IRS documentation

What is the lawsuit filed by federal employees against Elon Musk about?

The National Federation of Federal Employees, a major union representing federal workers, has filed a lawsuit to block Elon Musk and his Department of Government Efficiency team from accessing sensitive IRS records. The union is requesting that a judge review the case before Musk's team is granted access to private IRS data sets. This is one of numerous legal challenges against the Trump administration and Musk's government initiatives, which involve accessing sensitive information and implementing personnel changes across federal agencies.

Watch clip answer (01:03m)What has President Trump directed Elon Musk's team to do regarding government data access?

President Trump has directed Elon Musk and the Doge team to identify fraud at the Social Security Administration. As part of this effort, Musk's team has requested access to a sensitive IRS data system that contains Americans' personal tax information, including tax filings and bank statements. This request raises significant privacy concerns as it would give Musk's team access to highly confidential financial data of American citizens. The initiative appears to be part of a broader effort to investigate potential fraud in government systems, specifically targeting the Social Security Administration.

Watch clip answer (00:17m)What controversy surrounds President Trump and Elon Musk's efforts to restructure the federal government?

President Trump and Elon Musk's efforts to shrink the federal government have sparked nationwide protests and significant controversy, particularly regarding access to sensitive personal data. Musk's team, directed to identify fraud at the Social Security Administration, has requested access to sensitive information of millions of Americans, including financial data and employment records. The controversy deepened when they also sought access to IRS data systems containing Americans' personal tax information, tax filings, and bank statements. The situation has led to high-profile departures, including a top Social Security official who stepped down after clashing with the Department of Government Efficiency over these data access requests.

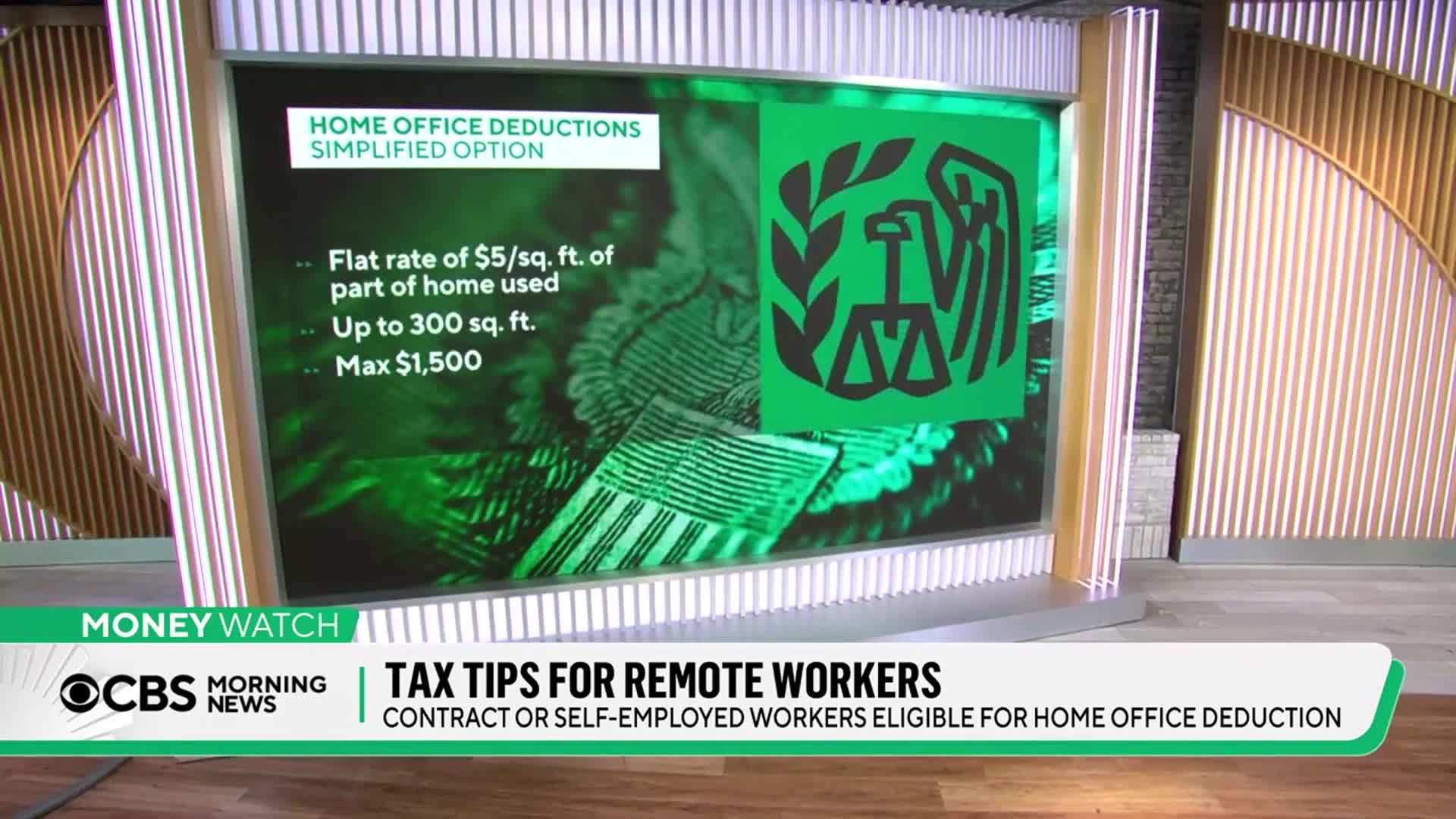

Watch clip answer (00:39m)How does the simplified home office deduction method work?

The simplified home office deduction method allows eligible taxpayers to claim $5 per square foot of their workspace, with a maximum allowable space of 300 square feet. This means the maximum deduction available through this simplified method is $1,500 ($5 × 300 square feet). This straightforward calculation method was introduced following the 2018 tax reforms to make it easier for self-employed individuals and those with secondary jobs to claim their legitimate home office expenses without complex recordkeeping requirements.

Watch clip answer (00:07m)