maintain economic momentum even as it faces trade tensions and tariffs, particularly in sectors like electric vehicles. By diversifying its international customer base and targeting markets in regions like Australia, Singapore, Malaysia, and the Middle East, China has created a more resilient export economy.

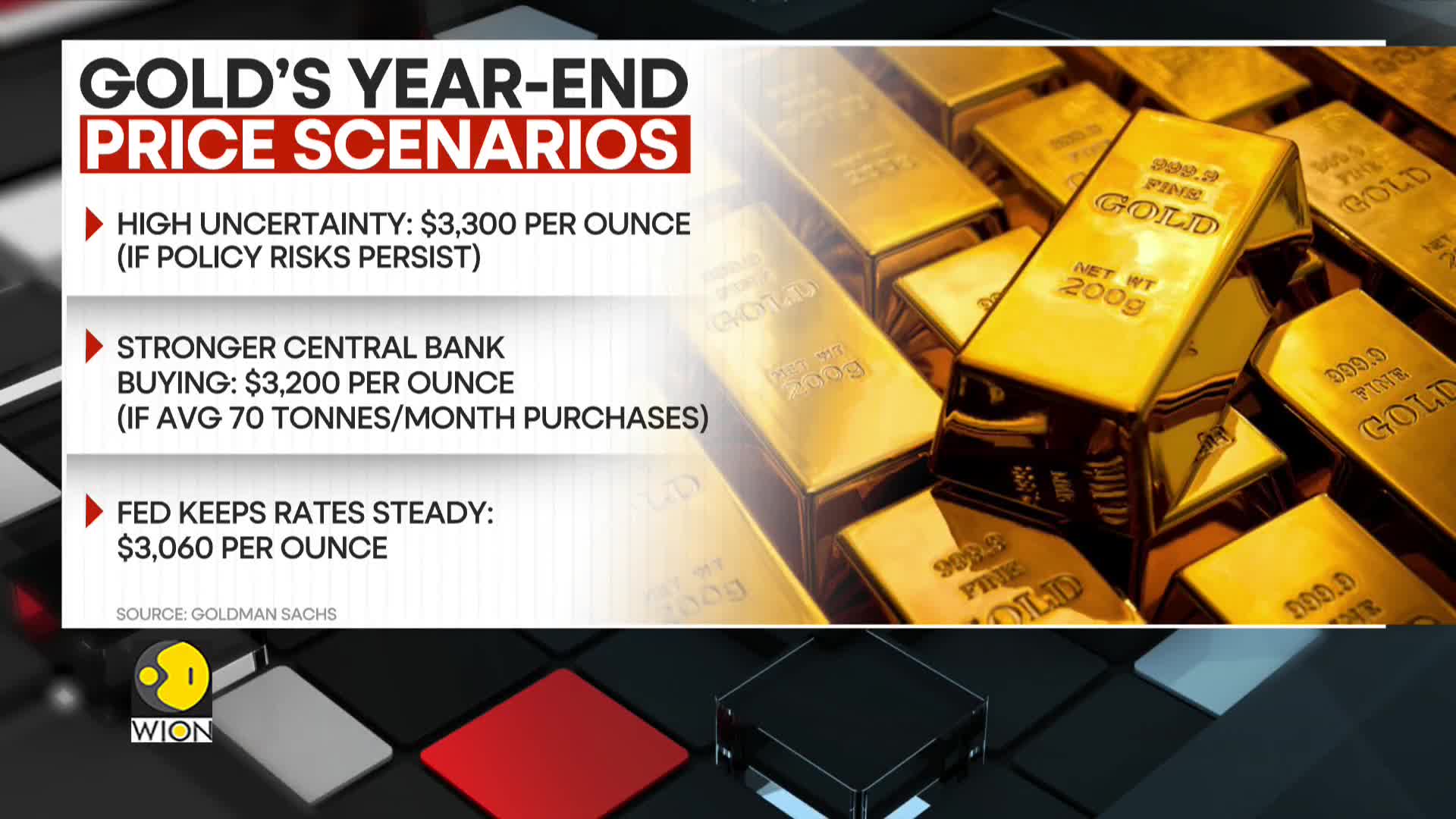

Watch clip answer (00:08m)What is Goldman Sachs' forecast for gold prices by the end of 2025?

According to Goldman Sachs, gold prices could potentially surge to $3,300 per ounce by the end of the year, primarily driven by ongoing high uncertainty in the financial markets. This bullish forecast is specifically influenced by concerns regarding tariffs and monetary policy risks that are expected to persist. The investment bank believes that prolonged economic and policy uncertainties will create favorable conditions for gold's appreciation as investors seek safe-haven assets. This projection represents a significant potential upside from current gold prices as the precious metal continues to be viewed as a hedge against financial instability.

Watch clip answer (00:14m)