Tariffs

How does Donald Trump plan to address trade imbalances with countries that charge high tariffs on US goods?

Trump plans to implement reciprocal but discounted tariffs against countries charging high rates to the US. For example, against China's 67% tariff, Trump would charge 34%; against the EU's 39%, he would charge 20%; and against Vietnam's 90%, he would implement a 46% tariff. This approach applies to numerous countries including Japan (24% instead of 46%) and Cambodia (49% instead of 97%). Trump emphasizes that his administration would consistently charge less than what other nations impose on the US, creating what he considers a fairer trade balance.

Watch clip answer (04:42m)Will Donald Trump's tariffs reignite the auto industry in the United States?

According to the political commentator, Trump's belief that tariffs will revitalize the American auto industry is misguided. The commentator emphatically states that the declaration of tariffs will not achieve this goal, noting that even the Secretary of Commerce cannot justify these measures. The speaker characterizes Trump's approach as having an 'absurdity' to it and warns that the current direction will 'break this economy.' Instead, the commentator suggests that Republicans' political fortunes depend on maintaining a 'white hot economy,' implying that tariffs would be counterproductive to economic growth and the auto industry's recovery.

Watch clip answer (00:30m)How do Trump's 25% tariffs on Chinese imports protect American automakers?

Trump's 25% tariff on Chinese imports protects American automakers by reducing the price gap between Chinese and American vehicles. By adding approximately $8,750 to a $35,000 Chinese car (making it $43,750), the tariff narrows the difference with American-made vehicles (priced around $45,000) to only $1,250. This smaller price gap gives American manufacturers a much better chance to compete against Chinese imports. The tariff strategy aims to prevent China from flooding the US market with cheaper vehicles, ultimately helping to preserve American manufacturing jobs and domestic production capacity in the automotive sector.

Watch clip answer (00:31m)How would Donald Trump's 25% tariff on Chinese cars help protect American automakers?

Trump's 25% tariff on Chinese cars would significantly reduce the price gap between American and Chinese vehicles. For example, a $35,000 Chinese car would face an $8,750 tariff, bringing its price to $43,750, compared to an American car at $45,000 - creating only a $1,250 difference between them. This narrowed price difference gives American manufacturers a much better chance to compete against Chinese imports, as the tariff effectively equalizes the market conditions. The policy helps sustain American manufacturing jobs and prevents China from flooding the US market with cheaper vehicles, illustrating how tariffs are designed to protect domestic industries.

Watch clip answer (00:52m)How is Canada responding to recent U.S. trade actions?

Canadian Prime Minister Justin Trudeau announced retaliatory measures against U.S. trade actions, implementing 25% tariffs on $155 billion worth of American goods. The plan includes immediate tariffs on $30 billion worth of products, followed by additional tariffs on $125 billion in goods after 21 days to allow Canadian companies to find alternatives. While implementing these protective economic measures, Trudeau emphasized the historically strong partnership between the U.S. and Canada, highlighting their successful economic, military, and security relationship that has been 'the envy of the world.'

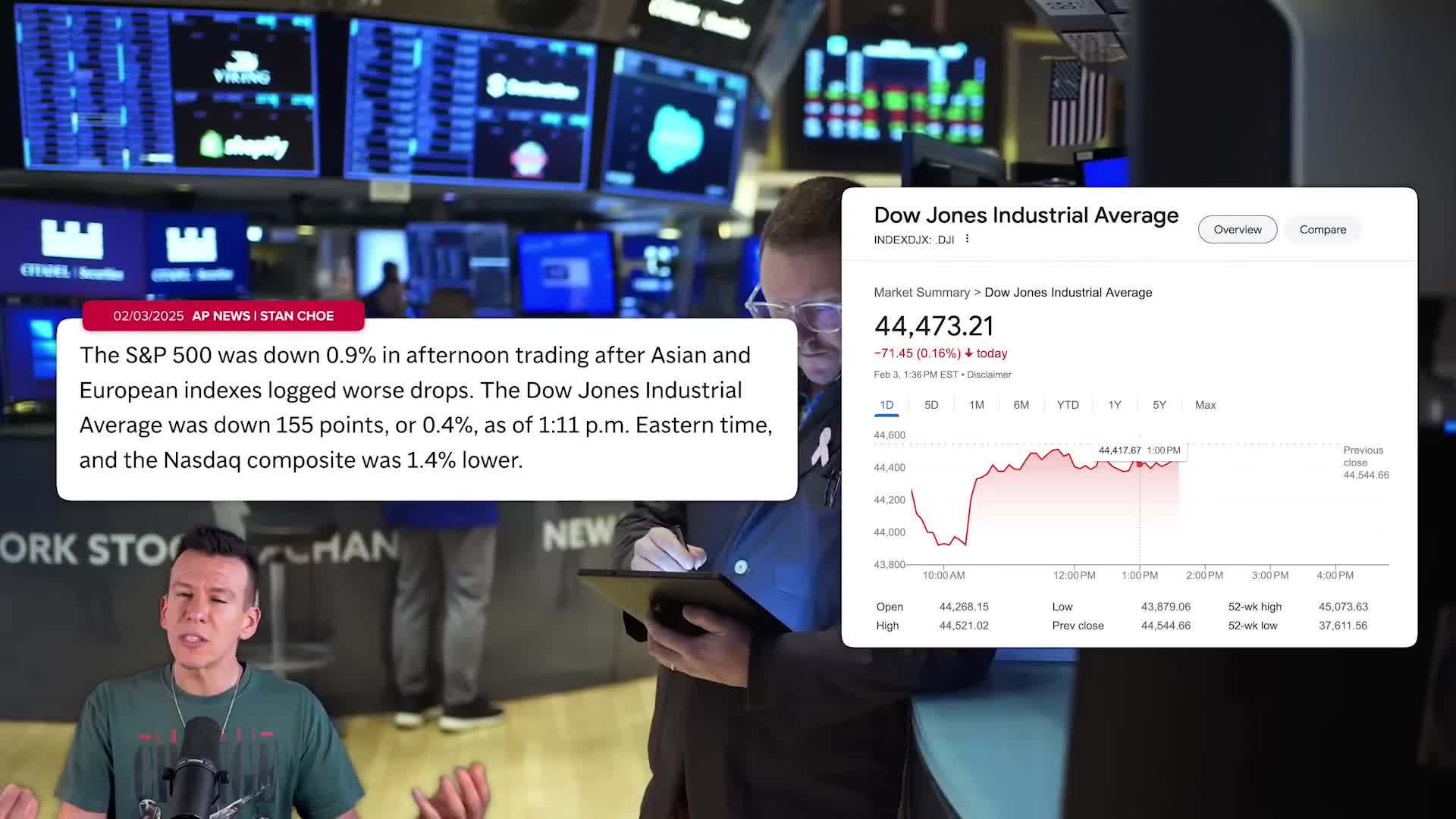

Watch clip answer (03:13m)How did the markets react to Trump's delay in tariff implementation?

The markets reacted very positively to the announcement that the tariff study wouldn't be completed until April 1, with tariffs potentially not being implemented until sometime after that date. This delay in the implementation of potential new tariffs was received as a relief by market participants. As Bill Cohan explains, this postponement gives businesses and investors more time to prepare and adjust strategies, reducing immediate economic uncertainty. The market's positive response indicates that concerns about tariffs' inflationary impact and potential disruption to global trade had been weighing on investor sentiment.

Watch clip answer (00:15m)