Private Sector Challenges

What was the purpose of Xi Jinping's meeting with Chinese business leaders?

Xi Jinping met with prominent business leaders including Jack Ma of Alibaba and Pony Ma of Tencent to address challenges facing China's private sector. During the meeting at Beijing's Great Hall of the People, Xi urged entrepreneurs to unify behind the Communist Party's economic 2025 policies, assuring them that current challenges were surmountable. This gathering represents a significant shift in tone as Beijing attempts to revitalize the economy amid multiple crises including real estate problems, low consumption, and high youth unemployment.

Watch clip answer (00:58m)What are the main concerns about DOGE Service staff accessing IRS systems?

The main concerns involve potential access to sensitive taxpayer information through IRS confidential systems. Officials are alarmed about security risks, with attempts to prevent DOGE staff from accessing classified information sometimes leading to confrontations. Legal challenges are being considered to block this access, similar to issues at the Social Security Administration that led to its head resigning. Additionally, the IRS faces threats of mass firings affecting 9,000-10,000 employees, creating further tension between the agency and the White House as systems control becomes a critical point of contention.

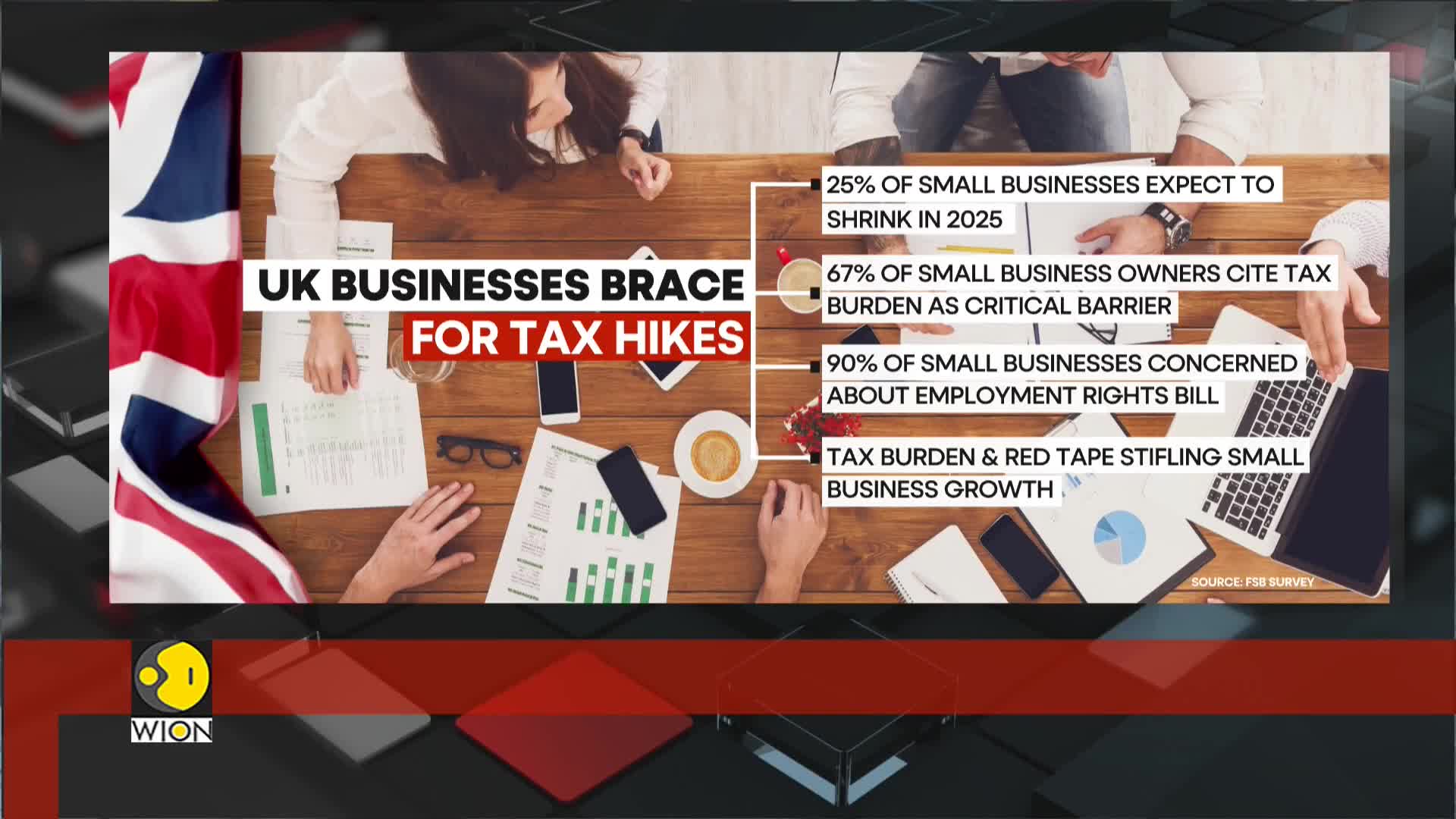

Watch clip answer (01:06m)How is the upcoming tax increase affecting UK businesses?

The major tax increase set to take effect in April is severely impacting UK business confidence, which has plummeted to its lowest level in a decade (outside pandemic periods). This unprecedented decline in employer confidence reflects widespread concerns about the sustainability of business operations under increased tax burdens. The situation represents a significant economic challenge, with businesses across various sectors preparing for financial strain that could potentially affect hiring decisions and growth strategies. This historically low confidence level suggests businesses are bracing for substantial negative impacts from the impending tax changes.

Watch clip answer (00:09m)How are the public and private sectors responding differently to rising tax burdens in the UK?

While the private sector is struggling with the increasing tax burden, the public sector is experiencing a more optimistic outlook. This contrast stems from recent public sector pay rises that have been funded by tax increases, creating a divergent economic reality between the two sectors. Small businesses are particularly vulnerable in this environment, with a Federation of Small Businesses survey revealing a steep decline in confidence among business owners. This highlights the disproportionate impact of the current tax policy, where increased taxation is simultaneously funding public sector improvements while potentially hampering private sector growth and confidence.

Watch clip answer (00:19m)How is the £25 billion tax burden affecting UK small businesses in a stagnating economy?

The £25 billion tax burden is severely impacting UK small businesses amid economic stagnation, with GDP growth nearly flat at just 0.1% in the final quarter of 2025. Small businesses already spend an estimated £25 billion annually on tax compliance alone, creating a double financial pressure on these enterprises. These tax burdens are exacerbating the economic situation as the private sector struggles while government spending and borrowing continue to drive minimal growth. Experts suggest that reducing this tax compliance burden could significantly improve productivity, allowing small businesses to allocate resources more effectively rather than being hindered by excessive regulatory costs.

Watch clip answer (00:25m)