Market Analysis

What caused Philips shares to drop significantly, and what are investors currently focused on in the market?

Philips, the Dutch healthcare tech firm, experienced a sharp decline of nearly 12% in its shares following disappointing sales performance and a weak outlook for 2025. This significant drop occurred during a mixed trading day for European stocks, which came after the Stoxx 600 index had hit a record close on Tuesday. Meanwhile, investors are shifting their attention to upcoming U.S. economic indicators, specifically awaiting the Federal Reserve's FOMC meeting minutes and housing data. These economic reports are anticipated to provide critical insights that could influence direction on global market trends in the near term.

Watch clip answer (00:22m)What are the three priority areas driving China's economic growth?

China has designated three key sectors as drivers of its economic growth. These priority areas are electric vehicles, lithium ion batteries, and solar cells, collectively known as the 'new three.' The industry's expansion has been primarily fueled by strong domestic demand within China's market. Additionally, Chinese manufacturers have successfully increased their global market share, extending their reach internationally. This strategic focus on green technology demonstrates China's commitment to sustainable development while positioning the country as a leader in the renewable energy and electric transportation sectors.

Watch clip answer (00:17m)How are Indian stocks performing compared to other Asian markets?

Indian stocks are showing remarkable resilience by trading higher despite a broader downtrend in Asian markets. During a volatile trading session, Indian equities have maintained positive momentum while other Asian stocks trade lower, demonstrating the relative strength of the Indian market. The Nifty index is specifically attempting to reclaim the key psychological level of 23,000, which represents an important threshold for market sentiment and investor confidence in the Indian economy.

Watch clip answer (00:09m)What types of fraud were revealed in the October 2024 US charges against crypto firms?

In October 2024, US authorities charged 18 individuals and major crypto firms with conducting various fraudulent schemes targeting everyday investors. The fraud primarily involved market manipulation, where 'market makers' artificially inflated trading volumes and prices through fake transactions to create an illusion of buyer interest for unsuspecting investors. Additionally, 'pump and dump' schemes were identified, in which crypto prices were artificially inflated before coordinated major sell-offs, leaving regular investors with significant losses. These deceptive practices exploit the volatility and lack of regulation in cryptocurrency markets.

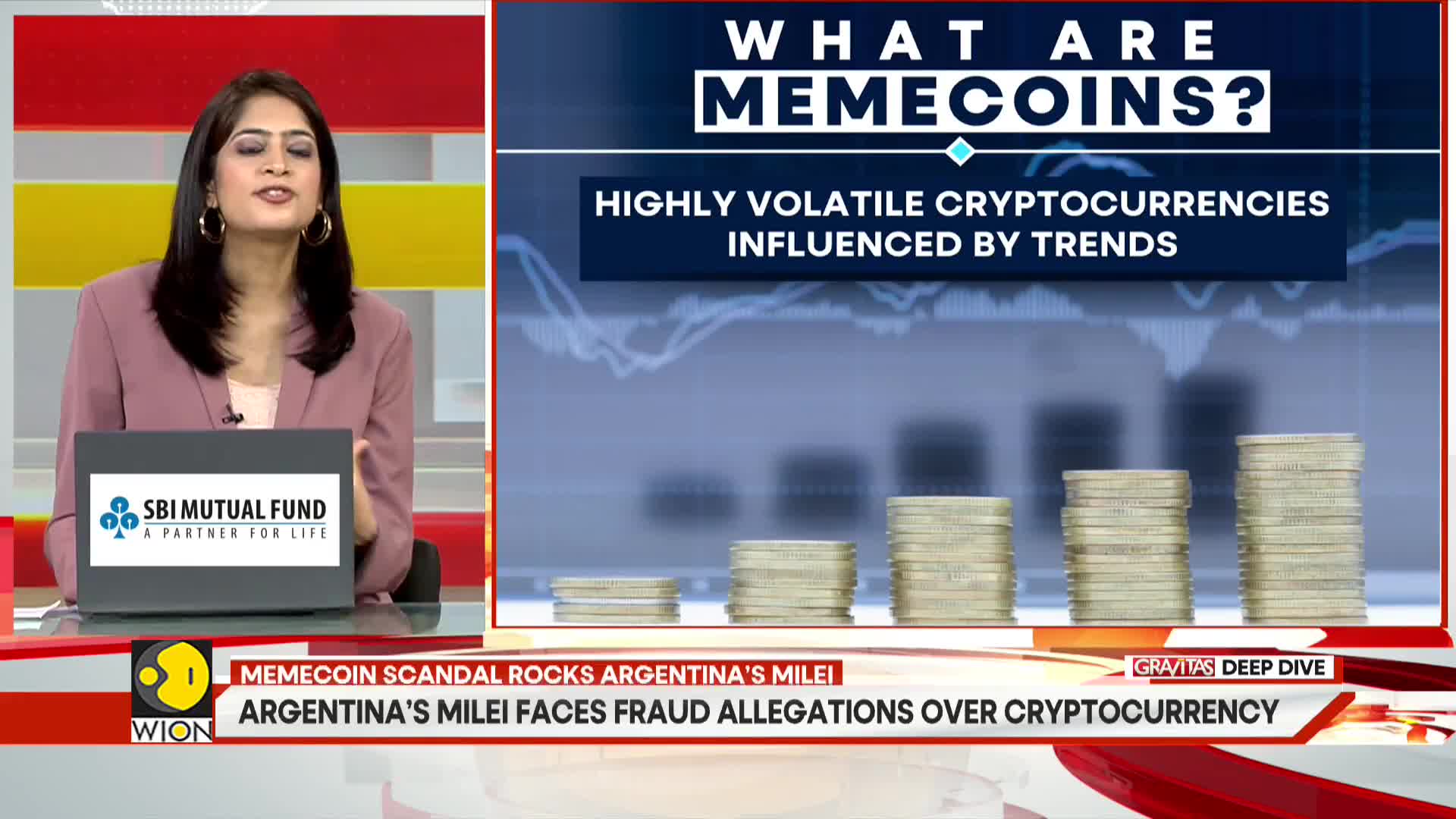

Watch clip answer (00:38m)What are the main risks associated with investing in meme coins?

Meme coins present several significant risks for investors. They experience unpredictable price swings and lack real-world applications or long-term viability, making them highly volatile investments. Additionally, future legal crackdowns could severely impact their liquidity and market presence. Investors also face security threats, as meme coin transactions can expose them to hackers and criminal operators. For these compelling reasons, financial experts strongly recommend exercising extreme caution before approaching meme coins, as they could result in substantial financial losses for unsuspecting investors.

Watch clip answer (00:25m)How did the Indian stock markets perform in the recent trading session?

The Indian stock markets exhibited volatility, with the Sensex dropping 29.47 points to close at 75,967.39 and the Nifty50 ending 14.20 points lower. The indices tested support at 22,800 before recovering mid-session. Sector-wise, IT and energy led the gains, while FMCG and auto sectors saw corrections. Mid-cap stocks ended slightly lower, dropping 0.2%, while small-cap stocks underperformed, shedding 1.7%. Analysts anticipate sideways trading within the 22,800-23,100 range, with future movements dependent on decisive breakouts. Overall market sentiment remains cautious as investors monitor global trends.

Watch clip answer (01:16m)