Financial Crime Analysis

Financial crime analysis encompasses the examination of financial transactions and patterns to detect illicit activities such as money laundering, fraud, and tax evasion. This multifaceted discipline is increasingly vital as financial criminals evolve their tactics, utilizing sophisticated methods like synthetic identities, deepfakes, and digital assets to obscure their illegal activities. The global cost of financial crime is staggering, with estimates reaching up to $2 trillion annually, emphasizing the urgent need for robust financial crime detection and prevention strategies. The process of financial crime analysis not only involves employing advanced forensic techniques and investigative methodologies but also necessitates the integration of powerful tools such as artificial intelligence (AI) and machine learning (ML). Recent advancements in these technologies are revolutionizing anti-money laundering (AML) efforts, enabling real-time monitoring and predictive analytics which enhance compliance capabilities and streamline risk assessment processes. Additionally, organizations are pivoting towards a proactive approach in their financial crime prevention strategies, aligning regulatory compliance with technological innovations to mitigate risks effectively. As regulatory scrutiny increases, financial institutions are compelled to adapt to changing compliance landscapes while enhancing their fraud investigation software and AML systems. The collaboration between financial organizations and regulatory bodies is crucial to counter the evolving threats posed by organized crime and cybercriminals. Understanding financial crime typologies, from trade-based money laundering to online scams, is essential for professionals in the field to develop effective frameworks and cultivate a culture of compliance in combating financial crime.

What led to Wendy Williams being placed under guardianship and what concerns were raised about her financial situation?

Wendy Williams was placed under guardianship after her bank, Wells Fargo, identified irregular financial transactions and filed court documents claiming she was an incapacitated person. The bank alleged that Williams was a victim of undue influence and financial exploitation, which prompted the legal guardianship process. Attorney Sabrina Morrissey was subsequently appointed as Williams' guardian to oversee both her healthcare decisions and financial affairs. This guardianship arrangement has become controversial, with Williams herself claiming to be a victim of financial exploitation while under this legal protection. The situation has raised significant public concern, leading to the #FreeWendy movement as supporters question the restrictive nature of her current circumstances.

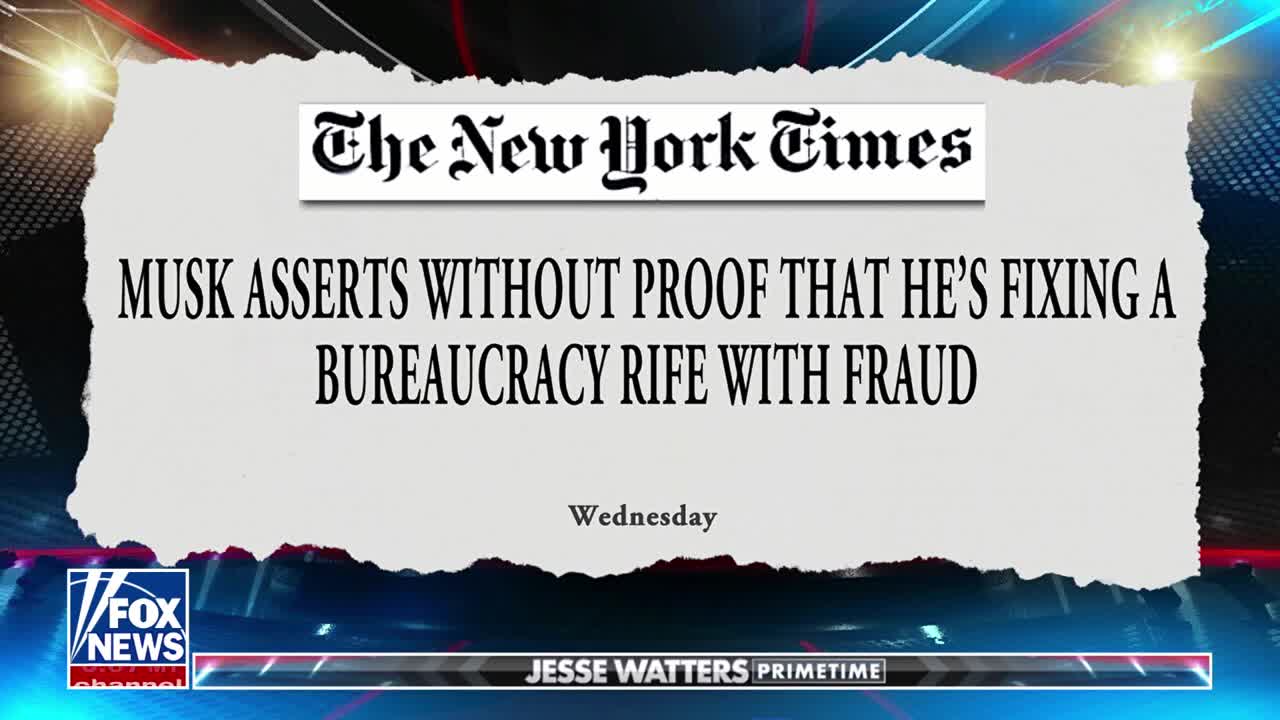

Watch clip answer (00:25m)How has media coverage of government waste and fraud been consistent across different presidential administrations?

According to Jesse Watters, The New York Times has maintained consistent coverage of government waste across multiple presidential administrations, including Obama, Clinton, and Bush. This suggests that government inefficiency and wasteful spending is a persistent, bipartisan issue that transcends party lines. Watters highlights the irony in Obama's claim that he could cut waste and fraud without congressional approval, implying that such promises are often made but the problem persists regardless of which administration is in power.

Watch clip answer (00:11m)What are the contradictions between the Trump administration's claims of fighting fraud and corruption versus their actual policy actions?

The fundamental contradiction lies in the disconnect between rhetoric and action. While claiming to combat fraud and corruption, the Trump administration systematically dismantled the very institutions designed to prevent these issues. This includes firing inspectors general who save taxpayers $70 billion annually in waste prevention, gutting ethics offices, weakening the FBI and Department of Justice, and closing consumer protection agencies. The real agenda appears to be wealth transfer from working-class Americans to billionaires rather than genuine anti-corruption efforts. When someone with fraud convictions leads anti-fraud initiatives, it creates an inherent conflict of interest that undermines credibility and effectiveness.

Watch clip answer (00:52m)What is the Dr. Emanuel Hoston insurance fraud case about and how significant is it?

Dr. Emanuel Hoston, an orthopedic surgeon and husband of Sonny Hosten, is at the center of a massive insurance fraud lawsuit involving nearly 200 healthcare providers. He's accused of providing fraudulent medical services in exchange for kickbacks by American Transit Insurance Company, which insures taxi, Uber, and Lyft drivers. This case represents one of the largest RICO cases ever filed in New York, with over 141 of the 186 defendants already agreeing to settle in principle. Dr. Hoston has denied the allegations, calling them a "frivolous smear campaign," but finds himself increasingly isolated as the vast majority of co-defendants have chosen to settle rather than fight the charges, highlighting the extensive nature of alleged healthcare fraud.

Watch clip answer (00:58m)What are the systemic issues with healthcare fraud and how do fraudulent medical practices impact the broader healthcare system?

Healthcare fraud represents a significant systemic problem involving fraudulent billing practices, kickbacks disguised as legitimate payments, and unnecessary medical procedures. As highlighted in the discussion about Dr. Emmanuel Hosten's case, healthcare providers may knowingly provide fraudulent medical services, including unnecessary surgeries, and receive kickbacks disguised as dividends or cash distributions. This type of fraud creates a web of corruption that extends beyond individual practitioners to involve insurance companies, government funding, and NGOs. The financial mismanagement and fraudulent activities not only harm patients who may receive unnecessary treatments but also burden taxpayers and legitimate healthcare consumers through increased costs. The prevalence of such practices, as noted by Joe Rogan's comment that "this happens all the time," suggests an urgent need for systemic reform, greater transparency, and stronger accountability measures within the healthcare industry.

Watch clip answer (00:30m)