Fraud Detection

Fraud detection refers to the systematic processes utilized by organizations to identify and prevent unauthorized or deceptive activities, particularly in financial transactions. In an era where financial fraud continues to escalate, with banks reportedly losing billions annually, implementing effective fraud detection systems has become crucial for maintaining both financial integrity and customer trust. This includes leveraging advanced technologies such as artificial intelligence (AI) and machine learning (ML), which expedite the analysis of massive datasets to uncover suspicious patterns and anomalies in real time. Modern fraud detection solutions integrate various techniques, including transaction monitoring, anomaly detection, and behavioral analytics, ensuring a robust defense against the evolving strategies of cybercriminals. Recent reports highlight that nearly all financial institutions are now relying on AI tools to enhance their fraud prevention capabilities while simultaneously striving to address challenges like false positives, regulatory compliance, and data privacy concerns. Furthermore, the growing complexity of financial instruments and the sophistication of organized crime necessitate a proactive, data-driven approach that incorporates collaborative efforts across sectors. As fraudulent behavior increasingly incorporates advanced tactics, such as utilizing AI-generated identities and engaging in account takeovers, organizations must adapt to stay ahead. These adaptive strategies not only protect against immediate threats but also help foster long-term customer confidence, demonstrating that a comprehensive fraud detection framework is essential for modern businesses aiming to safeguard their assets and reputations.

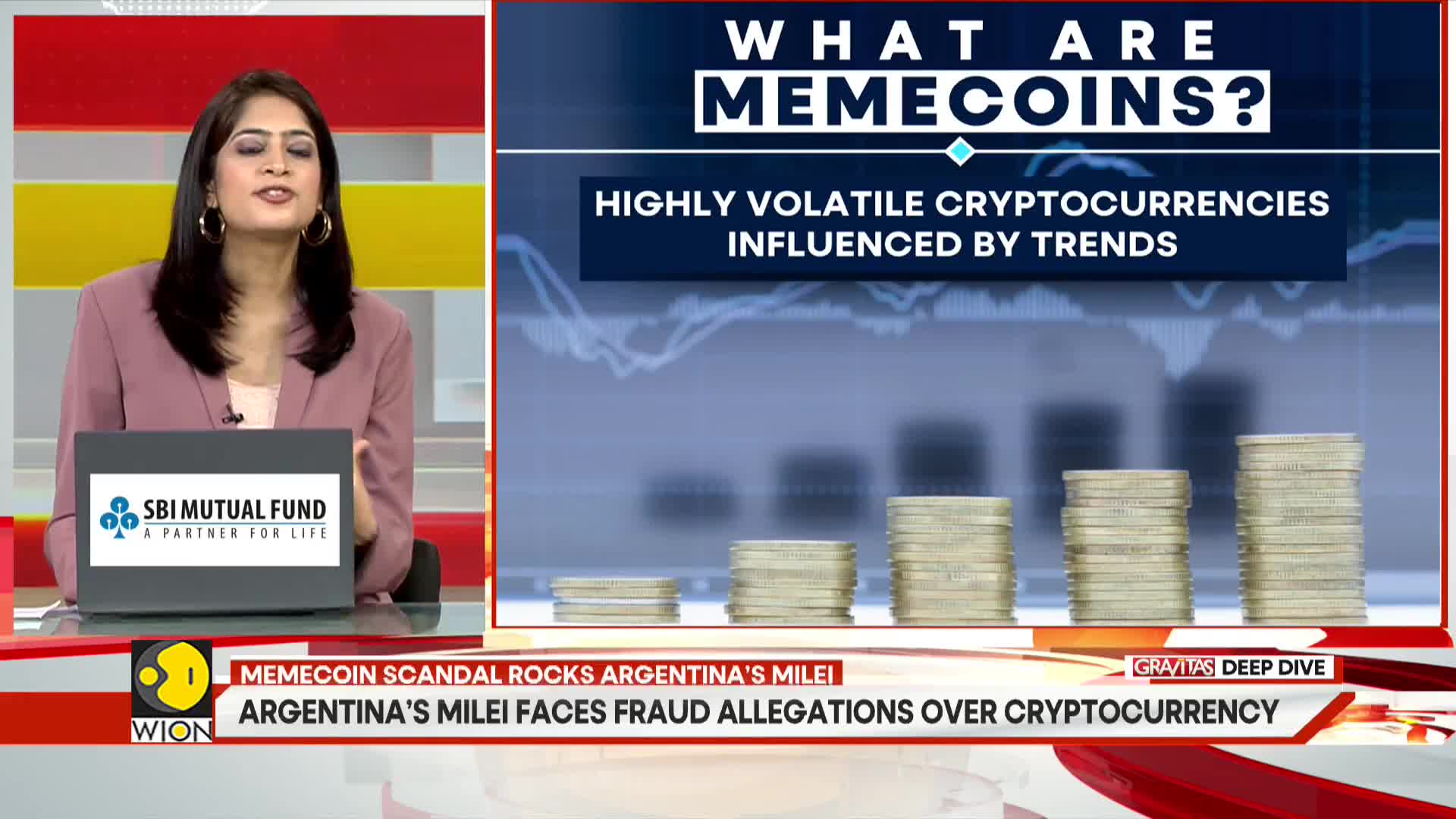

What is the crypto scandal involving Argentina's president Javier Milei?

Argentina's president Javier Milei is at the center of a crypto scandal that has led to impeachment calls and legal action accusing him of fraud. The controversy began when Milei promoted a cryptocurrency meme coin on his X social media platform, claiming it would help fund small businesses and startups. He even shared a purchase link, causing the coin's price to initially surge. However, within hours, the cryptocurrency's value plummeted dramatically, resulting in significant financial losses for investors. This rapid collapse after the president's endorsement has sparked accusations of potential market manipulation and raised serious questions about his role in promoting the volatile asset.

Watch clip answer (00:36m)What criminal risks and schemes are associated with meme coins according to authorities?

Governments have identified several major criminal risks with meme coins. In October 2024, US authorities charged 18 people and crypto firms for frauds targeting everyday investors. These schemes relied on market makers who artificially inflated trading volumes and prices, creating fake transactions to deceive unsuspecting investors. Beyond market manipulation, 'pump and dump' schemes present another significant risk, where prices are artificially inflated before major sell-offs, leaving late investors with losses. These fraudulent activities involve creating false impressions of buyer interest and market momentum, ultimately causing financial harm to retail investors who enter the market based on manipulated information.

Watch clip answer (00:50m)Is fraud a significant issue in the Social Security system?

Fraud is indeed acknowledged as a big issue within Social Security, as confirmed by Jeremy Peters. However, he clarifies that while fraud genuinely exists in the system, the extent of the problem appears to be significantly exaggerated in public discourse. The clip suggests there's a nuanced reality between recognizing legitimate concerns about Social Security fraud and understanding that the scale of the problem may be overstated. This perspective is important when considering government approaches to fraud detection and prevention in social welfare programs.

Watch clip answer (00:15m)What legal protections exist for Social Security records and how do they apply to internal versus public disclosure?

Social Security records are protected by multiple legal frameworks including the Federal Privacy Act and Internal Revenue Code, which impose strict rules about information disclosure. A recent court decision highlighted an important distinction between internal agency disclosure and public disclosure of sensitive information. The court found that while public disclosure may constitute irreparable harm warranting legal intervention, internal disclosure within an agency may not meet this threshold. This distinction is significant because it allows for internal information sharing while maintaining legal protections against unauthorized public release of personal data.

Watch clip answer (00:53m)How much did the Social Security Administration make in improper payments according to a recent audit?

According to an inspector general audit, the Social Security Administration made almost $72 billion in improper payments over a seven-year period. This represents less than 1% of all payments made during that timeframe. The report clarifies that most of these improper payments were overpayments rather than payments to deceased individuals or people who didn't qualify for benefits at all, contrary to what was suggested by the press secretary.

Watch clip answer (00:28m)What is President Trump's approach to staffing his administration according to the White House?

According to White House Press Secretary Caroline Levitt, President Trump is focused on recruiting individuals who are both highly qualified and committed to implementing his America First agenda on behalf of the American people. The administration acknowledges this approach may not appeal to everyone, which they consider acceptable. This staffing philosophy suggests Trump is prioritizing ideological alignment with his policy vision over traditional qualifications alone, indicating a deliberate strategy to ensure consistency in executing his administration's goals.

Watch clip answer (00:15m)