Corporate Restructuring

Corporate restructuring is a pivotal process that organizations employ to navigate through financial challenges, operational inefficiencies, or significant market shifts. This strategic management undertaking is not just about survival; it encompasses a comprehensive reorganization of a company's financial, operational, or organizational structures to enhance overall profitability and competitiveness. Various types of restructuring exist, including financial restructuring, which focuses on debt management, and operational restructuring, which aims to streamline operations and improve business efficiency through mergers, acquisitions, or divestitures. With the rise in bankruptcy filings and economic distress across sectors, particularly in healthcare and consumer services, the relevance of corporate restructuring has become increasingly pronounced. In recent times, trends indicate a growing dependence on Liability Management Exercises (LMEs) as alternatives to traditional bankruptcy proceedings. These tools enable companies to restructure outside of court, often providing quicker resolutions and minimizing reputational damage. As the global business environment evolves, organizations must engage specialized advisory teams to navigate the complexities of restructuring successfully. By aligning their strategies with both financial objectives and market demands, companies can position themselves for stability and growth while mitigating risks. Effective corporate restructuring not only aims for short-term recovery but is increasingly viewed as a pathway to long-term sustainability and shareholder value in today's dynamic corporate landscape.

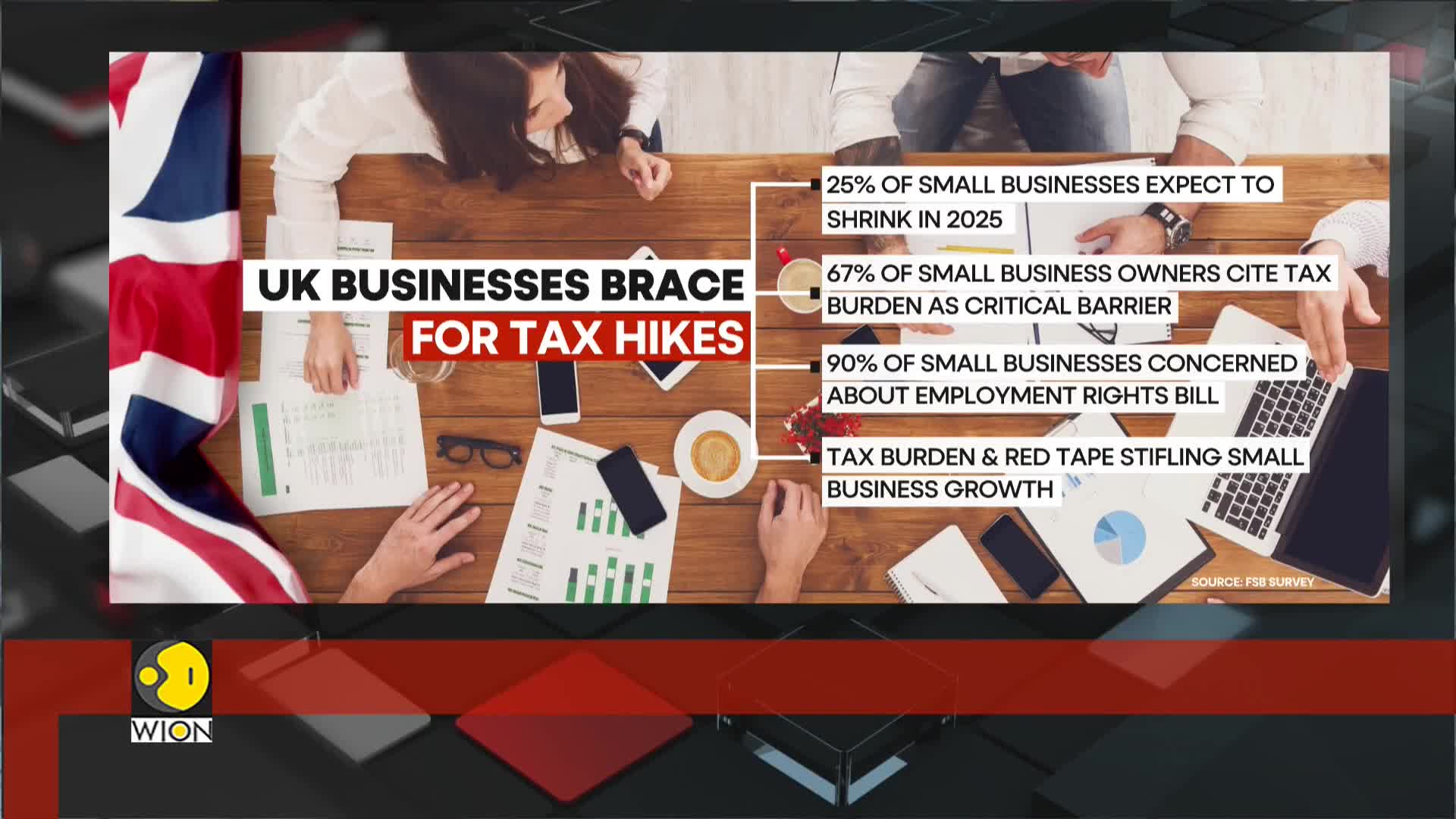

How are tax burdens affecting UK businesses in the current economic climate?

UK businesses, particularly small ones, are struggling with significant tax compliance costs that amount to an estimated £25 billion annually. Despite treasury promises, business leaders remain skeptical due to rising costs and increasing regulatory pressures. As the private sector faces these financial burdens, many companies are implementing hiring freezes and delaying investments. This economic pressure is occurring while government spending continues to drive minimal growth, making the path to economic recovery uncertain for many businesses in the final quarter of 2025.

Watch clip answer (00:34m)How do the current tech layoffs in 2025 compare to the massive waves of layoffs seen in 2022-2023, and what is the outlook for tech hiring?

The tech layoff landscape has dramatically improved compared to the crisis years of 2022-2023. January 2025 saw only 2,500 tech employees laid off, a remarkable decline from the 35,000 layoffs recorded in January 2024. This represents a significant shift from the "massive waves of layoffs" that characterized the earlier period. Current layoffs are largely attributed to normal annual budget assessments and priority reassessments that typically occur at the start of each year, rather than widespread industry distress. While companies like Meta cut 5% of staff and Workday reduced 8.5%, these numbers pale in comparison to previous years' devastation. The job market presents a mixed picture for tech professionals. Though layoff numbers have decreased substantially, the hiring environment remains challenging with reduced recruitment activity. However, there's cautious optimism for 2025, with surveys showing more employers hopeful about expanding headcounts and tech employees expressing greater confidence in the year ahead.

Watch clip answer (02:52m)How do the current tech layoffs in 2025 compare to the massive layoffs seen in 2022-2023, and what's driving these job cuts?

The current tech layoffs are significantly smaller compared to the massive waves seen in 2022-2023. In January 2025, approximately 2,500 tech employees were laid off, compared to 35,000 in January 2024, showing a dramatic decrease. Major companies like Meta cut 5% of staff and Workday reduced 8.5%, but these numbers pale compared to previous years' massive cuts. These layoffs are primarily driven by normal annual budget reassessments and priority adjustments that typically occur at the start of each year. Industry experts view this as a routine correction rather than a crisis, with companies evaluating their spending as they enter new fiscal periods. The outlook remains optimistic, with experts expecting layoff numbers to level off as 2025 progresses, suggesting a stabilizing job market in the tech sector.

Watch clip answer (02:08m)