Fraud Detection

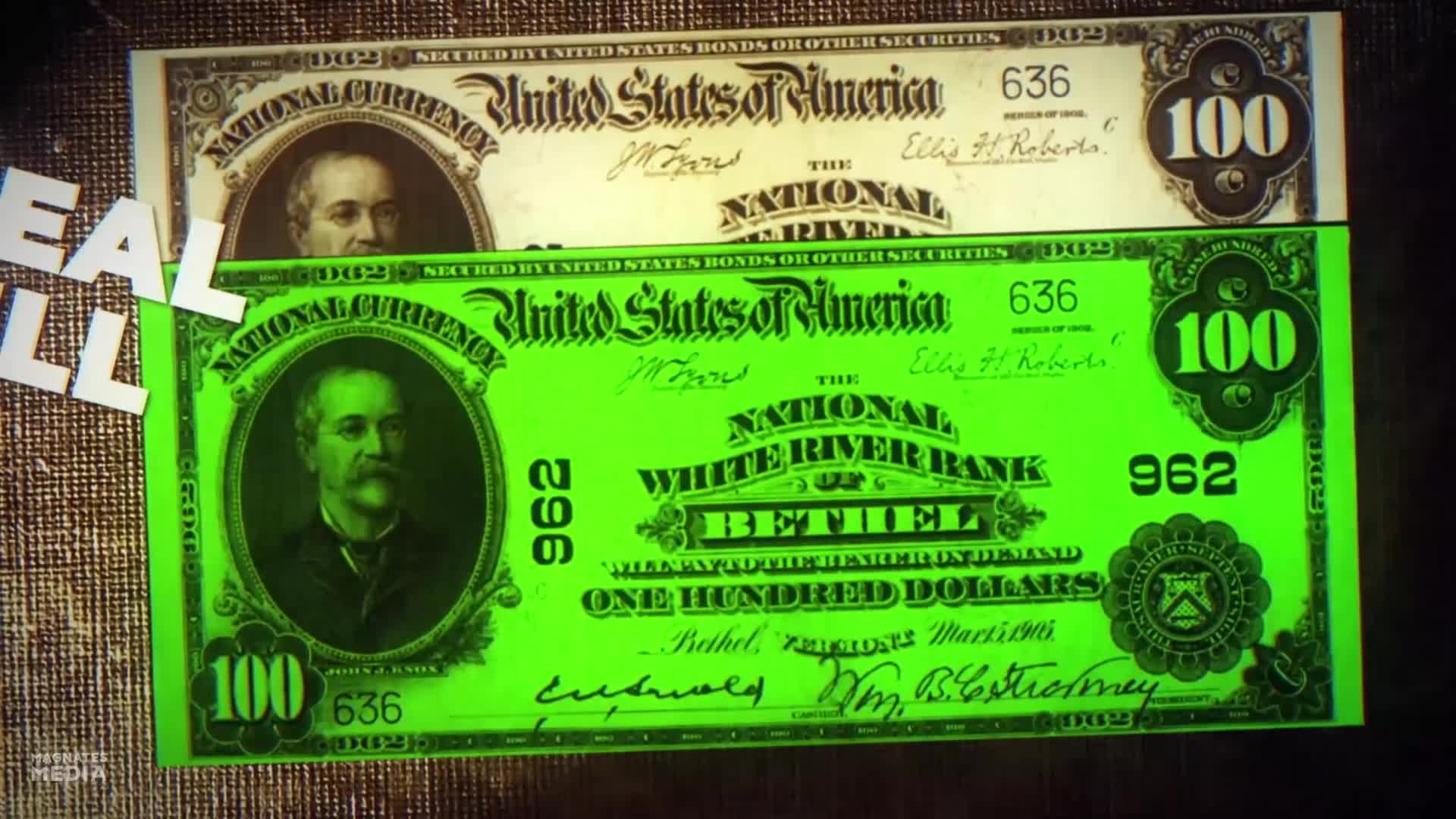

Fraud detection refers to the systematic processes utilized by organizations to identify and prevent unauthorized or deceptive activities, particularly in financial transactions. In an era where financial fraud continues to escalate, with banks reportedly losing billions annually, implementing effective fraud detection systems has become crucial for maintaining both financial integrity and customer trust. This includes leveraging advanced technologies such as artificial intelligence (AI) and machine learning (ML), which expedite the analysis of massive datasets to uncover suspicious patterns and anomalies in real time. Modern fraud detection solutions integrate various techniques, including transaction monitoring, anomaly detection, and behavioral analytics, ensuring a robust defense against the evolving strategies of cybercriminals. Recent reports highlight that nearly all financial institutions are now relying on AI tools to enhance their fraud prevention capabilities while simultaneously striving to address challenges like false positives, regulatory compliance, and data privacy concerns. Furthermore, the growing complexity of financial instruments and the sophistication of organized crime necessitate a proactive, data-driven approach that incorporates collaborative efforts across sectors. As fraudulent behavior increasingly incorporates advanced tactics, such as utilizing AI-generated identities and engaging in account takeovers, organizations must adapt to stay ahead. These adaptive strategies not only protect against immediate threats but also help foster long-term customer confidence, demonstrating that a comprehensive fraud detection framework is essential for modern businesses aiming to safeguard their assets and reputations.

How did Victor Lustig successfully execute his famous Eiffel Tower con that fooled multiple scrap dealers?

Victor Lustig's Eiffel Tower scam was a masterpiece of meticulous planning and psychological manipulation. He obtained forged credentials from the French Ministry of Posts and Telegraphs, posed as a government official at a luxury Paris hotel, and invited six major scrap dealers to a private meeting under the pretense of discussing sensitive government business. Lustig's genius lay in his multi-layered approach to deception. He made the dealers feel special by sharing a fabricated "state secret" about the tower's demolition, demonstrated credibility through extensive knowledge of the tower's specifications including exact measurements and rivet counts, and sealed their interest with concrete numbers—7,000 tons of high-grade salvageable iron. This combination of exclusivity, technical expertise, and financial opportunity created an irresistible proposition that left the experienced businessmen completely mesmerized and eager to participate in what they believed was the deal of a lifetime.

Watch clip answer (01:26m)