Small Business

What is the process for incorporating a company?

Incorporating a company today has become quite accessible through various options. You can use online services like Stripe Atlas or Clerky to handle the process digitally, which simplifies the entire procedure. Alternatively, you can hire a lawyer who will help prepare and mail the necessary paperwork to Delaware (a common state for incorporation). The process typically involves sending documentation and a small check, after which you receive confirmation that your company has been officially established. With modern tools, entrepreneurs now have multiple straightforward paths to establish their legal business entity.

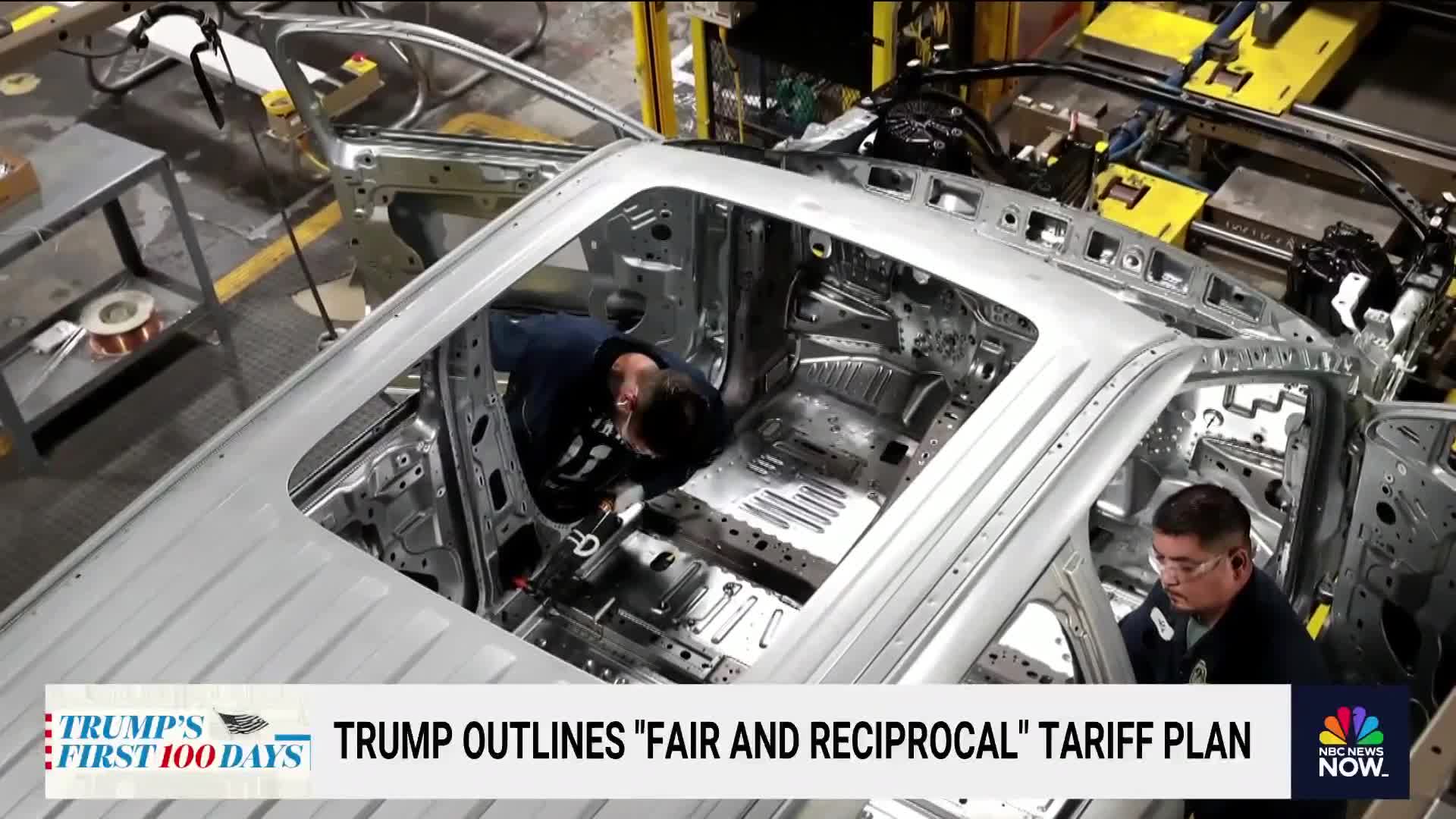

Watch clip answer (00:17m)How do tariffs affect Sandra Payne's concrete equipment business?

Tariffs affect every aspect of Sandra Payne's business since her company relies heavily on imported materials like steel, aluminum, bearings, hose, and wire that are no longer sourced domestically. These tariffs create delays in receiving materials and increase costs that must eventually be passed on to customers. The impact extends beyond her business to the entire construction supply chain, affecting civil and large commercial projects, ultimately hurting everyone in the industry. As Sandra notes, she has little control over where materials originate, but must pay the higher prices regardless.

Watch clip answer (01:40m)How does Square Capital empower underserved entrepreneurs?

Square Capital empowers underserved entrepreneurs by providing accessible funding to those traditionally overlooked by the banking system. Their data shows 54% of loans go to women (compared to just 18% nationally) and 37% to underrepresented minorities. Additionally, 80% of funding supports businesses outside the 25 most populous American cities. Through technology, Square Capital helps entrepreneurs like Courtney Foster, who was denied traditional bank loans but used Square Capital to expand her single-chair salon and launch her own hair care line. The platform creates economic opportunity by removing intimidating banking processes, focusing on business performance data rather than personal factors, enabling small business owners to not just survive but thrive.

Watch clip answer (06:19m)How do the changes in MSME classification help businesses grow?

The revised MSME classification allows businesses to expand without losing critical benefits. Previously, companies had to remain small to maintain access to government subsidies, tax perks, and low-interest loans. Now, with significantly increased investment thresholds (2.5 crores for micro, 25 crores for small, and 125 crores for medium enterprises) and higher turnover limits, businesses can scale up substantially while still qualifying as MSMEs. This change essentially removes the growth ceiling that forced businesses to artificially limit their expansion. The government's message is clear: 'Don't hold back. Grow as much as you want and we would still have your back.' This represents a transformative shift toward enabling small businesses to become bigger, stronger, and more profitable while continuing to enjoy MSME benefits.

Watch clip answer (01:48m)What changes has the government made to enhance loan access for MSMEs and startups in India?

The government has doubled the loan guarantee limit for MSMEs from 5 crore to 10 crore rupees, and increased the limit for startups from 10 crore to 20 crore rupees. These government-backed guarantees make banks more willing to lend to small businesses, as the government covers potential losses. This significant policy change unlocks an additional 1.5 trillion rupees in credit over the next five years, benefiting India's 4.5 crore MSMEs that contribute 29% of GDP and 50% of exports. The initiative aims to help small businesses grow while reducing dependence on imported products.

Watch clip answer (01:14m)Why are small and medium enterprises (SMEs) unable to access loans despite generous government terms?

Despite the government's SME loan system offering extremely favorable terms - including zero interest and a two-year moratorium period - many small and medium enterprises still struggle to access these loans due to lack of basic documentation. According to Minister Colm Imbert, these businesses often don't have the minimum requirements such as company accounts, financial statements, income tax registration, and NIS registration. The government has established this system with banks to help entrepreneurs, requiring only repayment of the principal amount with no payments necessary for the first two years. However, the fundamental documentation issues prevent many SMEs from benefiting from this generous financial assistance program.

Watch clip answer (00:37m)