Economic Development

Economic development is a comprehensive process focused on enhancing the economic well-being and quality of life of individuals and communities. It transcends mere economic growth, which is typically measured by increases in GDP, by emphasizing sustainable practices, infrastructure improvements, job creation, and empowerment through education and skill development. The relevant strategies for economic development often include tailored initiatives such as business incentive programs, community growth planning, and comprehensive economic development strategies that align with the unique characteristics and needs of local populations. Recently, the global economic landscape has been characterized by slowing growth and persistent uncertainty, factors that have considerable implications for economic development efforts. While advanced economies face stagnation and threats of stagflation, emerging markets strive to adopt alternative development models that leverage local resources and inclusive policies. The shift towards a more mercantilist international economy, where trade and fiscal policies dominate over monetary solutions, further complicates the dynamics of economic development. In this context, it is essential for policymakers and economic development professionals to adapt strategies that not only create wealth but also ensure that economic benefits are distributed equitably among their communities. Continued emphasis on resilient economic frameworks, designed to withstand volatility, is critical in navigating modern challenges and fostering prosperity for all.

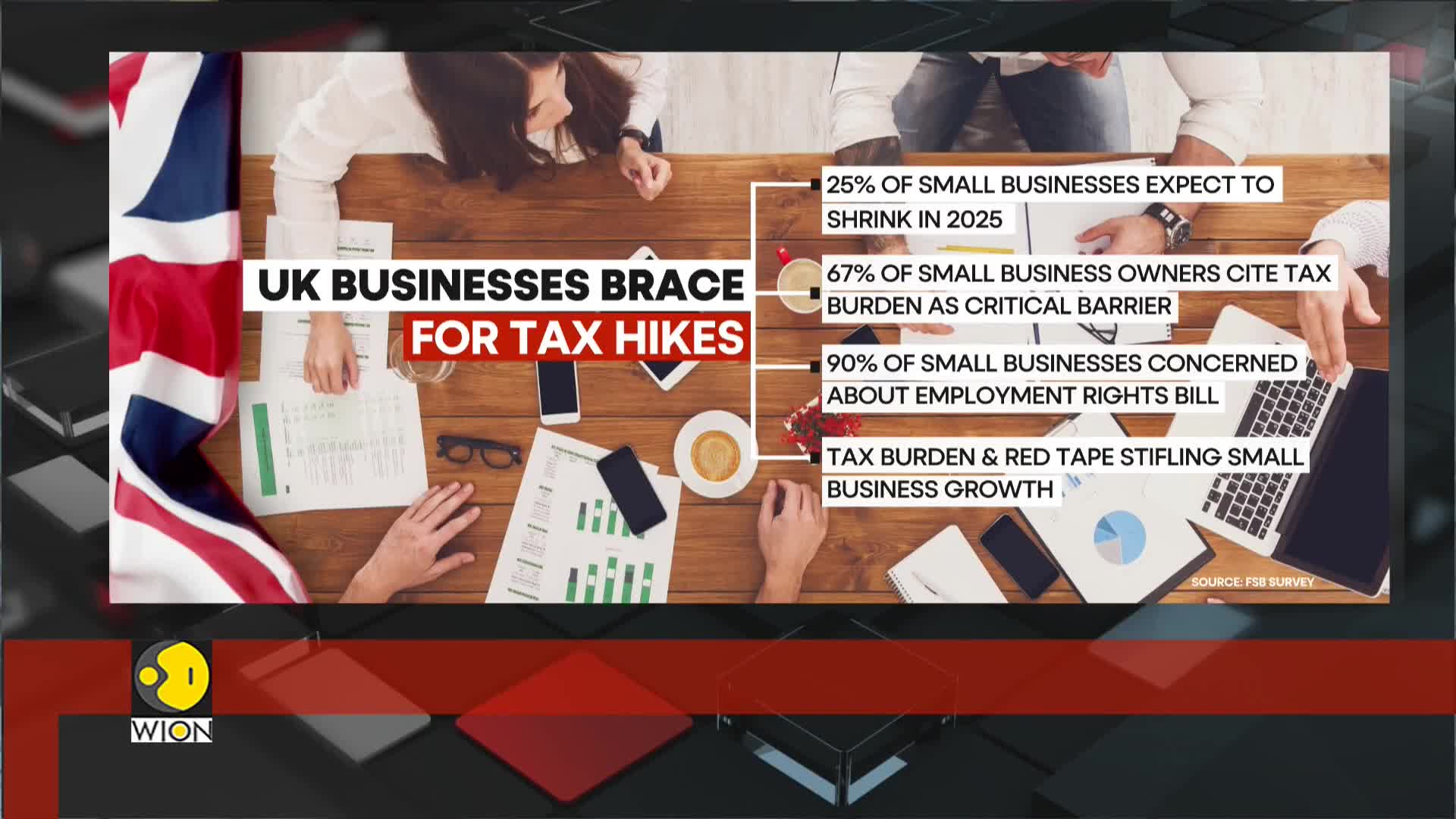

How are the private and public sectors in the UK responding differently to rising tax burdens?

While the private sector struggles with increasing tax burdens, the public sector is experiencing a more optimistic outlook, benefiting from recent pay rises funded by tax increases. Small businesses are particularly vulnerable, with surveys showing a steep decline in confidence – more than a quarter expect to downsize in the first quarter of 2025, and over 67% cite the tax burden as a critical barrier to growth. This dichotomy highlights the uneven impact of fiscal policies, where public sector employees gain from increased government spending while private businesses face mounting challenges that threaten their sustainability and growth potential.

Watch clip answer (00:30m)How is the UK government's tax policy affecting small businesses?

The UK government's 25 billion pound tax is severely impacting small businesses, exacerbating economic stagnation across the country. With one in four companies planning layoffs—the highest rate in a decade—small business confidence has plummeted, with 67% citing tax burdens as a major barrier to growth. This financial pressure is particularly devastating retail and hospitality sectors, which are experiencing lower earnings while facing higher costs. New regulations, including the Employment Rights Bill, are adding further strain to businesses already struggling with rising national insurance rates, creating a perfect storm of economic challenges.

Watch clip answer (00:12m)How are UK businesses responding to the upcoming tax hike?

UK businesses are facing significant challenges due to an upcoming tax hike, with one in four companies planning to lay off staff. This marks the highest proportion of employers considering redundancies in a decade (excluding the pandemic period), according to a survey by the Chartered Institute of Personnel and Development. The rising national insurance rates and lower earnings threshold are particularly impacting retail and hospitality sectors, which are expected to be the hardest hit as they already struggle with higher costs. Employer confidence has fallen to its lowest point in 10 years outside the pandemic, with the tax increase set to take effect in April further undermining business outlook.

Watch clip answer (00:40m)How are tax burdens affecting UK businesses in the current economic climate?

UK businesses, particularly small ones, are struggling with significant tax compliance costs that amount to an estimated £25 billion annually. Despite treasury promises, business leaders remain skeptical due to rising costs and increasing regulatory pressures. As the private sector faces these financial burdens, many companies are implementing hiring freezes and delaying investments. This economic pressure is occurring while government spending continues to drive minimal growth, making the path to economic recovery uncertain for many businesses in the final quarter of 2025.

Watch clip answer (00:34m)What are Tesla's hiring plans in India and what prompted this move?

Tesla has announced plans to begin hiring in India, with the company looking to fill 13 specific roles. This strategic initiative follows a significant meeting between Elon Musk and Indian Prime Minister Narendra Modi during the latter's visit to the United States. The announcement comes at a time when Indian stock markets have shown some volatility, starting Tuesday on the back foot. Tesla's decision to enter the Indian job market highlights growing international interest in India's talent pool and suggests potential expansion of the electric vehicle giant's operations in the country.

Watch clip answer (00:30m)What is the projection for India's total exports in the current fiscal year?

India's total exports are projected to exceed $800 billion in the current fiscal year, signaling a robust performance for the country's trade sector. This projection comes amid strengthening bilateral trade with the United States, which has already increased by 8% to over $106 billion, with merchandise exports to the U.S. reaching $68.47 billion. Despite facing a trade deficit of $22.99 billion with the U.S., India's overall trade outlook remains positive, with stakeholders targeting $500 billion in bilateral trade with the United States by 2030.

Watch clip answer (00:09m)