Economic Growth

Economic growth is a critical metric that reflects the sustained increase in the production of goods and services within an economy. Typically measured by the rise in Gross Domestic Product (GDP) or GDP per capita, economic growth is integral to enhancing living standards and alleviating poverty. Recent evaluations indicate that global GDP growth is expected to stabilize in the range of 2.6% to 3.3%, amid numerous challenges such as geopolitical tensions and inflationary pressures. Understanding economic growth is not only essential for policymakers and economists but also for citizens as it influences job creation, income levels, and overall societal progress. Key drivers of economic growth include investment in physical capital, growth in the labor force, and advancements in technology, which together facilitate a nation's ability to expand its output effectively. Moreover, various economic theories, including endogenous growth theory, emphasize the role of innovation and human capital in achieving long-term growth. Additionally, the ongoing discussions about sustainable economic development highlight the importance of creating growth strategies that not only boost GDP but also are equitable and environmentally conscious. As nations work towards sustainable solutions, comprehending the dynamics of economic growth becomes increasingly pertinent amidst continual global shifts in economic conditions and policies.

What happened with President Javier Milei's promotion of the Libra virtual coin?

President Javier Milei promoted the virtual Libra coin on social media platform X last Friday, claiming it would encourage economic growth by funding small businesses and startups. Following his endorsement, the price of Libra skyrocketed almost immediately. However, the situation quickly deteriorated when the coin's value began to drop. In response, Milei deleted his original post, but this action couldn't prevent the cryptocurrency from ultimately crashing. The incident has led to significant financial losses for investors and sparked accusations of fraud, with the president now potentially facing impeachment proceedings.

Watch clip answer (00:21m)What is President Milei's current priority amid the Libra coin controversy?

Despite the ongoing controversy surrounding the Libra virtual coin and allegations of fraud, President Milei's priority remains focused on reducing Argentina's inflation rate and guiding the country toward economic growth. This economic focus continues even as he faces serious political consequences, including an investigation into his role in what many are calling a fraudulent scheme. The situation has escalated to the point where Milei faces potential impeachment, yet he maintains his commitment to addressing Argentina's economic challenges. While the investigation into the Libra coin incident continues, Milei appears determined to keep his administration's focus on broader economic reforms rather than the cryptocurrency controversy.

Watch clip answer (00:17m)How is the upcoming tax increase affecting UK businesses?

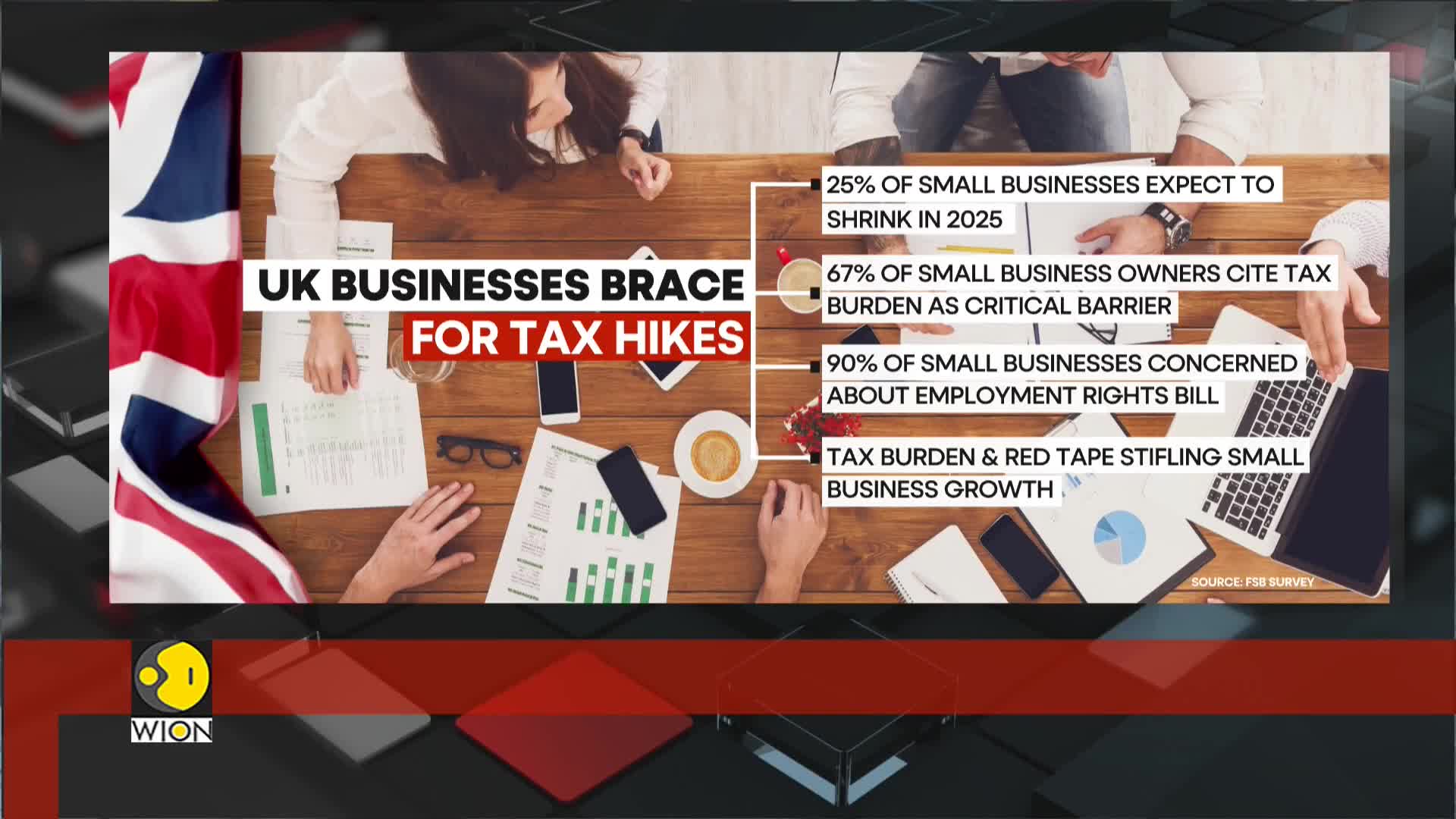

The major tax increase set to take effect in April is severely impacting UK business confidence, which has plummeted to its lowest level in a decade (outside pandemic periods). This unprecedented decline in employer confidence reflects widespread concerns about the sustainability of business operations under increased tax burdens. The situation represents a significant economic challenge, with businesses across various sectors preparing for financial strain that could potentially affect hiring decisions and growth strategies. This historically low confidence level suggests businesses are bracing for substantial negative impacts from the impending tax changes.

Watch clip answer (00:09m)How are the public and private sectors responding differently to rising tax burdens in the UK?

While the private sector is struggling with the increasing tax burden, the public sector is experiencing a more optimistic outlook. This contrast stems from recent public sector pay rises that have been funded by tax increases, creating a divergent economic reality between the two sectors. Small businesses are particularly vulnerable in this environment, with a Federation of Small Businesses survey revealing a steep decline in confidence among business owners. This highlights the disproportionate impact of the current tax policy, where increased taxation is simultaneously funding public sector improvements while potentially hampering private sector growth and confidence.

Watch clip answer (00:19m)Why are UK business leaders skeptical about economic recovery?

UK business leaders remain skeptical about economic recovery despite Treasury promises, primarily due to rising costs and increasing regulatory pressures. Companies are implementing hiring freezes and delaying investments as they struggle to manage mounting financial challenges. The economic outlook appears uncertain for many businesses as they attempt to navigate these obstacles. With one in four companies considering layoffs and employer confidence at its lowest in a decade, the private sector faces significant hurdles on the path to recovery amid stagnant GDP growth.

Watch clip answer (00:16m)What impact is the upcoming tax hike having on UK businesses?

The impending tax hike is causing significant disruption across UK businesses, with one in four companies planning to lay off staff. According to a survey by the Chartered Institute of Personnel and Development, this represents the highest proportion of employers considering redundancies in the past decade, excluding the pandemic period. The retail and hospitality sectors are particularly affected by rising national insurance rates and shrinking earnings thresholds. While the public sector remains somewhat insulated due to recent pay increases, small businesses are especially vulnerable, with many owners citing the tax burden as a major obstacle to growth and sustainability.

Watch clip answer (00:18m)