Housing Crisis

What approach does Rick Caruso advocate for low-income housing in Los Angeles' post-wildfire rebuilding efforts?

Rick Caruso advocates for an incentive-based approach rather than mandates for low-income housing during post-wildfire rebuilding. He suggests offering density bonuses to developers who choose to build low-income housing, arguing that this creates a win-win situation for all stakeholders. Caruso believes mandates would create more problems and upset communities by slowing down the rebuilding process, particularly for those who have already lost their homes and communities. By providing incentives instead of imposing requirements, he contends that people will be motivated to "do the right thing" while maintaining an efficient rebuilding timeline.

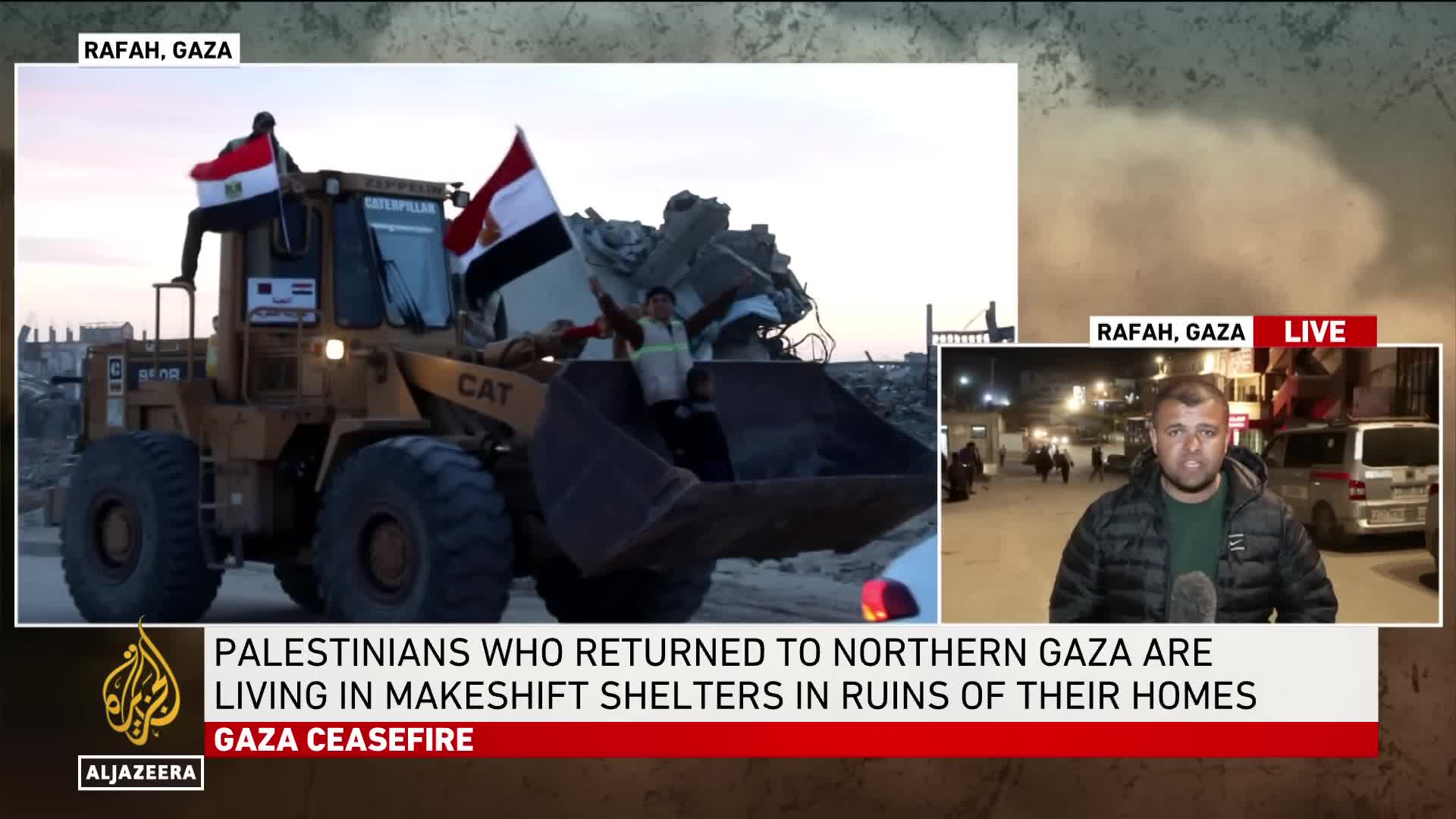

Watch clip answer (00:36m)What has the ceasefire in Gaza revealed about humanitarian needs?

The ceasefire in Gaza has provided a respite from constant bombing and bombardment, but it has also made the humanitarian crisis more visible. As the news anchor notes, the pause in violence has highlighted the severe shortage of basic necessities, particularly the urgent need for shelter and various forms of aid for civilians. The temporary calm has revealed the true extent of suffering and deprivation faced by Gazans after months of conflict. Medical supplies remain critically low while healthcare workers continue to operate under overwhelming challenges amid ongoing restrictions on aid delivery.

Watch clip answer (00:10m)How is the decline in China's property sector affecting the middle class?

China's property sector is facing significant pressure due to high debt levels and insolvency among major developers, resulting in a 12.9% drop in property sales by floor area as of 2024. This decline is directly impacting China's middle class, for whom property income represents a crucial component of household earnings. As real estate underperforms, middle-class homeowners are experiencing asset depreciation, with rental income falling and property values decreasing. This financial strain affects overall household wealth and spending power, contributing to weakened consumer confidence in what has traditionally been a cornerstone of middle-class investment strategy in China.

Watch clip answer (00:30m)What is Barclays' forecast for China's property market in 2025?

Barclays projects that China's property sales will decline by another 10% in 2025, following a significant 13% drop in 2024. This continued downturn reflects the persistent challenges facing China's real estate sector. In the worst-case scenario, analysts at Barclays suggest that the property crisis could extend until 2030, indicating a potentially prolonged period of market distress. This forecast has serious implications for China's economy, particularly affecting middle-class wealth and consumer confidence.

Watch clip answer (00:13m)What is happening to China's property income growth and what does it indicate about the real estate sector?

China's property income growth has reached its lowest level in over a decade, growing at just 2.2% in 2024, the slowest pace since 2014. This decline is part of a consistent downward trend that began in 2019, with 2021 being the only exception, highlighting the ongoing slump in the real estate sector. The situation is particularly severe in major cities like Beijing, where per capita net property income has fallen by 0.6% for three consecutive years. This persistent decline in property income growth serves as a clear indicator of the significant challenges facing China's real estate market and reflects broader economic concerns.

Watch clip answer (00:31m)Are there any signs of recovery in China's real estate market despite the prolonged downturn?

Despite the prolonged real estate downturn in China, some analysts see early indications of a potential turnaround. New home prices experienced an uptick in January, while the stock market has shown short-lived rebounds, particularly in the tech sector following AI innovation launches. However, significant uncertainty persists in the market. Government policymakers continue implementing stimulus measures, but their effectiveness for long-term real estate stability remains unclear. As China navigates this economic challenge, attention is focused on the government's upcoming strategies to stabilize the property sector and restore investor confidence.

Watch clip answer (00:35m)