Small Business

How has the community responded to help Francis's Diner after the floods?

The community has rallied together to restore Francis's Diner, a beloved local fixture that was badly damaged by the recent Kentucky floods. When word got out that the diner was underwater, help immediately moved in, with local residents coming together to support the 84-year-old owner, Francis Napier. As one helper expressed, 'They always support us, so we're here to support them.' This act of reciprocity demonstrates how the community that Francis has fed and nurtured for over five decades is now returning the favor by rebuilding her namesake restaurant.

Watch clip answer (01:25m)How is the community in Kentucky responding to the recent floods?

In Kentucky, despite devastating floods that have upended lives, residents are coming together to support a beloved community member. The community is rallying around Francis's Diner in Hazard, a cherished local eatery that was badly damaged in the disaster. This collective effort demonstrates resilience and hope in the face of adversity. As described in the news segment, this community response is characteristic of Eastern Kentucky culture, with hope 'already simmering' as neighbors unite to help rebuild what was lost, showing how community spirit can persist even in challenging times.

Watch clip answer (00:21m)What are the local merchants' views on speedos being permitted in Cape May?

Despite the potential appeal to tourists, some local merchants in Cape May oppose speedos on the beach. One merchant, Lily, expresses concern about men wearing speedos around children and states she doesn't find them attractive or family-friendly, reflecting traditional community values. Meanwhile, local officials like Bob Steenrod see value in attracting an international crowd, suggesting a more progressive approach to beach attire. This highlights the tension between preserving Cape May's traditional family-friendly image and the desire to revitalize tourism by appealing to a more diverse, international audience.

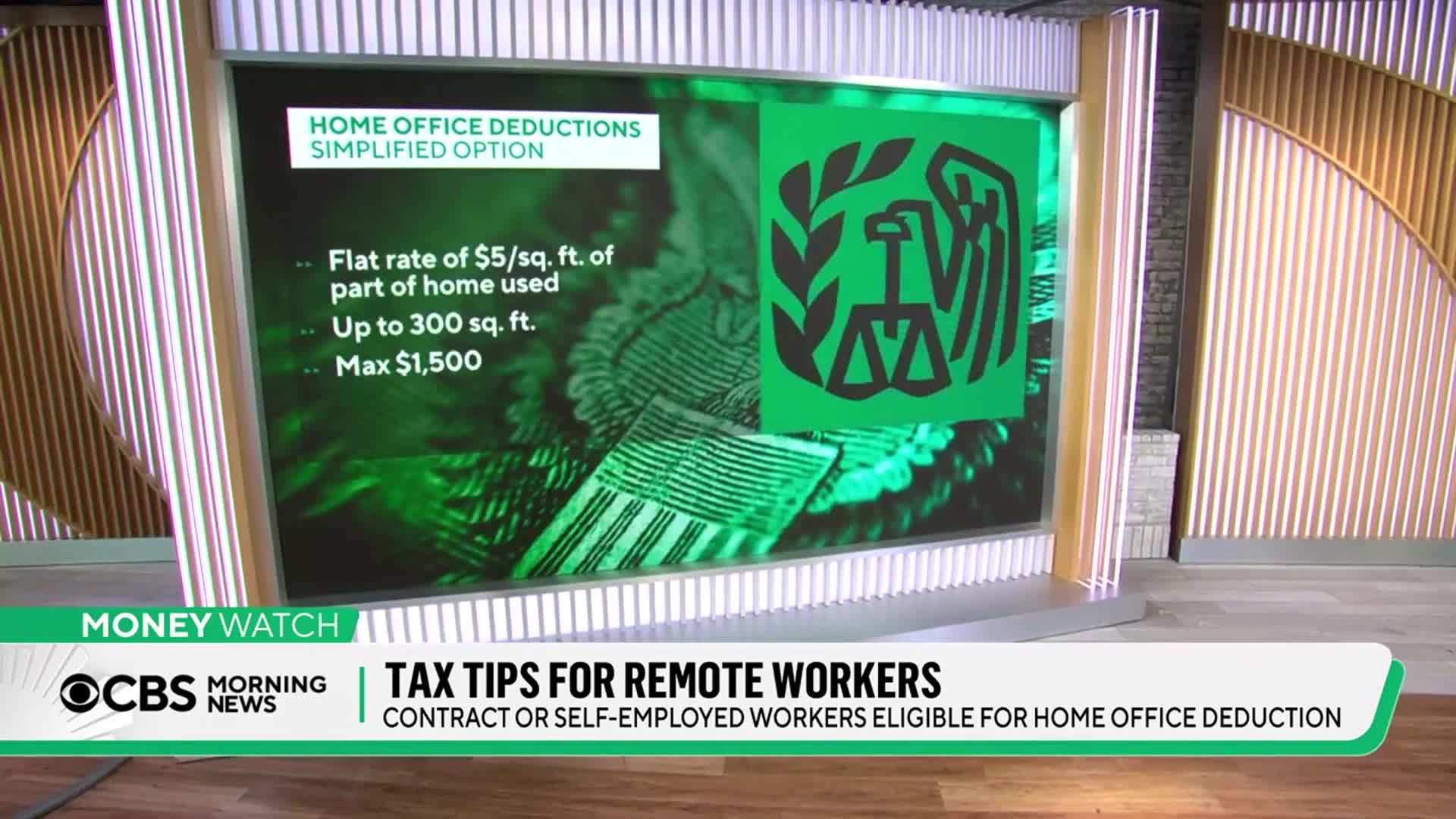

Watch clip answer (00:46m)What expenses can self-employed remote workers deduct from their taxes for a home office?

Self-employed remote workers can deduct much more than just basic office equipment. Beyond cell phones, laptops, printers and supplies, they can deduct a portion of their rent or mortgage, real estate taxes, homeowners insurance, and utilities based on the percentage of home used exclusively for business. For example, if 20% of your home serves exclusively as an office, you can deduct 20% of these housing-related expenses from your taxes. Proper documentation is essential when claiming these deductions, as all expenses must be thoroughly recorded to support your tax claims.

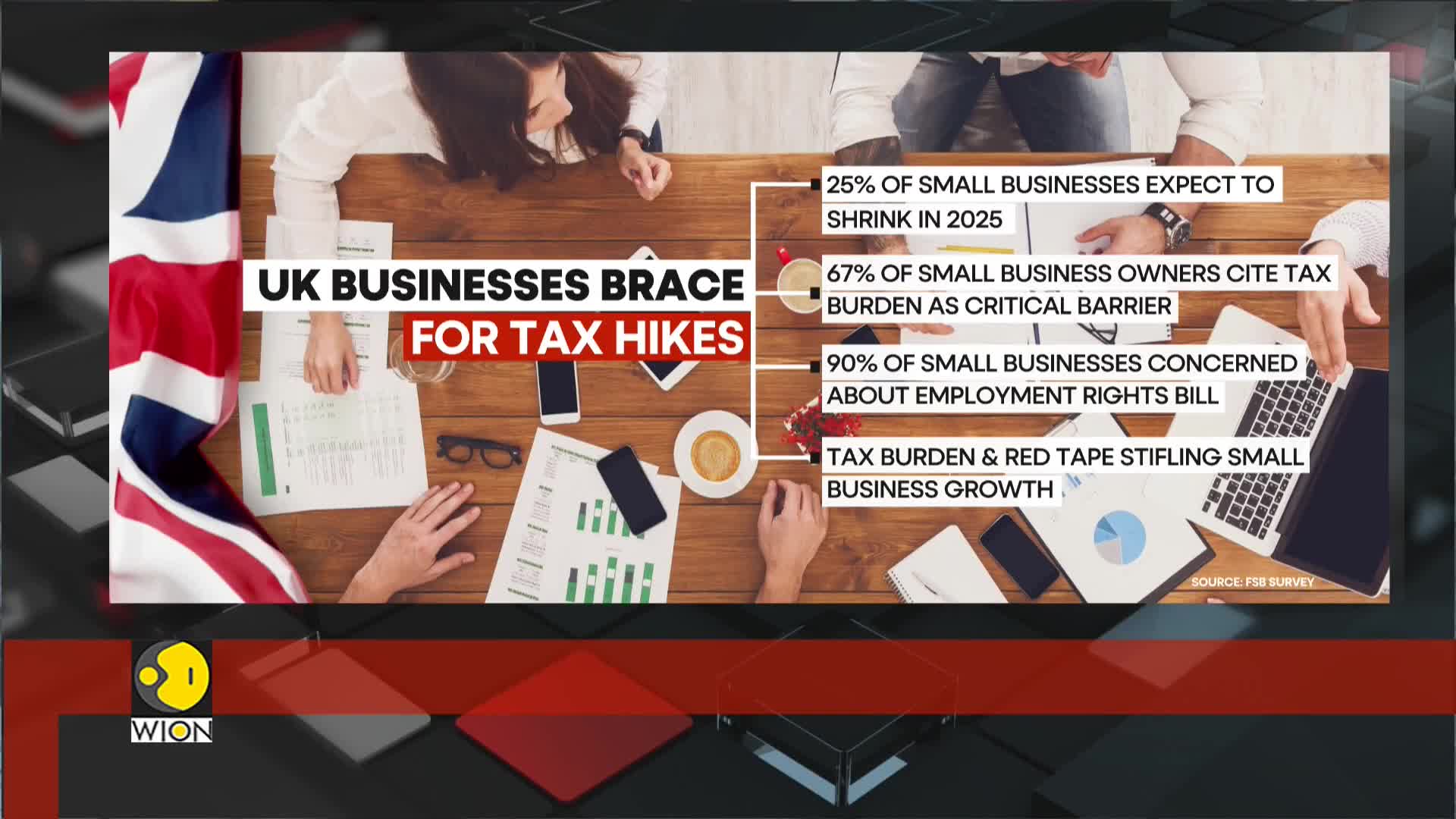

Watch clip answer (00:32m)How is the upcoming tax increase affecting UK businesses?

The major tax increase set to take effect in April is severely impacting UK business confidence, which has plummeted to its lowest level in a decade (outside pandemic periods). This unprecedented decline in employer confidence reflects widespread concerns about the sustainability of business operations under increased tax burdens. The situation represents a significant economic challenge, with businesses across various sectors preparing for financial strain that could potentially affect hiring decisions and growth strategies. This historically low confidence level suggests businesses are bracing for substantial negative impacts from the impending tax changes.

Watch clip answer (00:09m)How are the public and private sectors responding differently to rising tax burdens in the UK?

While the private sector is struggling with the increasing tax burden, the public sector is experiencing a more optimistic outlook. This contrast stems from recent public sector pay rises that have been funded by tax increases, creating a divergent economic reality between the two sectors. Small businesses are particularly vulnerable in this environment, with a Federation of Small Businesses survey revealing a steep decline in confidence among business owners. This highlights the disproportionate impact of the current tax policy, where increased taxation is simultaneously funding public sector improvements while potentially hampering private sector growth and confidence.

Watch clip answer (00:19m)