Market Volatility

How did defense stocks perform compared to tech stocks in the recent market?

While heavyweight tech stocks experienced declines, defense stocks continued to gain ground in the broader market, showing notable resilience. This divergent performance occurred alongside positive movement in mid and small cap indexes, with the BSE Mid cap index adding 1.2% and the small cap index surging by a more substantial 2.4%. This pattern indicates a rotation of investor interest from technology into defense sectors, potentially reflecting changing market sentiments and sector-specific dynamics.

Watch clip answer (00:13m)How did Asian markets perform on Wednesday?

Asian markets closed with mixed results on Wednesday as investors responded to recent earnings releases and economic indicators. Japan's Nikkei 225 showed gains, buoyed by strong corporate earnings, while Chinese markets struggled amid continued economic uncertainty. In India, the benchmark indices ended slightly lower after a volatile trading session. The Nifty index declined as heavyweight tech stocks faced downward pressure, though defense stocks continued to show strength in the broader market. This mixed performance reflects varying regional economic conditions and sector-specific trends across Asian markets.

Watch clip answer (00:27m)What factors are currently pressuring the Indian rupee and what is its expected trading range?

The Indian rupee is currently under pressure due to multiple factors including rising crude oil prices, weak market sentiment, and foreign investor outflows, according to financial experts. These elements have collectively weighed on the currency's performance. The USD/INR pair is expected to trade within a specific range between 86.75 and 87.25. Market analysts anticipate possible interventions by the Reserve Bank of India (RBI) at weaker levels, particularly when markets open, to potentially stabilize the currency against excessive depreciation.

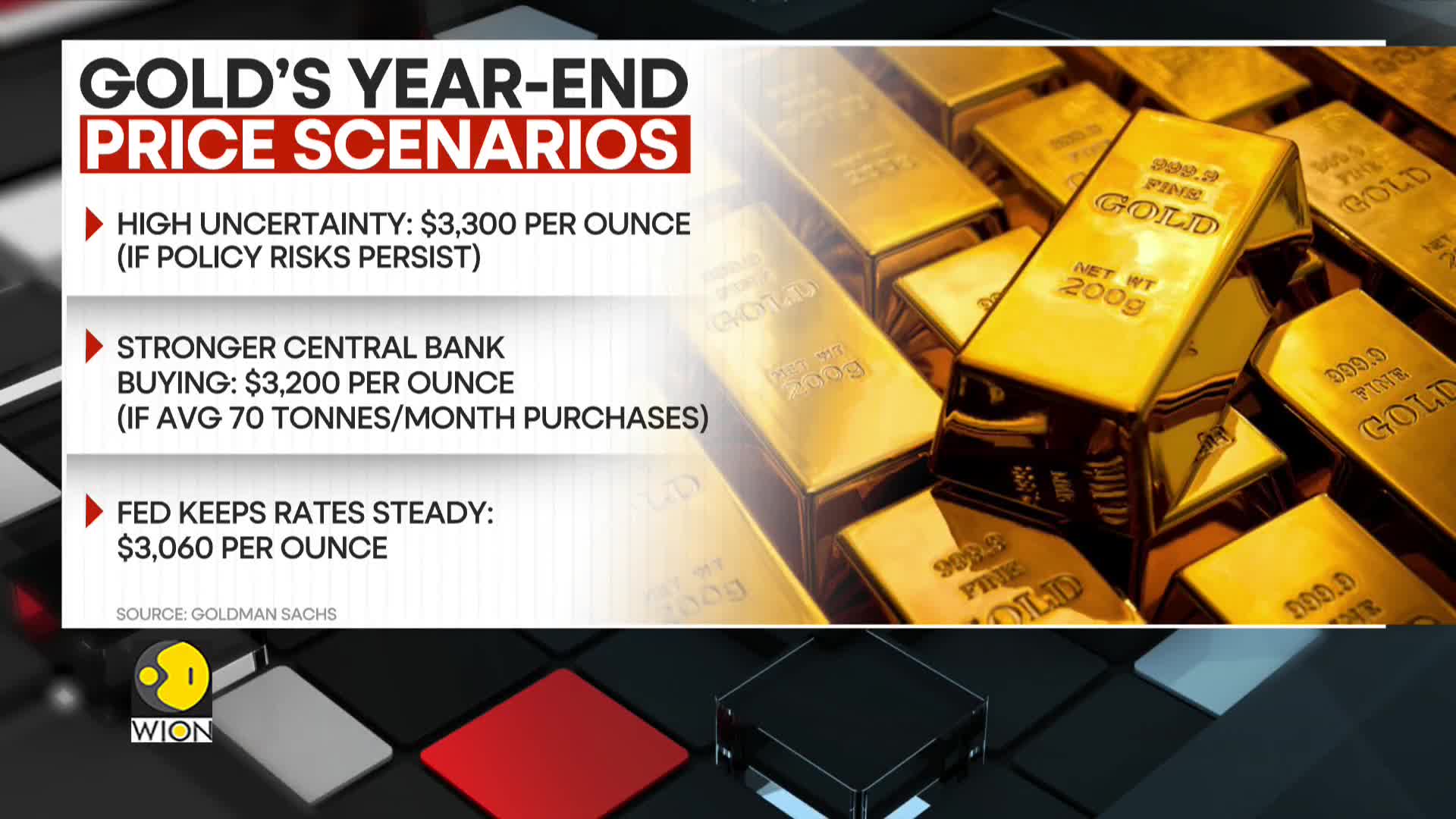

Watch clip answer (00:22m)Why does Goldman Sachs consider gold a valuable investment?

Goldman Sachs emphasizes that gold serves as a crucial hedge against multiple economic challenges in today's volatile market. Specifically, gold provides protection against financial and recessionary risks that could impact investment portfolios. Additionally, gold's value as a strategic asset is enhanced during periods of trade tensions and Federal Reserve policy uncertainty. This protective quality explains why Goldman has raised its forecast to $3,100 per ounce by the end of 2025, with increased central bank purchasing expected to reach 50 tonnes monthly.

Watch clip answer (00:10m)How are Indian stocks performing compared to other Asian markets?

Indian stocks are showing remarkable resilience by trading higher despite a broader downtrend in Asian markets. During a volatile trading session, Indian equities have maintained positive momentum while other Asian stocks trade lower, demonstrating the relative strength of the Indian market. The Nifty index is specifically attempting to reclaim the key psychological level of 23,000, which represents an important threshold for market sentiment and investor confidence in the Indian economy.

Watch clip answer (00:09m)What are the early signs of recovery in China's real estate market despite the ongoing downturn?

Despite the prolonged downturn in China's real estate market, analysts have identified promising indicators of a potential turnaround. New home prices experienced an uptick in January, suggesting the first signs of market stabilization after a difficult period for the sector. The positive momentum isn't limited to real estate alone, as the stock market has shown short-lived rebounds, particularly in the tech sector following the launch of new AI innovations. These early signals, while tentative, provide cautious optimism for investors watching for signs of recovery in China's crucial property market.

Watch clip answer (00:17m)