Employee Benefits

Employee benefits are essential components of workplace compensation that go beyond base salaries to enhance employee well-being and satisfaction. These encompass health insurance benefits, retirement plan options, paid time off, and various voluntary perks like gym memberships and tuition reimbursement. As organizations increasingly recognize the importance of comprehensive employee benefits packages, these offerings have become crucial for attracting and retaining talent in competitive job markets. With recent trends indicating that over 81% of employees deem benefits vital when considering job offers, the structured implementation of employee benefits is more relevant than ever. The latest analysis highlights the evolving landscape of employee benefits, showcasing a demand for personalized, holistic offerings that address diverse workforce needs. Key trends include a strong emphasis on mental health support, enhanced healthcare affordability, flexible work arrangements, and family-friendly policies that resonate across generational lines. Furthermore, employers are focusing on compliance and transparency in benefits administration, ensuring fiduciary responsibilities are met while managing cost pressures effectively. By tailoring benefits to accommodate the unique lifestyles and preferences of different employee demographics, organizations are fostering a healthier, more engaged workforce that not only boosts productivity but also aligns with modern workplace values.

What social responsibility initiatives does Bobi champion beyond making organic baby formula?

As a business leader, Laura Modi of Bobi advocates for several social responsibility initiatives beyond creating organic baby formula. She emphasizes paid family leave, highlighting the contradiction between government recommendations for six months of exclusive breastfeeding and the lack of federal paid leave policies to support this goal. Bobi actively works to address this disconnect by fighting for change through multiple channels. The company takes concrete actions including providing grants to customers, collaborating with influential figures like Naomi Osaka to amplify their message, gathering signatures for Congress, and generally taking a vocal stance on these issues. These efforts reflect Modi's commitment to changing not just products and industry standards, but also the broader culture surrounding parenting support.

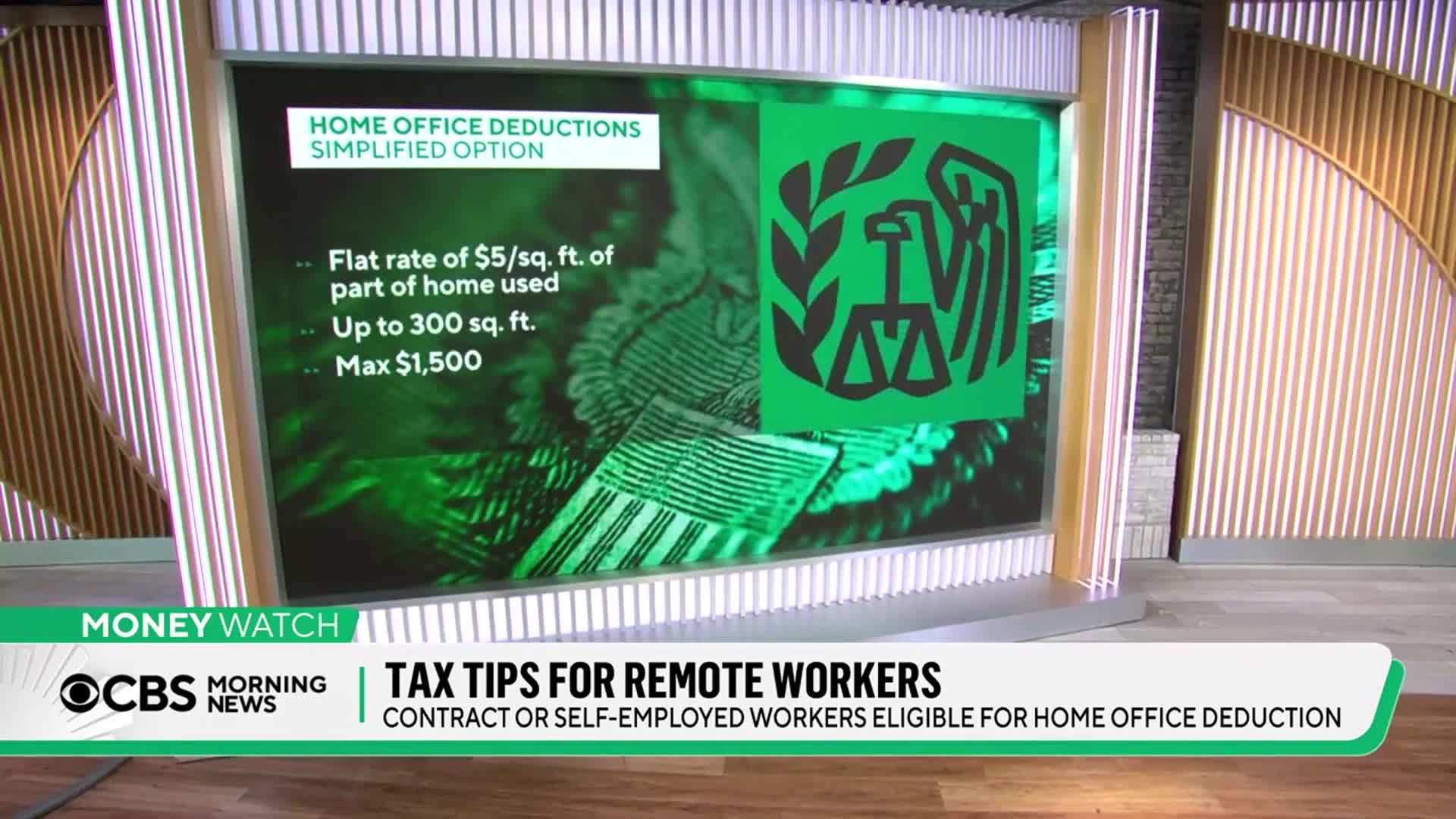

Watch clip answer (00:46m)What are ways people can reduce their tax bill?

Taxpayers can reduce their tax bill by maximizing contributions to their 401k or other retirement funds before the April 15 deadline, which provides pre-tax benefits for the 2024 tax season. This is a key opportunity that's still available. Additionally, given potential IRS staffing changes mentioned by Trump, including cutting staff or reassigning agents to border duties, it's advisable to file taxes as early as possible. Filing promptly ensures taxpayers receive assistance before any potential reduction in IRS services occurs.

Watch clip answer (00:48m)What challenges are federal workers facing during the recent layoffs?

Federal workers impacted by recent layoffs at agencies like the FAA and CDC are facing significant uncertainties in their employment status. As Elizabeth Anaskevich explains, laid-off workers have not received the necessary forms to file for unemployment benefits, leaving them in administrative limbo during this transition period. Additionally, these workers lack clear information about when their health insurance coverage will terminate, creating anxiety about healthcare access during a particularly concerning time with events like the measles outbreak in West Texas. This situation highlights the disorganization in the federal workforce as hundreds of employees navigate an unclear termination process without proper guidance.

Watch clip answer (00:30m)What impact did Elon Musk's terminations have on USAID employees?

Elon Musk's terminations at USAID created widespread fear and uncertainty among employees. According to Annie Lynn, dedicated public servants with decades of experience across multiple administrations suddenly lost their financial stability overnight, leaving them unable to pay for childcare, medical bills, and other essentials. The firings prioritized loyalty over competency, with employees being forced to leave the building immediately and never allowed to return. This abrupt dismissal not only disrupted the livelihoods of long-term public servants but also affected critical international aid programs, highlighting the significant personal and professional toll of these terminations.

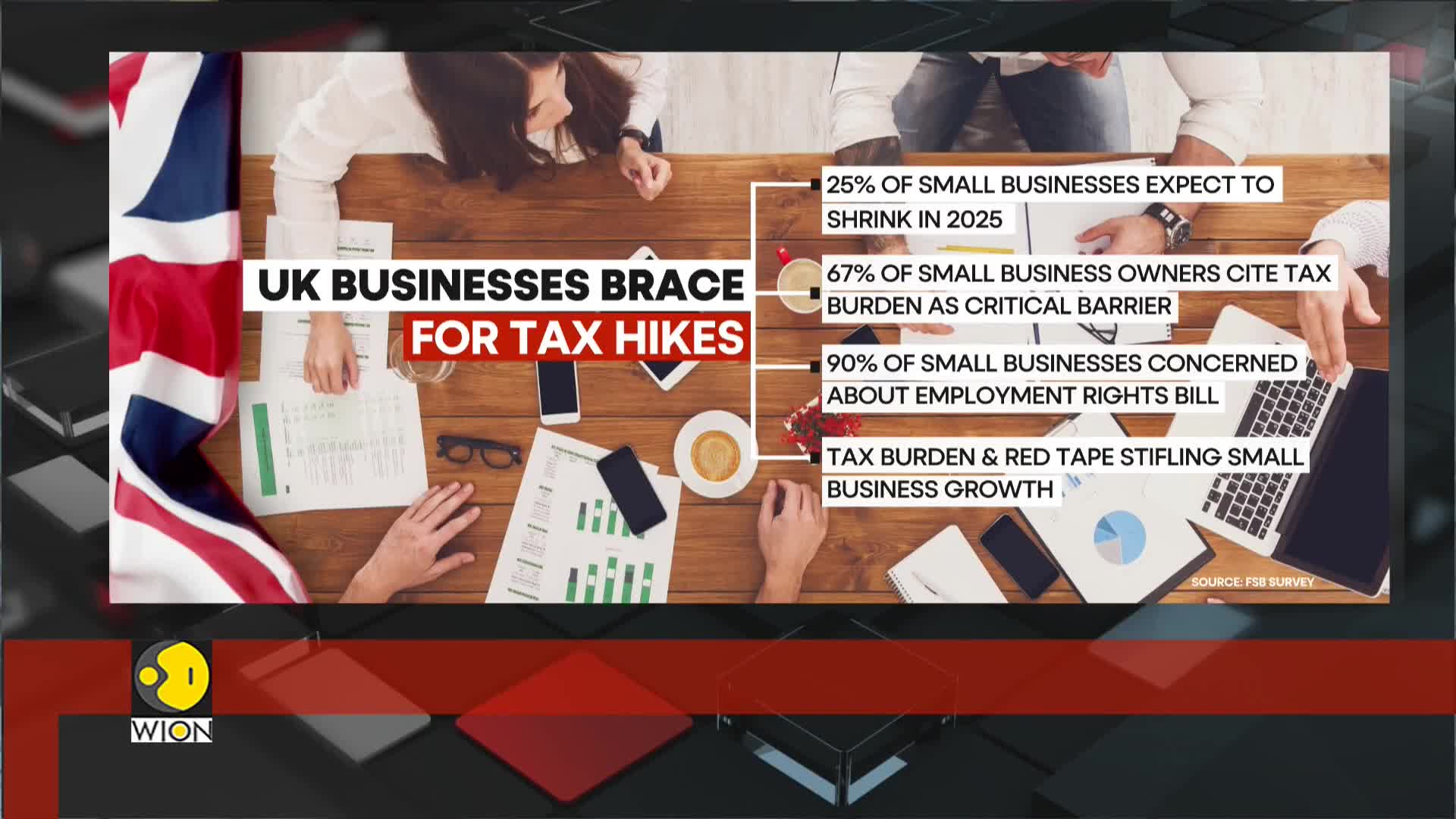

Watch clip answer (00:49m)How is the UK government's tax policy affecting small businesses?

The UK government's 25 billion pound tax is severely impacting small businesses, exacerbating economic stagnation across the country. With one in four companies planning layoffs—the highest rate in a decade—small business confidence has plummeted, with 67% citing tax burdens as a major barrier to growth. This financial pressure is particularly devastating retail and hospitality sectors, which are experiencing lower earnings while facing higher costs. New regulations, including the Employment Rights Bill, are adding further strain to businesses already struggling with rising national insurance rates, creating a perfect storm of economic challenges.

Watch clip answer (00:12m)What is the Republican strategy behind the Senate Budget Committee's resolution on immigration and defense, and how does it impact American families?

According to Senator Jeff Merkley, Republicans are using defense and homeland security as a "Trojan horse" to disguise their real agenda of cutting $1.5-2 trillion from essential family programs including healthcare, housing, education, and childcare. These cuts are designed to fund approximately $4.5 trillion in tax cuts primarily benefiting billionaires. The strategy creates a concerning fiscal pattern: reduce spending on programs that help families achieve middle-class stability, provide massive tax breaks to the wealthiest Americans, and increase national debt by $2.5-3 trillion. Merkley argues this three-part plan deliberately uses the respectable cover of defense and homeland security—typically bipartisan issues—to mask what he calls an "assault on families" and a giveaway to billionaires.

Watch clip answer (01:56m)